Bitcoin, Scarcer Than You Think

As the global economy grapples with ongoing financial turbulence, bitcoin remains a prominent subject of discussion that has increased in importance over the last decade. To an outsider who is merely glancing through a singular lens, bitcoin is only seen as a speculative asset. However, such a perspective only scratches the surface of bitcoin’s full potential. To truly fathom the possibilities of how this new medium will be used in value exchange, we must move past the surface level of market price and delve into the diverse financial functionalities this new technology affords. As we unearth more sophisticated avenues to leverage bitcoin’s properties of finite supply, fungibility, divisibility, and liquidity, a fundamental shift in its perceived and actual scarcity is inevitable. We will realize we have lived in an abundance of bitcoin with over 90% being distributed and easily accessible in the first decade, while in the coming decades acquiring bitcoin in size will become harder as companies begin to unlock bitcoin’s value. Companies like Unchained, Battery Finance, and AnchorWatch are creating novel ways to pair bitcoin with the $46T US credit market, $4T US real estate market, and $1T US insurance market in a truly uncorrelated way for mitigating risk and increasing returns. Unlike in previous cycles where dormant bitcoin has flowed onto exchanges for investors to access liquidity, in the coming cycles liquidity will be unlocked by novel products and services for holders of bitcoin, eliminating the need for selling bitcoin and further reducing the marginal supply available for purchase.

Bitcoin-backed Loans

Ancient Rome pioneered various financial instruments, with a formal process for collateral-backed loans standing paramount. Citizens often pledged tangible assets, such as land, as collateral to borrow capital. Bitcoin-backed loans are the digital age's interpretation of this practice, and Unchained, a bitcoin native financial service company, has produced the standard for lending in the digital age with their over-collateralized loans in a multisignature account. Much like how Roman farmers would leverage their land value while still cultivating it, today's bitcoin holders can secure liquidity without relinquishing their asset, preserving potential long-term appreciation while minimizing counterparty risk for both the lender and borrower through the use of distributed multisignature accounts that are easily verifiable on the blockchain.

Unchained currently offers loans at a 40% loan-to-value (LTV) ratio using Bitcoin as collateral protecting the borrower and themselves from the emerging asset’s volatility. Time and again, Bitcoin has showcased its superiority as pristine collateral thanks to its global availability for trade every minute of every day, which sets it apart from traditional collateral assets like real estate. Traditional assets often require lenders to factor in liquidation discounts due to a limited buyer pool, high transaction costs, and other restrictions. In contrast, Bitcoin's vast accessibility makes it the ideal collateral. Over the past six years, Unchained has successfully issued loans worth over half a billion dollars, all while maintaining a record of zero credit losses, even during dramatic 50% daily value dips. Whereas some competitors have ceased lending operations or closed down due to significant losses stemming from counterparty risks, Unchained has thrived across multiple cycles and drawdowns.

Battery Finance Powers Novel Financial Solutions

Battery Finance is an innovative institutional platform providing structured credit opportunities powered by bitcoin to meet real world asset financing needs. Battery’s solutions add a small amount of bitcoin collateral to traditional asset-backed loans while allowing lenders and borrowers to share in the long-term price appreciation of the asset, fusing the digital and the physical worlds. These innovative loan structures are designed to enable lenders and borrowers to both smooth out the short term volatility of bitcoin and create a return profile that is superior to that of traditional real estate lending alone. The infusion of bitcoin changes the financial contract’s overall profile like a pinch of spice changes a common dish into an exotic cuisine. Just as bitcoin revolutionized the concept of money and value, its union with real world assets is expected to further transform our understanding, laying the groundwork for a future where their interplay could redefine wealth and property in the 21st century.

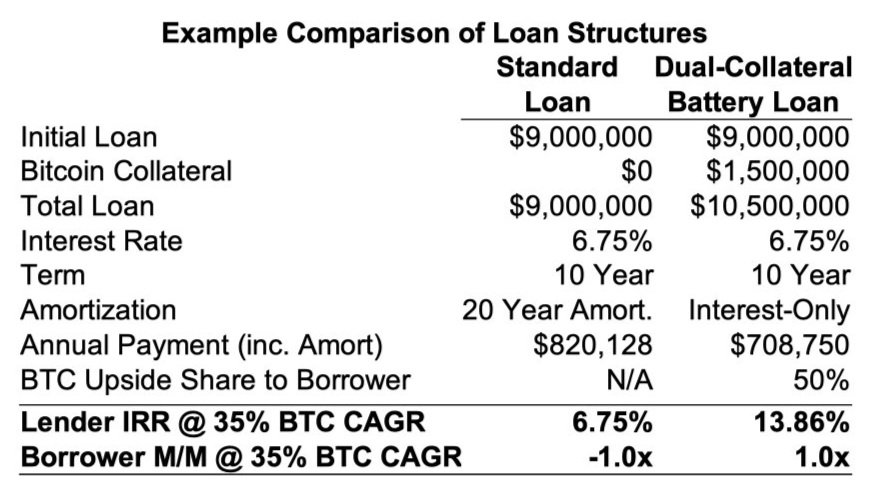

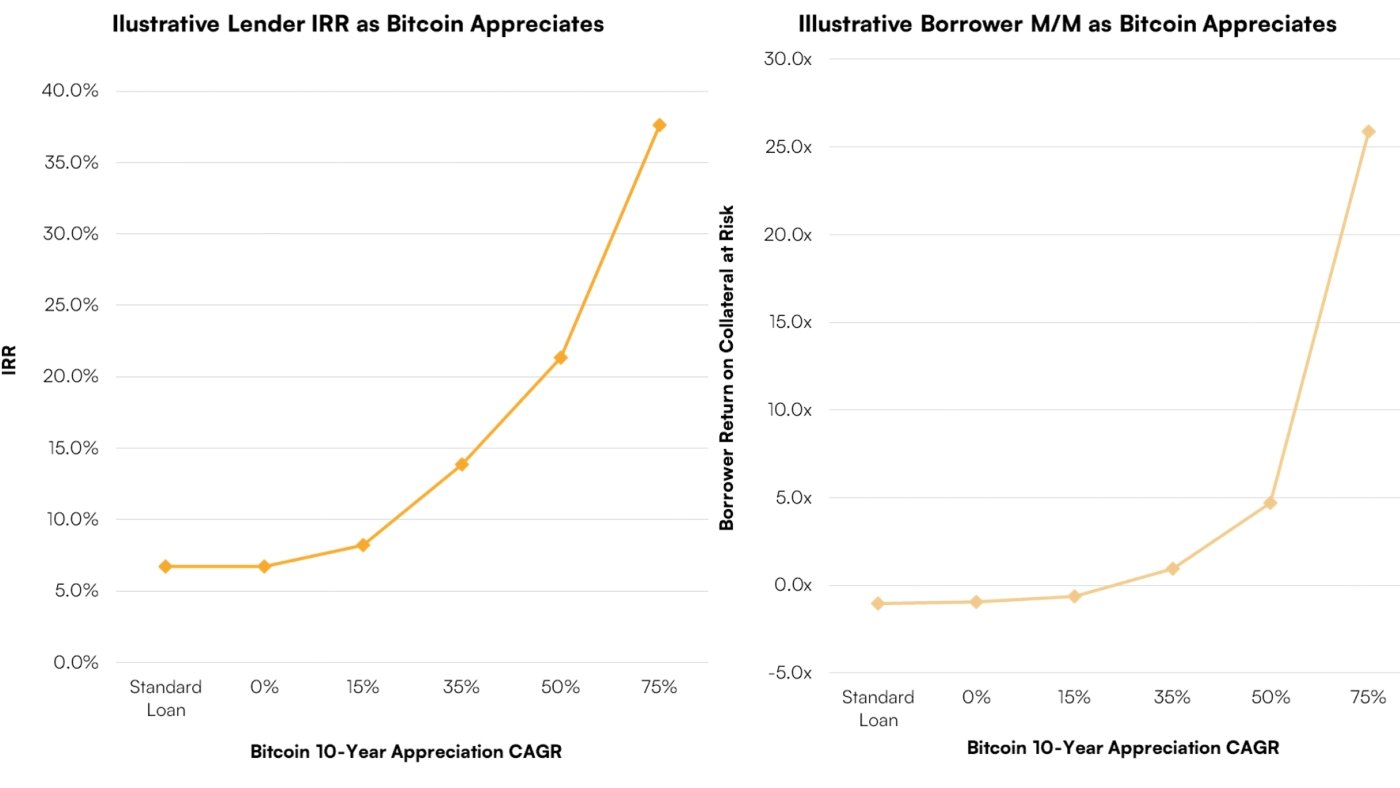

To zoom in on real estate lending, Battery Finance’s solution is the creation of a dual-collateralized loan composed of bitcoin and the real asset. The way this can be envisioned is when a property owner enters into an agreement where they are refinancing an underlying physical asset along with financing a bitcoin purchase. By pairing two uncorrelated assets, Battery is able to express its constructive long-term view on bitcoin as supplemental liquid collateral in a downside case, but also with bitcoin upside shared between the lender and borrower as the loan reaches maturity. Battery loan terms offer attractive borrower cash flow requirements through lower amortization or interest only rates and flexible repayment options without yield maintenance, compared to traditional loans that entail substantial interest, amortization, and make-whole clauses or prepayment premiums. In some instances, the cumulative difference between the cash flow requirements of a Battery loan and those of a traditional financing are close to the value of the bitcoin being financed (meaning the cumulative cash flow savings can nearly pay for the bitcoin being acquired). Put another way, the borrower is getting a long-dated bitcoin call option at a very low cost through a Battery financing.

During the past cycle we have seen multiple institutional collapses with >$100 Billion equity value evaporate from businesses who were promising “yield” on your bitcoin. What these businesses didn’t say was where the yield was coming from. Turns out the yield came from greater fool games, along with outright frauds. Unfortunately, a lot of hard lessons were learned by a global population of investors who may or may not have been fully informed on the risks they were taking. Battery represents a different, new, and promising path, with a more ethically minded sharing of risk of future performance. Meanwhile, in downside scenarios the pledged bitcoin is available to over-collateralize the loan, and provide the borrower better terms than if they had only the one asset. By better mitigating risk and sharing upside, Battery is able to more efficiently utilize productive capital.

Bitcoiners can also use their bitcoin to sustainably acquire income-producing properties, reorienting their returns to include both income from the traditional asset and appreciation from both the traditional asset and the bitcoin. Given that income generating assets often have extensive histories on their productivity, bitcoin holders will be better able to understand “where the yield comes from” and make informed decisions on the total risk they are assuming. Strategically combining bitcoin with other income-generating assets, investors can cultivate a steady flow of income from one or more projects thereby diversifying their overall assumed risk. Like dividends, this income stream is derived from the underlying asset's performance, allowing bitcoin holders to diversify their portfolios and realize consistent returns while still maintaining bitcoin upside.

Bitcoin Insurance Breaks New Waters

There have always been watershed moments when innovation has paved the way for new markets. The genesis of maritime insurance in the 17th century occurred as seafaring trade grew exponentially. There was an imminent need to cover the risk of valuable cargo being lost to pirates or natural calamities. Lloyd's of London, originally a coffee house where merchants and shippers met, transformed into an institution that started insuring ships and cargo. This innovation didn't just provide protection against losses; it fundamentally fueled global trade, allowing merchants to venture into new territories with minimized risks. Fast forward to the present day, and we witness a similar transformation with AnchorWatch leading the way in the realm of a digital asset, bitcoin.

For the first time, bitcoin stored in multisignature accounts can now be fully insured, a stark contrast to today where exchanges and qualified custodians can only cover up to a certain limit, and do not allow insured customers to hold their own keys, thus injecting additional counterparty risk. With 99% of all capital still to come into bitcoin the waters just got safer thanks to AnchorWatch who is able to fully insure institutions against lost and stolen bitcoin. This groundbreaking stride has been possible due to the native scripting language of the bitcoin protocol, which lays the foundation for truly programmable money. Multisignature accounts, by relying on multi-institutional custody and/or layered key permissions (such as AnchorWatch’s innovative and unique approach to Miniscript), dramatically reduce the risk of single points of failure and introduce robust disaster recovery pathways.

Just as ancient ports transformed from simple docklands to sprawling harbors, and then evolved again with the construction of colossal container terminals, AnchorWatch is redrawing the financial horizon. Container terminals became an inextricable part of modern seasides, so too will fully insured collaborative custody solutions become the standard for all fiduciaries interacting with bitcoin. AnchorWatch recognized and acted on this paradigm shift allowing bitcoin and bitcoin-collateralized lending to stand shoulder-to-shoulder with traditional assets and collateralized credit. A new wave is upon us, placing bitcoin-centric financial instruments on the same pedestal as their conventional counterparts.

Implications for Demand and Supply Dynamics

The 19th-century gold rush serves as a compelling analogy for bitcoin's supply-demand dynamics and its ultimate use as a medium of exchange. As thousands flocked to California, most miners’ immediate instinct was merely to sell the mined gold. Entire ecosystems — from infrastructure developments like railways to nascent financial systems — sprouted around the transaction of the precious metal. As new financial participants entered the fray to offer everything from bills of exchange to collateralized lending, there was a decline in the need to actively sell gold as value was exchanged in the form of a liability against an asset. This example showcases a historical path humanity developed for unlocking gold’s ability to be used as a medium of exchange in business without having to interact with gold directly. Similarly, as bitcoin evolves into a cornerstone of diverse financial instruments, the impetus to outright sell the asset for liquidity will diminish. Instead, leveraging bitcoin in a myriad of ways as presented above will become the norm. Just as towns and ancillary industries burgeoned around gold mines with the requirement to directly liquidate gold diminished for transacting business, bitcoin’s future is unfolding now with innovations that maximize its utility without holders having to deplete their reserves for utilizing bitcoin as a medium of exchange.

Conclusions

Historical parallels aren't just exercises in retrospection; they provide a lens to predict the trajectories of emerging phenomena. Financial innovations such as the Roman collaterals, coffee houses turned insurers, and boom towns of the gold rush have often broadened economic horizons, fostering societal wealth and advancing financial inclusivity. As our understanding of bitcoin transmutes around these time-tested analogies, its present day utility expands. Instead of merely being a speculative asset or static store of value, bitcoin is swiftly becoming a foundational pillar in modern financial architectures. The diverse and growing ways it can be interlaced with traditional asset classes not only accentuate its utility but also underline our evolving understanding of its scarcity.

Bitcoin is poised to be the cornerstone of 21st-century financial architecture on the back of innovative companies like Unchained, Battery Finance, and AnchorWatch, and will inevitably become far scarcer than many anticipate. As liquidity mechanisms evolve, selling bitcoin will become progressively less necessary, leaving less and less of bitcoin’s static supply available for sale against an accelerating market demand, radically amplifying bitcoin's scarcity. To be ahead of this curve, one must reevaluate their stance on bitcoin. The future is not just about owning Bitcoin; it's about comprehending its evolving utility. By harnessing these emerging financial innovations, we don't just witness history — we become active architects of a new financial system. So, as stewards of the future, let's champion, embrace, and pioneer these avenues, ensuring that we are not just spectators but active participants in this financial odyssey before us.