Quantum Leap?

Disentangling fact from fiction in bitcoin and quantum computing

Disentangling fact from fiction in bitcoin and quantum computing

Author’s Note: This piece is intended to be an approachable summary for mainstream readers and capital allocators evaluating bitcoin, and it may be updated over time as new technological advancements are made. We would like to thank Adam Back and Hunter Beast for their technical review and feedback.

As the largest investment platform focused on bitcoin, we field questions about bitcoin every day, and there are a handful of concerns that are common to almost everyone exploring the space. Most of these have been pretty clearly addressed just by the natural course of history; for example, every year that bitcoin maintains its massive lead in network effects, resilience, and value accrual relative to the rest of “crypto,” it’s progressively clearer why bitcoin can’t be easily copied or outcompeted, and every failed government ban of bitcoin – or more recently, various governments’ pivots to embracing bitcoin – only further cement why “the government will ban it” isn’t a strong bear case. But one long-running concern we frequently hear that is harder to quickly dispel at this point in bitcoin’s history is the potential for advances in quantum computing to eventually compromise bitcoin security in some critical way.

This concern has recently been in focus once again thanks to the announcement of Willow, Google’s newest quantum computing chip. The Willow chip represents a noteworthy step forward in the decades-long process of building a quantum computer that can eventually perform practical applications like compromising the public-key cryptography securing many systems including bitcoin, so its arrival has predictably inspired the latest round of bitcoin obituaries. However, while Willow shows impressive progress on some key dimensions, the journey toward a cryptanalytically relevant quantum computer (“CRQC”) – that is, a quantum computer that can threaten modern cryptography – remains in its infancy with many massive hurdles still to overcome, and recent updates are unlikely to alter existing timelines for quantum computing development. Meanwhile, this issue is far from unknown to bitcoin developers, and a variety of potential mitigating solutions are already available today. All the same, the progress of quantum computing could certainly accelerate from here, so it’s worth developing a clear idea of how a sufficiently scaled quantum computer could ultimately affect bitcoin and how the network might be able to respond.

Some Very Brief Background

Before diving in, it may be helpful to briefly review some key premises built into most modern digital security systems, including (but not limited to) bitcoin. Modern cryptographic security relies on various forms of assumed “computational hardness” – that is, the assumption that certain math problems are complex enough to be effectively infeasible for conventional computers. One example is the discrete log problem, which posits in simplest terms that it is extremely difficult to determine the solution to logb(a) when a and b are very large prime numbers.¹ Application of this problem to an elliptic curve allows for elliptic curve cryptography, an iteration of which underpins the generation of bitcoin’s public/private key pairs and the signature algorithm used for most bitcoin transactions (Elliptic Curve Digital Signature Algorithm, or ECDSA). This system rests on the fundamental asymmetry of “one-way functions”: it is trivial to produce and validate a signature for a public key (a particular point somewhere on the elliptic curve) if its private key (a randomly generated value) is known, but the discrete log problem makes it prohibitively difficult to reverse-engineer that same private key if only the public key is known.

This problem is difficult enough that there is no better approach for classical computers than guessing and checking many potential solutions for the private key – also known as “brute forcing” – but this is still practically infeasible even for the most advanced conventional supercomputer. Since a bitcoin private key is a 256-bit number, there are 2^256 or approximately 1.1 x 10^77 possible alphanumeric combinations in bitcoin’s keyspace, a figure roughly comparable to the number of atoms in the entire observable universe.² For the best known conventional algorithms, the difficulty of breaking a 256-bit key is the square root of the keyspace size (2^128 in this case),³ so if the world’s fastest conventional supercomputer were to focus solely on cracking a single bitcoin private key, it would need roughly 2 x 10^20 seconds, or 6.2 trillion years. For those keeping score at home, that would amount to ~450x longer than even the estimated age of the universe (~13.8 billion years).⁴ A graphic from Jameson Lopp may help to illustrate the scale we’re dealing with:

There are some proposed solutions for solving the discrete log problem efficiently, the most notable of which is Shor’s algorithm. However, all such approaches are untenable with conventional computers and explicitly rely on the development of a CRQC, whose basic computational units are known as “qubits.” In contrast to the binary “bits” familiar to users of conventional computers – which can only be in a 0 or 1 state at any given time – qubits can exist in a “superposition” of both states simultaneously and can be “entangled,” meaning the 0/1 state of different qubits can be directly linked regardless of their proximity to one another. Taken together, these properties could support greater processing power and more efficient parallel processing, potentially allowing a quantum computer to process many possibilities at once and (among other things) solve Shor’s algorithm exponentially faster than even the fastest classical supercomputer.⁵

Among the many issues that have historically plagued the development of this new mode of computing is the notorious difficulty of error correction to make a quantum computer’s operations reliable, particularly when scaling a quantum chip up to the sizes necessary for any kind of practical application. This was why Google’s recent announcement grabbed headlines: whereas prior attempts had shown worse errors at larger sizes, Willow is the first chip to successfully demonstrate exponentially better error correction with bigger qubit lattices, suggesting the eventual feasibility of practically scalable quantum computing hardware and, in turn, potential progress toward challenging the computational hardness assumptions baked into modern cryptography.

While practical quantum computing still has many hurdles ahead of it, bitcoin in its current form could be vulnerable to a CRQC attack in a few ways. At the highest level, bitcoin relies on two key cryptographic algorithms for most of its security: the previously discussed ECDSA, which generates keys and signs transactions, and SHA-256, which helps to generate addresses and is the core algorithm used in bitcoin mining. The latter would be much more resilient against even a very advanced quantum computer since Grover’s algorithm, the best known quantum approach for breaking SHA-256, only provides a quadratic advantage (rather than an exponential one), meaning such an attack would still likely be computationally infeasible even for a quantum computer.⁶ Bitcoin mining also has other defenses against a CRQC, including the sheer scale of network hashrate that a quantum computer would confront when attempting disruptive attacks, the difficulty adjustment, and changes that could be applied to mining’s underlying Proof of Work function to compensate for quantum miner participation.⁷ As a result, ECDSA would most likely be the first or only target of quantum computing attacks, and that will be the primary focus of this piece.

Putting Concerns in Context

Google’s Willow clearly represents a noteworthy milestone in the long history of quantum computing and has understandably reignited concerns about existing cryptographic systems like bitcoin that secure the world’s data and financial assets. That said, before prematurely declaring bitcoin dead yet again, it’s important to properly frame the actual impact of the announcement and its potential implications.

This is not a new concern. Anyone not following either bitcoin or quantum computing closely may be tempted toward a kneejerk view that Willow represents a previously undiscovered vulnerability to cybersecurity. But contrary to recent headlines in outlets like the Wall Street Journal which bizarrely claim that quantum computing has not been on anyone’s radar until now, this issue has been deeply analyzed by bitcoin enthusiasts for over a decade. The question of quantum computing was discussed in depth on bitcointalk.org at least as early as 2010, with specific discussion about vulnerabilities in bitcoin signatures as early as 2012. (As an aside, this is a good example of the rule of thumb that any concern one may have about bitcoin was already discussed at length on bitcoin web forums over 10 years ago.) More broadly, this risk is something cryptography experts well beyond bitcoin have been considering for decades, and there are already several quantum-resistant cryptography implementations available for deployment in bitcoin and elsewhere (discussed in greater depth below).

Bitcoin should be among the least of one’s worries. Virtually every sensitive system in the world – including bank and brokerage accounts, health records, personal identity information held by companies and governments, etc – relies on some form of asymmetric computational hardness for security, so any fears about quantum computing’s long-term impact on bitcoin must extend to these targets as well. While it’s possible that bitcoin’s ECDSA signatures may be more vulnerable to quantum attacks than the RSA-based cryptography that protects many other systems (though even that is up for debate), it’s safe to say that if ECDSA were ever cracked by a quantum computer, other frameworks would not be far behind. Moreover, while bitcoin would be a highly valuable target, the aggregate value of bank and brokerage accounts in the US alone still dwarfs bitcoin’s ~$2 trillion market cap by many multiples, making legacy systems a much richer prize.⁸ While it’s conceivable that a state actor not motivated by profit could covertly develop the first CRQC (or that they already have), such an actor would likely be reluctant to tip its hand by targeting bitcoin before first disrupting more strategically valuable targets like legacy banking rails or government intelligence databases. The upshot here is that it would be an internally inconsistent view to avoid bitcoin due to quantum computing risk while opting to store wealth in systems that would be both just as vulnerable and likely more attractive targets to both private and state actors.

Practical applications of quantum computing still have a long and uncertain road ahead. While Willow showed a breakthrough in its ability to successfully reduce error rates at larger qubit grid sizes, the quantum computing field still faces significant hurdles to reaching practical viability for applications like breaking traditional cryptography. These challenges include:

Logical qubit capacity: Given the instability and error frequency of quantum computers, a critical variable in this field is the relationship between “physical qubits” (the actual hardware components built into a chip) and “logical qubits,” which are the error-corrected results of many physical qubits interacting. For example, Google’s Willow chip uses up to 105 physical qubits to produce 1 logical qubit that would be useful for quantum algorithms and computations. Other systems like the H1 processor developed by Microsoft and Quantinuum have produced 12 logical qubits with only 56 physical qubits, though this system has not shown exponentially improving error rates at larger grid sizes like Willow.⁹ These figures are noteworthy because various estimates suggest breaking the 256-bit ECDSA that secures bitcoin private keys would require something north of 2,500 logical qubits, several orders of magnitude above what the bleeding edge technology can produce today.¹⁰ While Willow’s exponentially declining error rates could be a foundation for building toward this level, it’s still far from clear if the chip’s error correction effect could be scaled sufficiently to allow for arbitrarily large logical qubit values, particularly as physical lattices get much larger.

Stability and coherence time: Closely related to error correction is the need for systems that can maintain quantum coherence – the stable state in which useful quantum operations are possible – for longer periods of time. Better coherence times can improve error correction and effectively boost the “yield” of a system’s physical qubits, but coherence is fragile and can be easily disrupted, hence the need for highly controlled environments, and the longest recorded coherence times for general purpose superconducting chips like Willow are still measured in microseconds, or millionths of a second.¹¹ The Willow chip recorded a coherence time of ~68 microseconds, which was a 5x improvement vs Google’s prior-generation chip but still well short of even the most optimistic estimates for the minimum coherence time needed to solve the discrete log problem. For instance, one estimate from 2020 suggests a quantum computer would need at least ~11 full seconds of coherence under absolutely ideal conditions to execute Shor’s algorithm, representing a more than 100,000x improvement vs Willow’s current coherence time.¹² Given the practical constraints associated with quantum computing (e.g. time needed for error correction, measurement, processing of results, etc), this coherence estimate is still likely optimistic, and it’s important to note that actual required runtimes to break a private key even in this ideal state would probably be closer to one hour at minimum (which, as we’ll see, may be prohibitively long for many potential attacks on bitcoin).¹³

Physical scaling constraints: Recent estimates have suggested something like 317 million physical qubits would be needed to crack an ECDSA private key within an hour or 13 million within a day – the most relevant time thresholds for bitcoin, as we’ll see below – highlighting just how physically demanding this process would be in practice.¹⁴ While ongoing improvements in error correction and coherence could reduce the absolute physical qubits needed to reach critical logical qubit thresholds, practically operating a system anywhere near this scale would still require, among other things: a huge physical footprint; precise control of extremely low temperatures; advanced interconnectivity and control systems; and extremely granular fabrication processes for all the key components, which would be even more delicate than the notoriously complex manufacturing process for traditional semiconductors.¹⁵ And that’s all before considering the power consumption of operating such a system, which various estimates peg at something like 100MW, or roughly the capacity of a small combined cycle power plant.¹⁶ Even assuming progressively better ancillary technologies for things like temperature control and interconnectivity, practical quantum computing will likely remain an extremely physically complex and capital intensive proposition for many years, a major hurdle for aspiring attackers (particularly since, as we discuss in more depth shortly, the energy cost for any such attack would scale linearly with the number of public keys targeted).

Real-world applicability: A frequently hyped element of the Willow announcement was the chip’s five-minute completion of a benchmarking test (Random Circuit Sampling, or RCS) that would take classical computers 10 septillion years to perform. A quick glance at this result could lead a casual observer to extrapolate that Willow either already has surpassed or will soon surpass classical computers in the performance of everyday applications, but this would be a serious misconception. The RCS benchmark has no real-world applications, but rather was specifically designed to be infeasible for a classical computer while accentuating the strengths of a quantum computer to determine if a quantum chip can successfully perform a conventionally infeasible operation – basically a kind of go/no-go checkpoint for a quantum chip’s progress. While clearing the RCS benchmark was a noteworthy milestone and a precondition to eventually moving to practical applications, this test alone doesn’t tell us much about the probability that Willow will be able to perform real-world tasks anytime soon.

This wide array of hurdles helps explain why Google’s Quantum AI director noted in the wake of the Willow announcement that breaking modern cryptography is “at least 10 years away” and that the new Google chip doesn’t change previously established timelines at all. Similarly, Nvidia CEO Jensen Huang recently projected that we’ll need roughly another 20 years to achieve useful quantum computers.

Bitcoin’s Potential Vulnerabilities

All those significant caveats aside, it’s still no doubt disconcerting to think that bitcoin could one day be stolen by a quantum attack through a compromise of the signatures that secure bitcoin balances. However, it’s important to note that such a scenario could only take place under very specific circumstances, even assuming the emergence of a practical and cost-effective CRQC. There are four potential quantum vulnerability scenarios for bitcoin’s ECDSA signatures, each of which in some way involves revealing a public key to the bitcoin network – without that critical information, no form of quantum attack on bitcoin private keys would be possible.

Obsolete addresses: Bitcoin’s very first address format¹⁷ was known as “Pay-to-Public-Key” or “P2PK.” Whereas later address types pay bitcoin to the hash of a public key or a redeem script, thereby hiding this sensitive information about the recipient from the network, P2PK addresses receive bitcoin directly to, as the name suggests, an exposed public key. Such addresses would be vulnerable to a CRQC because they give an attacker the starting point they would need (i.e. the revealed public key) to make an attempt at reverse-engineering the associated private key. These addresses have been effectively deprecated for more than a decade, and no modern wallet software generates them, so this category is not applicable to the vast majority of bitcoin holders.¹⁸

That said, roughly 8% of bitcoin’s total supply currently sits in very old P2PK addresses, including about 1 million bitcoin commonly attributed to bitcoin’s creator Satoshi Nakamoto. Since this address format is theoretically the most vulnerable to a quantum attack and most of these addresses contain 50 bitcoin (~$5 million at time of writing), these balances would likely be the first to be targeted, thereby alerting the rest of the bitcoin network to the potential arrival of a CRQC. This protective effect for later address types has led some developers to term these coins “Satoshi’s Shield.”

Taproot addresses: While most address formats introduced after P2PK encode the critical receiving information within a hash, Taproot (P2TR), bitcoin’s most recently introduced address format, also uses exposed public keys. Uptake of this address format is still nascent and many wallets still have yet to build out support for P2TR, so these addresses currently secure <1% of bitcoin’s supply. That said, Taproot addresses could also offer one potential upgrade path for bitcoin users to relatively seamlessly transition to quantum-resistant addresses if that becomes necessary down the road (discussed more below).

Re-used addresses: While bitcoin held in post-P2PK and pre-Taproot addresses that have never sent any transactions benefit from hidden public keys, that protection disappears when coins from those addresses are first spent. Spending from any address type requires revealing the public key for that address, so any users concerned about quantum safety should be sure to not receive any bitcoin to addresses that have already sent a transaction. This is the category that could most realistically impact the widest array of bitcoin holders if a CRQC were to be developed, as estimates suggest something like 50% of bitcoin are currently held in re-used addresses.¹⁹ However, any risk here can also be easily eliminated by simply avoiding address reuse, which is a best practice for many other reasons and is already the default behavior of most wallets.

“In-flight” transactions: The least likely but most potentially concerning vulnerability for bitcoin in its current state is the possibility of recently broadcast transactions being “sniped” by an attacker while awaiting confirmation in bitcoin’s blockchain. Since spending bitcoin from any address type requires revealing a public key, a sufficiently powerful CRQC could potentially scan mempools for valuable “in-flight” transactions and reverse-engineer private keys for the associated addresses before transaction confirmation. This would be the most problematic quantum attack as it would make any bitcoin transaction inherently very risky, but it would also be far and away the most difficult for an attacker to execute given bitcoin’s relatively short blocktime – new blocks are confirmed, on average, every 10 minutes, so a CRQC would need to be powerful and fast enough to reliably crack private keys in that window. This would be a very high-risk proposition for an attacker, as any energy expended in the attempt would be an irrecoverable sunk cost should the attack fail (the same game of chicken faced by dishonest bitcoin miners today). Meanwhile, pending significant improvements in parallelization, any quantum attack would only be able to break one public key at a time, so the energy expenditure required for more attacks would scale linearly with the number of attacks performed (that is, 100 public keys targeted would require roughly 100x the energy cost), further disincentivizing attacks on all but the most valuable transactions.

The key takeaway here is that, contrary to the impression fostered by much of the mainstream commentary on this topic, any bitcoin stored in a single-use address employed by most modern wallets could not be compromised even by an advanced quantum computer, and anyone with bitcoin in a reused address can gain robust security against most conceivable quantum attacks with some fairly trivial UTXO management. Even in the “in-flight” scenario and assuming no changes to bitcoin, attackers would face an incredibly high bar with a potentially unattractive risk-reward skew in most cases.

How Could Bitcoin Respond?

When considering both the hurdles still facing practical quantum computing and the various ways that much of the risk to bitcoin can already be mitigated even with no changes to the network, it should be clear that sensationalized headlines about bitcoin’s security are overblown. All the same, if bitcoin is ultimately expected to store hundreds of trillions in global wealth for centuries, it’s reasonable to look for ways to improve security over time for progressively greater assurances against even the most unlikely left-tail risks. Moreover, the National Institute of Standards and Technology (NIST), which sets US cybersecurity standards, recommends all systems upgrade to quantum-resistant cryptography by 2035, and an application of Moore’s Law to quantum chips would suggest critical qubit thresholds could be reached around 2040, so it’s undoubtedly prudent to consider potential upgrades before these dates (particularly since quantum development could accelerate even more rapidly from here).²⁰

Fortunately, there are already three NIST-approved quantum-safe algorithms that could lay the foundation for better security both in bitcoin and digital systems more broadly. All of these options are available for production and practical application today, and there are other implementations in development that will likely also play a role in the future. Meanwhile, since this issue has been discussed among bitcoin developers for some time, there are already several proposals at various stages of maturity that could be deployed to enhance bitcoin’s resistance to theoretical quantum attacks. Probably the most developed proposal is Hunter Beast’s BIP-360, which includes support for two of the NIST-approved quantum-safe algorithms and two others. This upgrade would add a new address format called P2QRH (“Pay to Quantum-Resistant Hash”), which, like most modern address formats, would hide each address’s public key within a hash. While these addresses would still reveal public keys at the time of spending, that information could not be used by a CRQC to reverse engineer private keys as part of an “in-flight” attack since P2QRH’s key pairs would be generated with quantum-safe algorithms. BIP-360 comes with some trade-offs, including the larger size of its quantum-resistant signatures and the fact that its implementation would require a soft fork (and thus a good deal of consensus-building among bitcoin users), but it could be a valuable foundation to future-proof bitcoin for the very long term.

Of course, it’s likely that best practices in this field will evolve as our understanding of quantum computing develops, and the quantum-safe primitives we have today would no doubt benefit from more real-world stress testing. These points are potentially an argument for moving cautiously with any bitcoin upgrades to avoid creating technical debt that swiftly becomes obsolete as quantum-safe cryptography matures. To that end, the ecosystem could also explore earlier-stage constructs like the ideas suggested by bitcoin veteran Matt Corallo in this recent bitcoin developer mailing list thread, which would leverage the existing capabilities of bitcoin’s recent Taproot upgrade to enable alternative, quantum-resistant spending conditions that could be used as emergency fallback options if CRQC development dramatically accelerated. Elsewhere, pseudonymous developer Conduition has also published a more fleshed out proposal that may be worth consideration. Notably, neither of these paths would require soft forks today, delaying both the need for consensus-building and costly on-chain transactions to move to quantum-safe addresses until a quantum threat is closer and more fully defined. Additionally, these paths could allow for greater flexibility into the future as the cryptography sphere further researches and builds out post-quantum algorithms. We encourage interested readers to take a deeper dive into these proposals, and we note this is not an exhaustive list of proposed solutions that could be deployed.

This discussion is not intended as an endorsement of any particular path, but simply an illustration that even in a downside case, the emergence of CRQCs would not be an intractable problem that bitcoin couldn’t solve. In fact, bitcoin is probably better suited to tackle this problem than the vast majority of software stacks protecting the rest of the world’s data. As a monetary network based on an endogenous digital bearer asset rapidly accruing value, bitcoin offers an embedded incentive for those working on it to move quickly and decisively if necessary to protect the project’s significant embedded value, a dynamic less likely to animate most government and corporate cybersecurity teams. Meanwhile, as an open source project securing ~$2 trillion in wealth, bitcoin is one of the most scrutinized and battle-tested pieces of software in the world and has attracted some of the world’s best developer talent to maintain and improve upon it, a claim few banking IT departments can make.

Conclusion

As with any legitimate risk, it would be misguided to completely dismiss the long-term potential for quantum computing to disrupt bitcoin and most other cryptographically-secured systems. On balance, though, the significant hurdles still facing quantum computing, the likely timelines needed to reach practically relevant quantum computers, and the various upgrade paths already available for the world’s digital infrastructure collectively suggest that progress toward a CRQC is not presently an existential bear case for bitcoin (and if it is, as discussed before, then it’s an even greater bear case for legacy financial rails and securities markets). But for readers who may still find themselves on the fence due to the complex, black-box nature of this field of study – and especially for those readers who have delayed an allocation to bitcoin because of this concern – it may be helpful to reduce this question to a simple expected value calculation. The table below shows that even if we apply extremely high probabilities to existential quantum risks for bitcoin, the probability-weighted upside to bitcoin’s current price would still imply 10-50x+ appreciation from here.²¹

This is obviously an illustrative, oversimplified binary, but it distills an important point for anyone still on the sidelines because of quantum computing risk. If any version of the bitcoin bull thesis proves correct, the asset is likely to continue capturing an appreciable percentage of the world’s total wealth, leading to substantial price upside from here (we recommend The Bullish Case for Bitcoin and Gradually, then Suddenly as refreshers on this view). Even if we were to apply a 50% chance of a sudden advanced quantum attack that sends bitcoin’s value to zero literally overnight – a probability which seems several orders of magnitude too high given everything we’ve covered in this piece so far – bitcoin at ~$100,000 is still extraordinarily attractive on a probability-adjusted basis. The development of quantum computing warrants close monitoring, but in any fair analysis, it should not be a barrier to owning bitcoin.

1 For example, the result of this function where a = 8 and b = 2 is 3 because 2^3 = 8. This is easy to determine when these values are small composite numbers (even without a calculator), but becomes exceptionally difficult when a and b are both sufficiently large prime numbers (even for a conventional supercomputer).

2 See Mastering Bitcoin and this lengthy Bitcoin Stack Exchange discussion for sources and additional detail.

3 See Pollard’s Rho algorithm as an example of one of the best known conventional computer algorithms that would only provide a quadratic speedup for an attacker.

4 Result based on 128-bit security, which gives 3.4 x 10^38 searchable keys divided by 1.7 x 10^18 guesses per second = 1.95 x 10^20 seconds or 6.2 trillion years required. It’s worth noting that the operations necessary to brute force a private key are more complicated than the simple floating point operations for which the fastest supercomputers are optimized, so in practice this process would most likely take even longer than reflected here.

5 This primer from Scientific American offers a longer discussion of these concepts.

6 See Cisco Systems, 2017 for more.

7 See Ten31’s discussion with Matt Corallo on this topic from December 2024.

8 Per the Federal Reserve, US commercial bank accounts collectively hold ~$18 trillion, while Vanguard and Charles Schwab alone hold ~$20 trillion in total client assets.

9 Microsoft and Quantinuum announcement, September 10, 2024.

10 Kudelski Security Research, 2021.

11 Other approaches like trapped-ion quantum computing have shown much longer coherence times, but usually at the expense of computation speed or lack of scalability to multi-qubit architectures required for practical quantum computing tasks.

12 University of Surrey, 2020. See calculations and discussion on pages 6-7.

13 Microsoft Research, 2017. See table and discussion on page 21.

15 See this overview from McKinsey and this 2024 research paper from various industry professionals for more detail on quantum computing’s physical scaling challenges.

16 See estimates for quantum computing power consumption here and here.

17 For the purists, P2PK is technically not an address format at all since the whole point is it doesn’t generate an address for receiving bitcoin. We call it an address type here for ease of discussion.

18 We recommend this summary overview from Unchained for more information on bitcoin’s various address formats.

20 See NIST memo on post-quantum cryptography and Introduction to Quantum Computing for Business.

21 Analysis assumes $100,000 current bitcoin price and approximately $500 trillion in addressable global wealth, per latest estimates from Boston Consulting Group.

Sats Flow: z16a Killer

Ten31 Co-Founder and Managing Partner Grant Gilliam gave a keynote talk at the August 2024 Baltic Honeybadger Conference on how sats flows will totally reshape investing at all scales.

Ten31 Co-Founder and Managing Partner Grant Gilliam gave a keynote talk at the August 2024 Baltic Honeybadger Conference on how sats flows will totally reshape investing at all scales.

Bitcoin on the Ballot

The 2024 US Presidential election marks a potentially significant geopolitical turning point for bitcoin that all capital allocators should study closely.

Selected Potential Impacts of the 2024 Election

President-elect Donald Trump has aggressively courted the support of bitcoin-aligned voters and interest groups over the course of his campaign with a variety of proposals friendly to the bitcoin ecosystem. Trump gave a lengthy keynote speech at the Bitcoin 2024 conference and has surrounded himself with advisors like Cantor Fitzgerald CEO Howard Lutnick, who recently announced a multi-billion dollar bitcoin-backed lending facility after having been adamantly pro-bitcoin for years. Meanwhile, Republicans appear poised to capture control of both chambers of Congress (a so-called “Red Wave”), likely reducing friction for Trump’s legislative agenda and approval of his appointees to key cabinet positions.

We acknowledge that campaign promises often diverge sharply from actual policy implementation and the President-elect may end up disappointing bitcoin enthusiasts in one way or another, particularly given his historical skepticism toward bitcoin. However, the combination of factors listed above could drive substantial tailwinds for bitcoin holders and the broader bitcoin technology ecosystem if the incoming administration approximately follows through on its proposals. The following is a brief summary of selected key impacts we see as most likely over the next four years if President-elect Trump’s campaign rhetoric translates to actual policymaking and cabinet appointments. In the optimistic case for bitcoin in President Trump’s second term, the tailwinds discussed here merit the serious attention of all individual investors, institutional allocators, and fiduciaries.

Strategic Bitcoin Reserve

At the Bitcoin Conference in July 2024, Wyoming Senator Cynthia Lummis proposed a bill that would direct the US Treasury to build a “strategic bitcoin reserve” of 1 million bitcoin to be acquired over 5 years and held for a minimum of 20 years. The same day, President-elect Trump endorsed the idea of the US building such a reserve, though he did not specify a target amount. While exact details behind the implementation of any such plan are still to be determined, this initiative would add a net new bid of up to ~550 bitcoin per day (relative to current daily new issuance of ~450 bitcoin) from a price-inelastic buyer with an infinite budget who has historically been a net seller of bitcoin.

To the extent the US does implement this plan, or is even thought to be seriously considering it, other large nations will likely be incentivized to make similar moves given bitcoin’s fixed supply. Several smaller nations including El Salvador and Bhutan have already been openly building their bitcoin reserves, but the world’s most powerful government doing so would materially raise the profile and credibility of this strategy, thus opening up a powerful new demand spigot for bitcoin (and consequently for the companies building the most successful bitcoin enabling technologies).

Reduction of Regulatory Risk

Given bitcoin’s well-established regulatory framework as a commodity (acknowledged repeatedly by both the SEC and CFTC across multiple administrations), the US government’s long history of open market sales of bitcoin, and the recent launch of spot bitcoin ETFs by massive institutions such as BlackRock and Fidelity, the left-tail risk of bitcoin ownership being “banned” in the US was already low and declining by the year. That said, the election of President Trump and a Red Wave in Congress further reduce the risk of adversarial regulatory action against key functions like bitcoin self-custody and bitcoin mining, both of which President-elect Trump has explicitly committed to protecting.

Given Trump’s rhetoric and campaign platform, his appointments for key cabinet and administrative positions — which a Republican-controlled Congress would likely approve without much friction — are all likely to be more friendly to bitcoin holders and technology companies than their predecessors, creating a clearer and more standardized regulatory environment for founders and developers in the space. In particular, new leadership at the Treasury Department, FDIC, and OCC (and potentially the Federal Reserve later in Trump’s second term) should solidify better access to legacy banking rails for bitcoin companies, which had become a notable sticking point under the previous administration. Meanwhile, a Trump-appointed Attorney General would be likely to overhaul the DOJ’s recent trend of regulation by enforcement of financial rules that are often poorly defined or inconsistently enforced.

Reduction of Career Risk

The above points further reduce the “career risk” capital allocators naturally face when advocating for exposure to a new technology like bitcoin. In a scenario where the world’s most powerful government is acquiring bitcoin (or at least explicitly protecting and promoting its use), institutional investors, corporate treasurers, and fiduciaries of all stripes will increasingly have the air cover they need to leg into bitcoin positions with the conviction that a catastrophic regulatory outcome is largely off the table. To take it a step further, if the US government and competitive foreign treasuries begin openly and aggressively acquiring bitcoin, capital allocators will increasingly be required to develop a serious bitcoin strategy to avoid becoming laggards in the adoption of a geopolitically significant technology. In such an environment, career risk will come from ignoring bitcoin rather than embracing it.

Meanwhile, a clearer regulatory landscape and government-level adoption of bitcoin should help pave the way for more executives at legacy finance, technology, and energy companies to evaluate integrating bitcoin into their products and technology stacks across a variety of use cases.

Continuing / Accelerating Fiscal Deficits

The US has spent the past two Presidential terms running peacetime fiscal deficits of unprecedented size, driving the publicly held debt to GDP ratio to ~100% for the first time since the 1940s. The CBO and the Treasury Department both project substantial increases over the next decade, and recent estimates suggest President-elect Trump’s policy platform (which combines sustained high spending with new tax cuts) will boost this metric even further. An acceleration of this trend under the new administration (enabled by an accommodative Congress) would likely be stimulative and inflationary on the margin, particularly if paired with the aggressive tariff policies the President-elect has floated, driving both individuals and institutions to seek exposure to hard assets like bitcoin or gold that have historically performed well in such environments.

At the same time, the growing burden of federal interest expense – which recently surpassed defense spending and will potentially exceed Social Security spending next year – will only get heavier as deficits widen under President Trump and inflation threatens a resurgence, potentially driving the need for more accommodative monetary policy by the Federal Reserve, which would also tend to drive more flows toward assets like bitcoin that best resist dilution. All such adoption growth would also be a tailwind for companies building the tools and services that enable bitcoin onboarding and extend the asset’s utility.

Greater Integration into Traditional Financial Services

With greater regulatory clarity and a more neutral or accommodative set of financial regulators at the Treasury Department, SEC, FDIC, and elsewhere, traditional banks and asset managers will likely have more leeway to enter the bitcoin custody market and provide associated bitcoin-native financial services. Bitcoin — which is highly liquid, fungible, permissionless, and globally salable 24/7/365 — has already proven itself to be uniquely pristine collateral, as evidenced by Unchained Capital’s 7+ year track record of originating more than $700 million in bitcoin-backed loans without a single loan loss across multiple turbulent market cycles. With fewer regulatory complications to bitcoin custody and financial services, we expect this “super collateral” value proposition will become much clearer to traditional lenders during President Trump’s second term.

Specifically and most significantly, a bitcoin-friendly President and Congress will likely allow for the repeal of SAB-121, a piece of SEC accounting guidance that has historically made bitcoin custody cost-prohibitive for traditional financial institutions. This guidance was repealed by Congress earlier this year in a rare display of bipartisanship, but that legislation was subsequently vetoed by President Biden. While BNY Mellon was recently granted an exemption to this guideline, successful removal of the rule would help clear the way for broader bitcoin participation among a wide base of banks and custodians, driving incremental institutional demand for bitcoin. This development would also potentially represent a tailwind for existing custody providers and bitcoin infrastructure businesses that may become attractive takeout targets among this large acquirer universe of banks and asset managers.

Continuation of US Bitcoin Mining Infrastructure Buildout

President-elect Trump has worked closely with several large, publicly traded bitcoin miners during his campaign and has made a variety of positive public comments about supporting the mining industry in the US. While various states like Texas and Tennessee have been highly accommodating to bitcoin miners over the past few years, several federal overtures such as the proposed DAME tax and an invasive but ultimately aborted “emergency survey” targeting bitcoin miners have threatened to send the industry into other jurisdictions. A more pro-bitcoin administration and Congress would ensure the industry can continue to grow sustainably in the US, a tailwind for the miners themselves, the energy and power industries that are increasingly intertwined with bitcoin mining, and adjacent infrastructure providers.

Outperforming Bitcoin

Reckoning with the new cost of capital

Reckoning with the new cost of capital

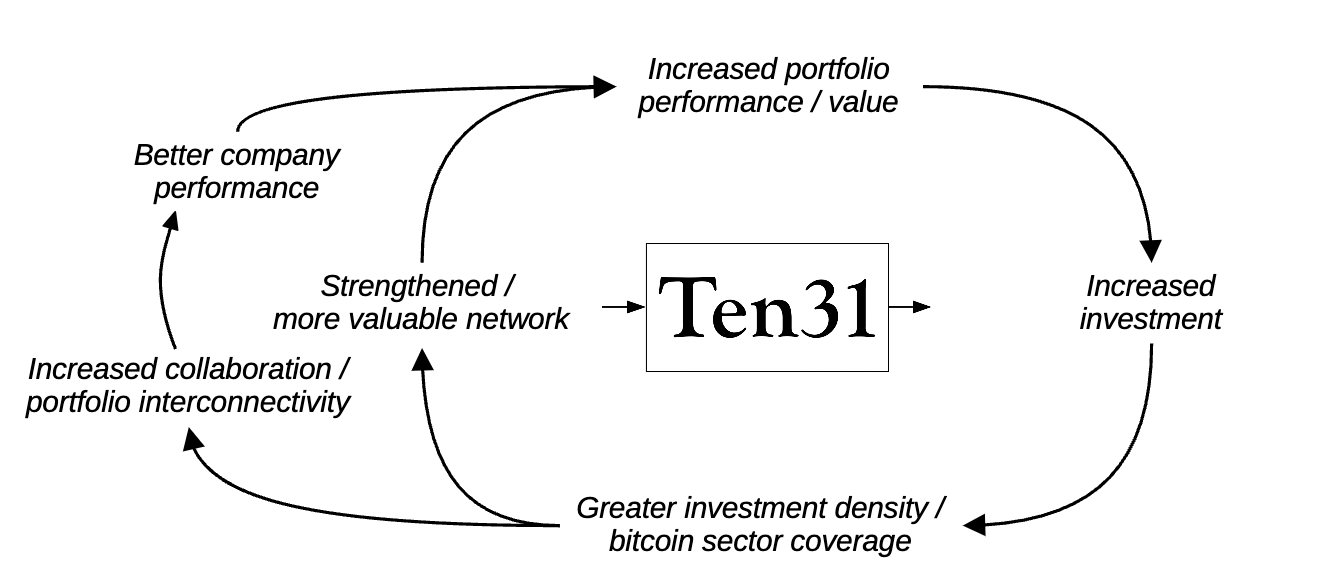

At Ten31, our central thesis – which we’ve written about extensively elsewhere – is that bitcoin is superior monetary technology, and as understanding of it distributes over time, all self-interested actors across industries will ultimately have to adopt it in some form, driving trillions of dollars of demand for enabling technologies and infrastructure to allow for that adoption. Communicating that thesis to capital allocators has its own hurdles given bitcoin’s relative infancy and volatility, though every year brings this view closer to the mainstream, as most recently evidenced by record-breaking launches for spot bitcoin ETFs and the capitulation of previously ardent critics like BlackRock’s Larry Fink. But once we’re past that discussion, the next question we typically hear from both dedicated bitcoiners and bitcoin-curious allocators is: if our bitcoin thesis is correct, the asset will likely see huge upside over the coming decades, so how can Ten31’s investments possibly outperform that hurdle?

This is an important question and one that is foundational to everything we do at Ten31 – we were the first investment platform to explicitly address this theme nearly three years ago, and it has informed all of our investment decisions since then. If investors agree with our view of bitcoin’s future adoption, they can always simply allocate directly into bitcoin to express that thesis. In the same way, the Ten31 team and all the founders we support could be spending our scarce time at larger companies drawing salaries to stack sats rather than investing in and building innovative bitcoin infrastructure, likely foregoing some near-term bitcoin accumulation in the process. As a result, we evaluate every investment we make relative to its potential to outperform bitcoin over relevant time horizons, and we seek to build a portfolio that can collectively do the same. At the end of the day, bitcoin’s performance is our cost of capital.

This is undoubtedly a high bar to clear, and many investors attempting to hurdle it will fall short. However, for a platform like Ten31 with differentiated deal flow and superior investment selection, the case for this outperformance is much stronger than might be immediately obvious when first considering bitcoin’s expected price trajectory over the coming decades. As the largest investor focused exclusively on the bitcoin ecosystem, Ten31 has deployed over $130 million into 36 of the best companies – including both blue chip “picks and shovels” providers and forward-thinking incumbents who were not originally “bitcoin companies” – that will directly enable and benefit from bitcoin’s adoption growth, and we have high conviction that this portfolio and our future investments will deliver levered returns on bitcoin.

The 21,000 Foot View

To build the high level intuition underpinning this thesis, we’ll start with a caveat: if you’re reading this, you should own bitcoin. Allocations to bitcoin itself and bitcoin-linked equities are not mutually exclusive, just as ownership of an internet-connected smartphone is not mutually exclusive with owning shares of Apple or Google – the potential cash flows and expected returns of the latter are a direct function of the utility and adoption of the former.

Owning bitcoin very likely offers more economic upside to a user than owning the latest iPhone, but that expected price upside forms the foundation of the bullish case for bitcoin infrastructure: ongoing and sustained growth in bitcoin’s price necessarily implies ongoing growth of bitcoin adoption (more users, businesses, and governments coming into the market to utilize bitcoin in a myriad of ways), which in turn implies growing demand for the technologies enabling and adding value to that same adoption. If you’re bullish on bitcoin, the only coherent position is to also be bullish on the infrastructure that will enable and propel its growth.

Many investors inadvertently take an internally inconsistent stance on bitcoin technology investments, arguing that since bitcoin’s expected price performance is so strong, it won’t be possible to outperform bitcoin with technology investments in the space. The key disconnect in this logic is that these technology providers are directly enabling and benefiting from the underlying dynamics driving that price growth. It’s certainly reasonable to take the view that the vast majority of alternative strategies (e.g. generalist venture capital and private equity) will not outperform bitcoin, but Ten31’s strategy is not attempting to drive outperformance with investments in some uncorrelated theme; rather, our investments are directly strapped to the rocket of bitcoin’s adoption growth across payments, financial services, energy and power, consumer technologies, and eventually every industry on earth. Bitcoin-levered equity is therefore the only strategy with a durable opportunity to outperform bitcoin in the coming decades.¹

Moreover, there is strong historical precedent for this dynamic playing out in other industries. The best equity investments in the bitcoin ecosystem will be leveraged plays on bitcoin adoption, just as the leading infrastructure and technology providers in oil & gas and pharmaceuticals have historically been leveraged plays on their underlying themes:

Getting More Granular

With that broad framework in mind, we can delve deeper to illustrate how this outperformance might play out in practice for Ten31, starting with the hypothetical case of an individual investment in our portfolio. A critical precept as we make this evaluation is that Ten31’s funds operate with a standard 10-year life, which means – contrary to a misconception that often plagues investors thinking through these dynamics – that we are not trying to outperform bitcoin over an indefinite, open-ended future, but rather over a defined 10-year window. Bitcoin may well go up forever in purchasing power, but our task as fund managers is to deliver superior risk-adjusted returns levered to bitcoin’s performance over the span of a given 10-year fund.

The most straightforward and obvious way to do this would be to provide investors with expedited dollar-denominated returns – said another way, our best investments should be able to drive 10-100x dollar returns over a shorter period than bitcoin itself and thus higher IRRs than bitcoin. For example, an emerging leader in bitcoin technology (or a forward-thinking player from a traditional vertical leveraging bitcoin in creative ways) might return 50x over a 5-year investment window while bitcoin appreciates “only” 10x over the same time frame. In practice, these expedited returns will be driven primarily by traditional exit events like acquisitions and initial public offerings (IPOs), though we expect acquisitions will be the more common path near-term.

If bitcoin’s ongoing adoption trajectory continues to look much like that of the internet several decades ago, incumbent players will experience progressively more disruption to legacy business models and see growing strategic value in many of the companies in the Ten31 portfolio. This increasing strategic awareness of and interest in bitcoin-linked technology will likely start in the verticals most clearly affected by bitcoin’s properties – financial services and fintech, payments, credit & lending, oil & gas, power & utilities – but will ultimately expand outward to touch virtually every industry on earth, as we’ve detailed in prior writing. As this incumbent interest spreads, the most expeditious and capital-efficient path to integrate innovative bitcoin technologies will in many cases be acquisitions of the leading bitcoin companies that have already developed differentiated technology stacks, expertise, network effects, customer relationships, and brand equity (i.e. strategic acquirers will often choose to buy vs. build).

When acquirers (or public markets investors evaluating new IPOs) take action, they will underwrite their valuations of the leading bitcoin companies by projecting the expected future cash flows of their targets, which will be at least partially a derivative of expected future bitcoin adoption. These acquirers and investors will be willing to pay the discounted present value of a bitcoin company’s future cash flows, in effect pulling forward bitcoin’s expected future performance and allowing early investors in acquired or newly-public companies to capture bitcoin’s price appreciation faster than they would have by holding the asset itself.

To really dig into how this might work and the drivers that could flex outcomes higher or lower, we can posit both an illustrative outlook for bitcoin’s price over the coming decades, as well as an operating profile of a hypothetical early-stage bitcoin company with the kind of growth trajectory and margin expansion typical of a top-quartile software or technology business:²

Given the hypothetical projections above, how might a strategic acquirer or IPO investor evaluate this target? While the answer can vary substantially based on the acquirer’s discount rate, the company’s maturity when the acquisition is made, and many more factors, we can establish some basic error bars. For instance, assuming an initial investment by Ten31 in 2024 and an acquisition of this hypothetical target nine years thereafter (in this case, 2033), an acquirer’s valuation might look something like this:³

For investors who deployed capital into this hypothetical company at the Seed or Series A Stage, exit valuations in the range above would drive highly attractive returns that would outperform bitcoin in virtually every scenario, even ignoring any potential synergies (e.g. cross-selling or back office rationalization) an acquirer might be able to achieve, which would serve to push exit valuations even higher:

For those most concerned with bitcoin-denominated returns – which doesn’t yet describe many institutional investors but certainly applies to the Ten31 team – it’s important to highlight that the above return profiles equate to earning more bitcoin than was foregone in the initial investment. If Ten31 made a $1 million Seed stage investment in this company at a $15 million valuation in Year 0 (2024) with bitcoin’s price at ~$65,000 and achieved a ~86x dilution-adjusted exit in Year 9 (2033) with bitcoin’s price at ~$1.2 million, we would have effectively invested 15.4 bitcoin and returned the equivalent of 72.9 bitcoin, a 4.7x multiple on foregone sats. Note also that in most cases in the above scenario analysis, an acquisition of this nature even in later years would yield an IRR superior to bitcoin liquidated much earlier on, meaning an early-stage equity investor would be more than fairly “paid to wait” for an exit, even in bitcoin terms.

The more bullish an acquirer or public markets investor is on bitcoin’s long-term adoption growth, the more they should be willing to pay for the company’s equity all else equal. Even more importantly, as bitcoin adoption grows and its market cap rises to levels only achieved by the largest, most liquid assets in the world, its staying power will become more obvious and assured, and it will seem progressively more de-risked to both corporate incumbents and large institutional investors (including the world’s largest asset managers). This growing certainty and comfort in bitcoin’s longevity will allow acquirers and investors to a) more confidently and optimistically forecast cash flows for leading bitcoin businesses and b) apply lower discount rates to those cash flows, both of which will tend to drive higher valuations for the best companies with a bitcoin strategy. The Lindy Effect will work just as well for bitcoin-levered companies as it has for bitcoin itself.

Finally, investors in the most successful early-stage bitcoin companies will benefit from a few additional levers that should further amplify returns:

First off, Ten31 estimates roughly a 100:1 mismatch between cumulative funds raised for broader “crypto” funds relative to bitcoin-focused vehicles, meaning that investors deploying into this ecosystem today can often get deals done at valuations 25-75% lower than what might be expected in comparable rounds in broader crypto or tech thanks to the relative dearth of capital currently chasing the bitcoin ecosystem. Ten31 in particular benefits from this dynamic thanks to our deep network, reputation among founders, and our partners’ long track record in the bitcoin space, which have collectively allowed us to lead rounds or serve as exclusive partner for over 80% of the capital we’ve deployed, often at advantaged entry valuations.

Meanwhile, at the end of the investment life cycle, returns to early-stage investors could be compounded by the growing sense of urgency and optimism that typically accompanies the later stages of bitcoin bull cycles, with the resulting spike in corporate and investor appetite likely supporting higher exit multiples for the best bitcoin businesses at local cycle tops (a dynamic that could become particularly common over time after a few early movers have set a precedent for acquisitions).

It’s still early, but Ten31 has already seen evidence of all these dynamics playing out in our portfolio, as several of our larger investments have undergone 20-30x valuation markups since initial deployment a few years ago while bitcoin’s price has increased only 5-6x over the same period. While these markup events still have yet to be monetized, they stand as solid early evidence that the market is validating our thesis that forward-thinking companies building on bitcoin can drive levered returns on bitcoin’s performance.

Downside Mitigation

Another angle on this question that investors should consider is the potential downside volatility mitigation that a portfolio of bitcoin-levered equity positions could provide across bitcoin price cycles. Anyone considering an allocation to bitcoin inevitably notices its price volatility right away, as the asset’s history is littered with examples of 50%+ drawdowns (only for bitcoin to eventually jump back to new all-time highs). However, the same is not true for the overall trajectory of bitcoin’s adoption, which generally seems to move consistently up and to the right over time. The process of a user coming to understand bitcoin is typically a one-way function regardless of near-term price volatility, as evidenced by HODL Waves – which illustrate a consistently growing proportion of bitcoin buyers turning into long-term holders – as well as persistent growth in unique on-chain entities and the number of bitcoin addresses with balances >0.1 bitcoin.

The users that continue to hold and interact with bitcoin across price cycles do so because bitcoin solves some underlying problem for them: a superior long-term store of value, a rail for cheaper remittances, a means of escaping hyperinflation, and many other use cases. Bitcoin’s unique properties can solve a variety of problems at the individual and enterprise levels regardless of the vagaries of short-term price action, and we expect a growing awareness of these properties to drive progressively greater appetite for bitcoin technology acquisitions among a diverse set of strategic players, even during price drawdowns.

For example, oil majors like Exxon and ConocoPhillips are increasingly recognizing bitcoin mining’s potential to monetize otherwise wasted resources like vented or flared gas, and we expect this convergence to accelerate over the coming decade since mining represents a unique and unprecedented source of revenue for the energy industry. Meanwhile, power grids have become progressively more intertwined with bitcoin mining over the past several years, as mining represents a unique flexible power load that – unlike traditional data centers – can be switched off and back on almost instantly to accommodate a grid’s unpredictable needs. While interest in these applications will no doubt be higher during bull markets, neither of these use cases are direct functions of bitcoin price gyrations, as clearly demonstrated by bitcoin network hashrate increasing more than 300% from 2022 to 2024 even as bitcoin’s price ranged anywhere from 30-80% off its prior cycle highs during that same interval – a dynamic that directly benefited several Ten31 portfolio companies during this period.

Various other verticals where founders are building thriving bitcoin businesses not directly tied to bitcoin’s price include payments and remittances, which can drive substantial disruption to legacy infrastructure across market cycles as long as bitcoin remains sufficiently liquid; on / off ramps that see increased trading volume during both upside and downside volatility; and consumer applications that can leverage bitcoin’s unique properties for new use cases regardless of price swings. The Ten31 portfolio has representation from all these sectors, and we believe category leaders in each vertical can drive favorable monetization events for early investors even during bear markets.

To be sure, we certainly expect our portfolio to perform better during periods of more bullish bitcoin price action, but our investments are fundamentally a levered play on bitcoin adoption, not necessarily bitcoin price. Over a longer time frame, those two will largely look the same as price follows adoption, but over shorter intervals they can decouple in either direction: price can outrun underlying adoption growth during periods of leveraged euphoria, and underlying adoption typically continues growing even during drawdowns. Indeed, many of our companies saw exactly that dynamic this past bear market, and we would expect that scenario to become more common as bitcoin technology becomes entrenched into more industries and its perception becomes more de-risked, offering another lever for periodic outperformance of individual investments relative to bitcoin’s price.

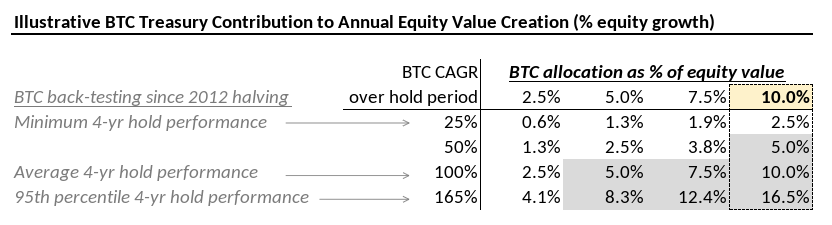

Sats Flows

A final and unique driver of potential outperformance for bitcoin companies is their ability to generate positive bitcoin-denominated cash flows, or “sats flows.” As Ten31 first discussed when we coined the term several years ago, companies that understand bitcoin today (whether they’re building enabling technologies for the ecosystem or are simply leveraging bitcoin’s properties to build an unrelated business) are in the uniquely advantaged position of being able to accumulate (or distribute to investors) a greater share of bitcoin’s fixed supply than laggards that only come to understand bitcoin years from now. As we said almost three years ago, those companies that can combine this early understanding of bitcoin with a profitable business model are therefore positioned to effectively become “bitcoin miners” that use their operations to acquire more bitcoin than they could otherwise accumulate by buying spot with the same starting capital. Critically, though, in most cases these businesses will be both far less capital intensive and have far more durable competitive advantages than traditional bitcoin miners.

A major theme of Ten31’s investment process is therefore evaluating how quickly businesses can achieve net positive cash (sats) flows, and bitcoin is a forcing function biasing founders toward this outcome. Just like Ten31, the best founders consider bitcoin their opportunity cost, and they are universally focused on flipping to profitability as quickly as is practical so they can begin accumulating bitcoin. Meanwhile, thanks to the relative scarcity of institutional capital historically focused on bitcoin, these founders have not grown accustomed to coming back to market for another fundraise every ~12 months to sustain unworkable unit economics. As a result of these dynamics, the vast majority of our portfolio companies operate on incredibly lean teams, and several have already paid out bitcoin dividends to investors.

While we expect that the majority of our fund returns in the coming decade will be driven by more traditional monetization events like acquisitions and IPOs, sats flows from efficient, profitable companies can further amplify performance. In some cases these sats flows could return an investment’s foregone bitcoin within a 10-year fund life even before any potential exit event of the underlying equity. For example, in the case of the illustrative company analyzed above, an investment could return 1x its foregone bitcoin solely through bitcoin dividends in as little as 6 years (and in most cases generally in less than 10 years) depending on a handful of variables:

Meanwhile, over the same period, this illustrative investment could drive positive bitcoin-denominated returns (i.e. returns that would more than compensate for foregone bitcoin) even if this company remained a private, independent sats-flow machine indefinitely:

While these returns would spill outside the boundaries of a 10-year fund life construct, investors in such a fund would still benefit from these longer term bitcoin returns either via 1) in-kind distributions of equity positions in this company at the end of the fund life or 2) secondary sales of equity positions to other financial buyers at the close of the fund. In either case, we would expect shares in a bitcoin-producing machine with a dominant market position to be highly attractive as bitcoin’s new supply issuance trends to zero and demand increases exponentially.

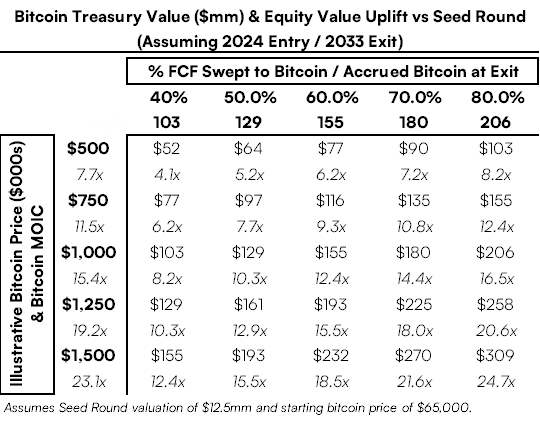

Alternatively, this company could use some of its free cash flow to accumulate bitcoin on its balance sheet – a strategy we’ve discussed at length in prior essays – which could support materially higher ultimate equity value for early investors in the event of a more traditional exit. This accumulated bitcoin treasury would effectively establish a floor value for a liquidity event, and in some cases the uplift in the value of the accrued bitcoin relative to the investment’s entry valuation could by itself drive equity value outperformance vs. bitcoin.

In the case of this hypothetical company, accumulating ~200 or more balance sheet bitcoin would drive equity value uplift (relative to the Seed Round valuation) in excess of bitcoin’s returns even before considering the discounted present value of the operating business.

Once is Happenstance, Twice is Coincidence…

So far, we’ve established that individual investments in the best bitcoin companies have the potential to outperform bitcoin within a typical fund life by pulling forward bitcoin’s future expected performance through traditional exits like acquisitions and IPOs, mitigating near-term price downside through leverage to ongoing adoption trends, and / or sweeping free cash flows to bitcoin. But however we conceptualize a single investment outperforming bitcoin, the ultimate question any individual or institutional allocator will have to ask is whether the same claim can be made at the portfolio level – given the risk and failure rates associated with early-stage companies, what would we have to believe for a fund composed of 20-30 investments to have a chance of outperforming bitcoin?

Assuming a $100 million fund ratably deployed over three years⁶ and a range of monetization outcomes similar to what we illustrated in the hypothetical investment above (and similar to outcomes for the best early-stage venture investments), we can envision a wide variety of scenarios where a fund could outperform even a very bullish price trajectory for bitcoin over the next decade:

As with the individual investment profiles above, this analysis is highly illustrative, but it paints a realistic case that an investor with access to the best deals and strong investment judgment has a path to building a portfolio that can meaningfully outperform bitcoin over a 10-year fund life, often by several multiples. We can make a few additional observations on the above:

In Scenario A, which posits 4 monetization events (a 16% hit rate in a portfolio of 25 companies) evenly spaced across years 3 through 9, this portfolio would return a post-carry IRR substantially above bitcoin’s in virtually every scenario, even relative to the best possible bitcoin IRR in this projection period.

In Scenario B, which assumes a more optimistic 6 monetization events – two in each of years 5 and 7 and one in each of years 3 and 9 for a 24% hit rate – the portfolio would outperform bitcoin’s 10-year IRR and its maximum possible IRR even if the portfolio were underweight its winners and if those winners averaged exit multiples well below 100x.

Even in less favorable outcomes like Scenario C, which assumes only two monetization events in years 5 and 7, the fund IRR would still exceed most achievable bitcoin IRRs.

In any given scenario, returns from an investor’s hit rate could be compounded by skillful sizing. If this fund were to skew more heavily toward investments in the portfolio’s ultimate winners (i.e. with an average pre-dilution investment above the simple average of $4 million for winners), the fund would drive even higher total returns on the same underlying percentage of monetized investments.

All these IRR figures – including bitcoin’s – are highly sensitive to the timing of cash flows. Earlier liquidity events would drive substantially higher IRR figures all else equal, though later exits might be more likely to drive higher MOIC as companies become more mature over the fund life.

While we could construct a very favorable cherry-picked scenario wherein an investor could generate higher bitcoin IRRs by exactly timing cycle bottoms and tops (as indicated by the “Max Possible Bitcoin IRR” scenario in the output above), this is exceedingly difficult to do in practice, as the last few bitcoin cycles have illustrated. Moreover, this type of precisely timed trading strategy doesn’t capture the way the vast majority of capital allocators (from individual bitcoin investors to large institutions) tend to look at bitcoin; instead, most potential investors we interact with have at least a 5-10 year “buy and hold” time horizon for bitcoin, so it’s more instructive to compare a fund strategy to that investment horizon. That said, it’s noteworthy that in many cases the hypothetical fund above would still meaningfully outperform bitcoin’s IRR even relative to that maximally cherry-picked scenario.

We believe the bitcoin price performance outlined throughout this piece is not overly conservative, as there are still few market participants anticipating $1 million+ bitcoin within the next decade. If this bitcoin forecast were to prove too pessimistic – as many of bitcoin’s most outspoken proponents might argue – that would certainly raise the hurdle for fund outperformance. However, that would also necessarily imply an even greater secular tailwind for companies building bitcoin infrastructure and thus likely also higher exit multiples and / or faster monetization events for a fund investing in those companies.

The illustrative fund IRRs reflected in this piece are no doubt ambitious, so it would be reasonable to ask how these returns might compare to some historical benchmarks for early-stage investment funds.

The historical data shown here suggest the range of IRRs targeted by a bitcoin-focused fund should fall well within the established precedent of the best venture funds of the past several decades. This is obviously a bullish target to set, but it’s exactly what we should expect given the backdrop of the strategy. If we’re right about bitcoin’s monetization and its highly disruptive potential, we are sitting at the precipice of a transformative technological wave comparable only to that of the internet in the early 1990s, and the early investors in the blue chips of this wave should be able to achieve returns comparable to the funds that made similar investments during the early adoption phase of the internet.

Conclusion

Ultimately, the relevant question for an investor weighing an allocation to early-stage equity in bitcoin technology companies is not whether the emerging blue chips in the ecosystem can actually outperform bitcoin, or even whether a whole portfolio can outperform. In principle, the case for both of these is very clear, and there’s no fundamental reason either should be inherently unachievable. Instead, the right question is how do you get there? How do you select a fund manager that can provide the best opportunity to achieve positive bitcoin-levered returns?

As discussed, this is by no means a trivial undertaking, and it will require a manager with a combination of differentiated deal flow and superior investment selection. As the largest bitcoin-focused investment platform with over $130 million in cumulative capital deployed, Ten31 provides exactly these capabilities. We have served as lead investor for 90% of the capital we’ve deployed, and over 80% of our capital has been deployed on an exclusive basis. Our funds have sizable, unique allocations to both bitcoin bellwethers at the Series A and B stages and the most promising early-stage innovators at the Pre-Seed and Seed stages. Our team combines deep experience in bitcoin – including several partners with over a decade of focused work in the space – and long tenures at blue chip institutions including CVC Capital Partners, Goldman Sachs, and Citadel, giving us both an unmatched network of founders and the tools to identify and execute on the best deals with institutional sophistication.

Outperforming bitcoin will put the funds that can achieve it among the best-performing vintages of all time, and no investor is better positioned to accomplish that than Ten31.

1 Some observers may contend that non-bitcoin “crypto” strategies have in some cases shown a track record of outperforming bitcoin. While this topic is beyond the scope of this piece, we question the long-term durability and risk-adjusted repeatability of such strategies as long as bitcoin continues to dominate the winner-take-all monetary race, a point addressed at length by Ten31 Advisor Parker Lewis here and here. We also note that a changing regulatory environment may limit some of the strategies that have historically driven outlier returns for some “crypto” funds.

2 Metrics for this hypothetical company are partially informed by comprehensive benchmarking analyses from venture bellwether Bessemer Venture Partners. The operating profile shown here is highly illustrative and only intended to give a sense of a long-term glide path; in practice, most companies will likely show lumpier growth (higher peaks and lower valleys), particularly in their earlier years.

3 Valuation analysis in this section assumes 0 net debt at acquisition and includes no credit for any bitcoin treasury potentially accumulated by the company.

4 Illustrative Seed and Series A valuation ranges are broadly in line with median data from 2020-2023, per data collected by Carta.

5 Expected future dilution assumes this hypothetical company raises a $12 million Series A at a $60 million post-money valuation in Year 2 followed by a $21 million Series B at a $150 million post-money valuation in Year 5. Assumes the investor does not participate in any future funding rounds (e.g. no exercises of pro rata rights).

6 The hypothetical bitcoin deployment schedule shown here is aligned with the typical multi-year deployment of a standard private capital vehicle, which is representative of true opportunity cost given capital is generally called over a number of years rather than all upfront. We note that the illustrative bitcoin IRRs shown here would not materially increase even if all capital were deployed into bitcoin in Year 0.

Bitcoin: Medium o̶f̶ for Exchange

Trying to explain what bitcoin is to someone unfamiliar with financial and computer science terms is usually pretty difficult and nearly impossible when the definitions are not clear.

Introduction

Trying to explain what bitcoin is to someone unfamiliar with financial and computer science terms is usually pretty difficult and nearly impossible when the definitions are not clear. There are typically a lot of words like money, bearer asset, trust minimized, network, protocol, as well as many others being used to describe bitcoin. So, to say someone can get lost in translation is an understatement as it can be a frustrating experience for either party. Given that every human on the planet from almost our earliest days has participated in the exchange of goods and services, it is fair to say that there is an inherent understanding of money and why it is useful. This basic premonition follows that money facilitates the exchange when you want to buy a house, a car, or food at the grocery store to alleviate the coincidence of wants problem (i.e. having to barter). Today’s money and all the historical iterations (transition states) can therefore be thought of in a broader approach as mediums *for* exchange. Thus, it can be understood that the advent of money indicates the purpose of an environment for exchange to occur. Bitcoin is simply the end state digital transformation of money from the shared physical environment to a shared digital environment. An openly accessible digital environment without barriers to entry or seigniorage creating conditions that are better described as a medium *for* exchange. What could be brushed aside as a simple change in wording is actually a fundamental shift on how to grasp and explain what bitcoin is.

Medium

A medium is defined as the substance that transfers the energy from one substance to another substance or from one place to another, or from one surface to another.

surrounding objects, conditions, or influences; environment.

Of

expressing the relationship between a part and a whole.

For

used as a function word to indicate purpose

used as a function word to indicate an intended goal

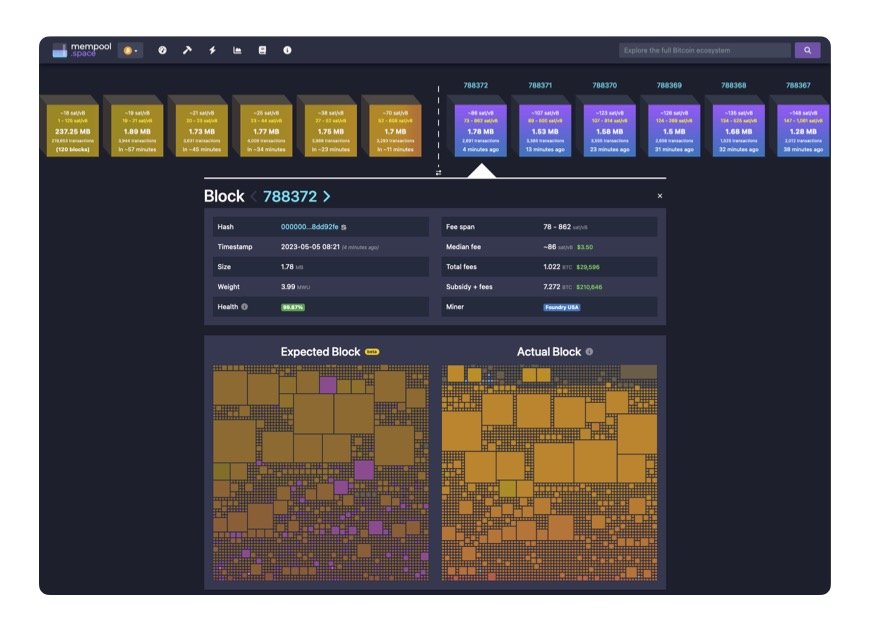

Through this lens, Ten31 sees companies operating at today’s transition point as creating new technologies that will accrue outsized value facilitating commerce in different and innovative ways leveraging a new medium for exchange. These bitcoin technology companies are allowing their customers to interact within the environment of bitcoin in such ways as for the visualization of the environment (Mempool.Space), entrance to a global marketplace for the environment (Strike), and many others Ten31 has supported over the last five years.

Visualizing Transparency