The Case for Building, Supporting and Investing in Open Source Businesses

It may seem obvious to those who most believe in bitcoin, but the importance of the open source nature of bitcoin cannot be overstated. Bitcoin is a natively-digital, bearer asset independent of governments and corporations and resistant to debasement, confiscation and deauthorization. Bitcoin operates on a singular, global, open network that anyone can use to store or transmit value across space and time without permission.

While proof-of-work mining clearly plays a central role in bitcoin’s censorship-resistant and seigniorage-resistant properties, the open source nature of bitcoin is also a critical component enabling its decentralization and censorship resistance. In a world that is becoming increasingly gated, controlled, censored, and manipulated, it is more important than ever to offer an alternative which is open, permissionless, transparent, trust-minimized and egalitarian. Bitcoin offers a new financial system which provides financial freedom and financial inclusion to all. The open source principles from which it is based represent a key building block for protecting human rights and freedom over the long term.

It is also critically important to apply open source principles to software and business applications plugging into the bitcoin network or built on top of bitcoin. The continued development of open source software and business applications remains paramount to counteract the centralizing forces of institutions, technology, and the associated encroachment on human freedoms that come as a result.

Most people might instinctively think the pursuit or support of open source development is some combination of (i) a philanthropic endeavor, (ii) a lopsided David vs. Goliath battle with entrenched, better funded incumbents, or (iii) an effort destined to burn cash even if an open source project becomes successful. However, the development of open source software and business applications in the open bitcoin monetary network can not only coexist alongside commercial motivations, but open source development and commercial aspirations can in fact be additive to one another resulting in a better end result than would have been achieved by either strategy on a standalone basis. The value proposition from an open source strategy will be far more meaningful than we’ve seen prior to bitcoin, and the open nature of its network will be the key value unlock for enabling this.

While it is traditionally tough to derive the community benefits at the early stages of an open source project, the value proposition of open source within bitcoin will be accelerated dramatically as the network effect of bitcoin grows stronger block by block. Rather than starting from scratch, open source applications can plug into the growing open source network we already have with bitcoin and get a head start. Suddenly it’s not just David vs Goliath, but an army of David’s that can quickly displace incumbents with open source innovation and scale benefits from the growing bitcoin network. That paves the way for participants across the ecosystem to pursue open source endeavors in a more meaningful way than they might have considered previously, including individual contributors, companies, investors and other capital providers. Some already understand this (e.g. @jack), but most do not. The attractiveness of building, supporting, and investing in open source businesses specifically within the bitcoin ecosystem will become more obvious over time, especially as early winners emerge.

The importance of free and open source software

It is helpful to look back at the origins of the cypherpunk movement to understand the importance of open source principles. I will not give a full history lesson here—you will get a better overview from Alex Gladstein in The Quest for Digital Cash—but the cypherpunk movement is rooted in an open source ethos. To counteract growing concerns about technological power centralizing to institutions and governments (and the coercive tendencies as that power grows), the cypherpunks took an offensive approach to invent and use technology that these groups could not stop. Core to that effort was not just cryptography, but also open source principles.

Authorities classified cryptography as munitions and tried to ban the export of encryption software. The cypherpunks understood the importance of maintaining individual privacy through encryption, and Paul Zimmerman released PGP in 1991 under a core cypherpunk belief that code is free speech and should be protected by first amendment rights. There were significant efforts to share that open source code widely, and as a result the knowledge base decentralized and the code became censorship resistant. We may not have PGP today if it wasn’t for those open source principles.

Cryptography has done wonders to tip the scale in favor of individuals with respect to communication, information, privacy, and now money; open source values are a critical complement, democratizing and decentralizing access to information, tools and applications, thereby supporting censorship resistance. Cryptography and open source principles together serve as critical tools for protecting freedom. Just as encryption is a human rights imperative, so too are other open source tools and systems.

What is open source software?

Free and open source software (FOSS) is by definition software that is free for anyone to use, modify, and distribute. Free does not just mean free of cost, but also means freedom (the four essential freedoms as defined by Stallman):

The source code is available and open for anyone to see, verify, access and use

Anyone has the freedom to modify the code in any way they choose

Anyone has the freedom to redistribute and/or commercialize the code

Anyone has the freedom to distribute copies of the modified code, which gives the community the opportunity to benefit from any such changes

There are many benefits of free and open source software, including accessibility and censorship resistance. FOSS can create a viral community that strengthens the software and can protect users from coercive actions of an antagonistic third party, whether a centralized authority or even the upstream team. In addition, open source software gives users the power to verify the code that is running (it is otherwise impossible to interact with software in a trust-minimized way if the source code is not viewable). In effect, open source software dramatically tilts the power balance away from those who might want to exploit their position to control users, allowing the code to outlive the team and project.

There are dozens of common open source licensing strategies, the most common of which are GPL, MIT and Apache, estimated to represent roughly 85% of open source licenses:

GNU General Public License (GPL) - referred to as a “copyleft” license, GPL protects the open source code such that anyone can fork the code, modify and sell it, but the code (and any modifications/contributions) must remain open under the same GPL licensing framework (i.e. any derived code inherits its license terms). This license would, for example, provide protection that a corporate giant doesn’t steal the original work, make modifications to it and then switch the greater work to closed source.

MIT - this license (used in bitcoin core) is generally most permissive in that it allows anyone to do whatever they wish with the original code without copyleft restrictions, meaning anyone has the freedom to fork the code and switch to another licensing model or even switch to closed source. The essence is that the community owns the code; no single entity owns more rights to it (important for self sovereignty). As well, there is no warranty behind it, removing any liability from the authors.

Apache 2.0 - a permissive license similar to MIT, with the primary differences being that any major modifications to the original source code must be disclosed (unlike MIT) and the explicit grant of patent rights to users (somewhat ambiguous in MIT)

In practice, some companies opt for licensing strategies which are not by definition free and open source but do offer users benefits versus proprietary software. For example, two common approaches are:

Business Source License (BSL) - the source code can be modified and compiled, non-production use of the code is free, and the code is available to become open source under a GPL or compatible license at a certain point in time. This license provides a model for a company to protect commercial interests, while allowing for open code which protects users from vendor lock-in.

Open core - typically involves offering a core or limited feature version of open source software, while offering enhanced features in a commercial version. In this case some code is open source, but non-core code is not available in source form, cannot be modified and compiled, cannot be contributed to and will remain closed source (does not protect users from vendor lock-in for those features).

Under these approaches, users have the power of source-viewable code, but the companies utilizing these types of licenses do not fully unleash the viral nature of FOSS development.

For companies, the open license utilized has often been a triggering topic within the bitcoin community, resulting in feuds among different teams (usually based on the “openness” of a company’s license, how it is marketed to the broader ecosystem/user base, and the commercial implications of the license). I will not get into specific past debates here but will note there are tradeoffs that need to be considered in a company’s licensing strategy, including potential impacts on scaling, development, community building, competition, and funding/monetization, among other factors. Depending on the existing license (and subject to existing code remaining protected under that license), a company may consider pivoting to a different licensing strategy as its business objectives and the merits of its open source strategy evolve.

There are obvious benefits that can come to a company from building an open source business/application and allowing for community contributions, including accelerating product feedback and innovation, improving software reliability, scaling support, driving adoption, and increasing the pool of technical talent contributing to the business. On the flip side, some perceived challenges of open source are that a company opens itself up to more competition and restricts its ability to monetize its efforts. Common concerns are the possibilities of (i) a VC firm funding a fork of the project, allocating a significant marketing budget to prop up the new business, and none of the financial benefits accruing to the original creators, or (ii) a large corporation leveraging its more extensive resources or existing customer base to exploit the open source code for its benefit and at the expense of the original creators.

Notwithstanding these potential concerns, the real power of open source is the ability to take the code, remix it, provide it to the market and let the market decide. Competition drives progress. As we move towards a more bitcoin-oriented world, having an open approach will build trust with the community (anti-rent seeking behavior; win based on the merits, rather than exploiting a current position of power i.e. “proof-of-stake” approach). Within the bitcoin ecosystem, there are also tangible and reinforcing benefits for both the company and the network when building open source applications, which I’ll discuss in more detail further below.

Not every business will make sense for an open source model, and not every team or company will want to pursue an open source strategy, but every company should think about how it can support the open source mission in some way (for example, making a portion of its business open source or making contributions to open source development in the ecosystem). Some level of support for open source development is better than none, and we generally feel the more, the better, but that is up to each team to decide and strike a balance they feel is appropriate. From a company perspective, honesty is critical so as not to misrepresent the nature of the license used, the motivations around the selection of that license, and the considerations applicable to the use of its software.

Open source licensing is a tool to help deliver a better, more open and free world. Open networks are superior to closed networks, open software is superior to closed software, and everyone will win as these ways of business proliferate.

Open source business models

The full potential of open source can be achieved when technological development is paired with a sound commercial and funding model. Developing a viable economic model that pays for itself not only creates sustainability in a project, but can also accelerate the open source movement. A sustainable economic model can support a growing developer community, spurring further technological development, which in turn increases the economic incentives for open source.

There are many business models that can work, but they all typically revolve around selling services on top of open source software:

Support services: maintenance, installation, support

SaaS / managed services: backup, hosting, security, etc.

Tooling / enhanced functionality: paid features / performance on top of base software

Other services: diverse range depending on nature of the software functionality, and could even include hardware manufacturing / distribution bundled with FOSS

Red Hat is one of the more well-known companies to have successfully commercialized open source software by offering software for free and charging a support fee to customers for maintenance, support, and installation. Red Hat was founded in 1993, went public in 1999, was later acquired by IBM in 2018 for $34 billion, and today boasts more than $3 billion in revenue. Other businesses with open source models have proven successful, including MySQL (purchased by Sun Microsystems for $1 billion), XenSource (acquired by Citrix), Revolution Analytics (acquired by Microsoft), MongoDB (IPO), Mulesoft (acquired by Salesforce for $6.5 billion), Elastic (IPO), and Gitlab (IPO), among many others.

While it is not trivial to successfully commercialize an open source business, it is clear from past examples that companies can achieve tremendous success while incorporating an open source model. Companies must deliver a product or service which customers are willing to pay for on top of free software. The nuance is that it becomes less about monetizing the past (rent seeking), and more about getting paid for delivering value in the present. Companies that open source their business can win competitively by providing better service, community, expertise (knowing the code better than competitors), and customer experience.

There is a misconception that investors would not want to invest in something that isn’t proprietary, and that likely is true for a large chunk of traditional VC investors. But just like bitcoin requires an adjustment of mental frameworks and an openness to understand its potential, the same is true for conceptualizing investments in open source businesses. Investor participation in an open source business can also enhance development, growth and value creation.

Open source businesses in bitcoin

Building open source technology businesses has proven it can be an attractive strategy, but nowhere will this prove to be more true than in the bitcoin ecosystem, where the open monetary network will provide a stronger feedback loop to benefit both the network and those developing open source applications on top of it.

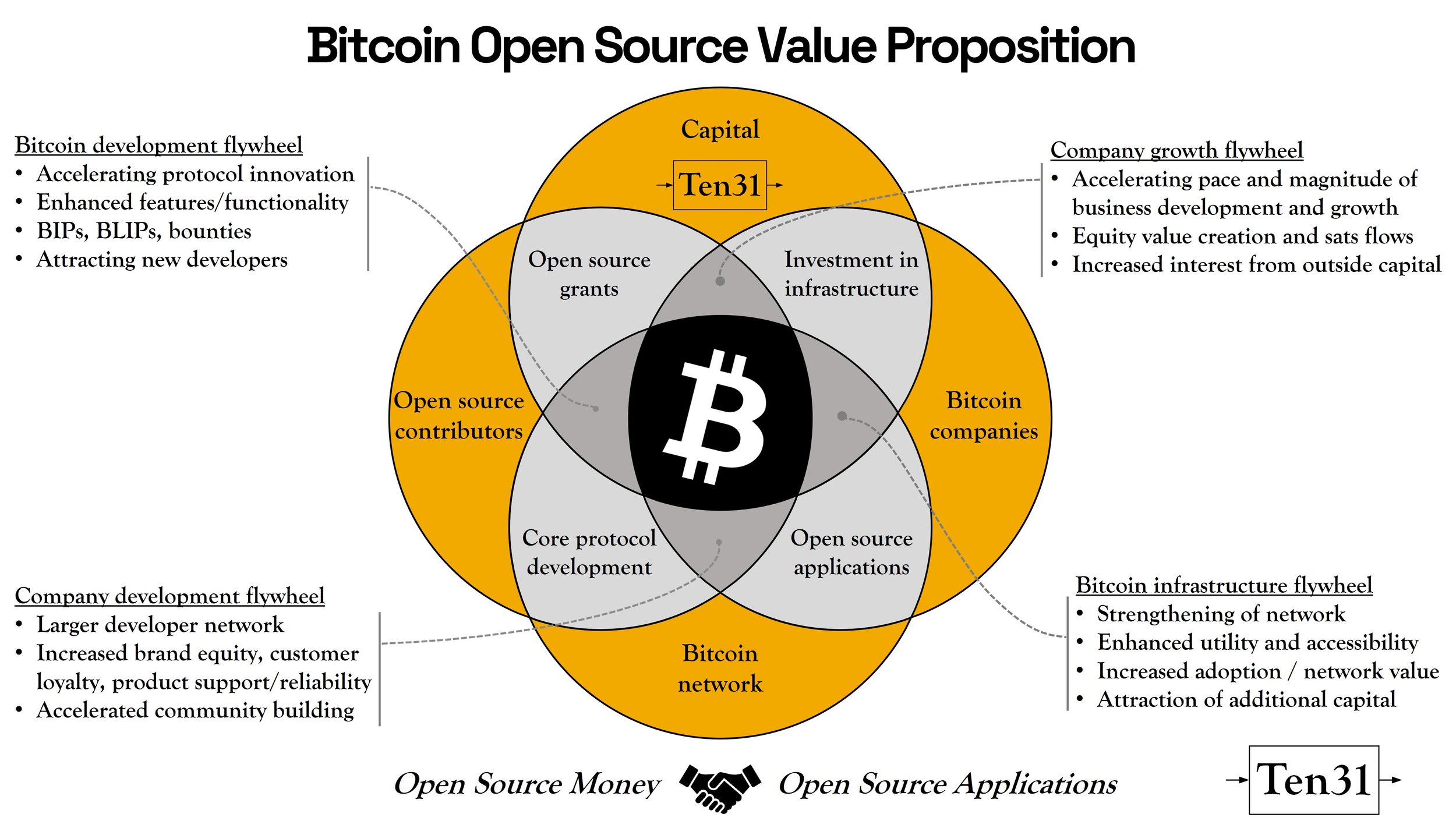

As above, an open source business model can provide a company with a larger developer network to support technological innovation, enhancing product support / reliability, building customer loyalty and brand equity and ultimately accelerating community building, which drives further interest from open source developers (the “company development flywheel”). In addition, within the bitcoin ecosystem, the value proposition to open source development extends beyond the company to also strengthen the network as a whole, driving enhanced utility for all participants, increasing adoption, and creating a flywheel that attracts additional capital into the ecosystem to support infrastructure development (the “bitcoin infrastructure flywheel”, which I outlined in my prior piece).

Furthermore, as capital is deployed within the ecosystem, both in the form of investments in companies building open source applications as well as grants to open source contributors, (i) further company resources are available for technological development, driving accelerated company growth and attracting additional capital investment (the “company growth flywheel”), and (ii) further resources are allocated to protocol innovation, opening up the possibilities of enhanced features and functionality, further attracting new developers and altogether strengthening the network (the “bitcoin development flywheel”).

These forces together form a very powerful vortex through which the entire ecosystem is pushed forward, reinforcing its strength and benefiting all participants in the network.

It should sound intuitive that open source applications should go hand in hand with open source money, but I think it is difficult for most to comprehend just how dramatic the impact of this will be. It will not only be a game changer for individual participants, but there is also a significant opportunity for early movers in the bitcoin ecosystem to unleash the power of open source to drive growth for their business and create projects of unprecedented scale by leveraging the network effects of bitcoin. In addition, one of the pain points for open source tools in the past was receiving money directly from users without a trusted third party; bitcoin enables new models as a result.

While it might be instinctive to think offering open source products could be cannabalistic to one’s own business, in the future we will find these efforts to have been a significant net add, strengthening not only the network but also the business and any others who contributed to those efforts (individual contributors or capital providers). It should be noted that not every open source project needs to have a profit motive to drive value, but it is also not the case that contributing to open source vs. pursuing commercial endeavors is an “either/or”: open source projects can drive significant profits, and in the bitcoin ecosystem this will result in sats flows and bitcoin dividends.

Just as I’ve said investing in bitcoin infrastructure provides great asymmetry, contributing to open source development will similarly provide great asymmetry to all those who do it, while benefiting all other participants at the same time. Bitcoin is uniquely designed to provide an incentive structure where the devotion of resources can be good for business, good for the industry, and good for humanity.

Ten31’s contribution to open source

When we formed Ten31 we thought it was important at the outset to give back to the ecosystem and to those contributing to its development. We were inspired early on by the efforts of Square and HRF, as well as Brink and OpenSats. We created a recurring management fee-based donation model, earmarking capital that could create a consistent source of funds to support the ecosystem. In doing this, we also hoped it might inspire other funds to think similarly and consider giving back on a recurring basis.

We continue to be impressed by the magnitude of contributions and open source development happening in the ecosystem today, and are grateful for all those committing time and resources to that effort, especially the developers and companies.

At Ten31 we are supporting the open source ecosystem in a variety of ways:

Grants to open source contributors: Initial grant in 2021 to Bitcoin QnA for his work in bitcoin education and informational content. 2022 grants will be announced soon

Founding contributor to OpenSats

HRF: sponsoring 4 developers to attend 2022 Oslo Freedom Forum

Bitcoin Commons: sponsoring a permanent seat for a developer to work in the new Bitcoin Commons in Austin, Texas

Investing in open source businesses: we are proud to be one of the most active investors supporting bitcoin businesses who contribute to open source development, including:

Hodl Hodl: built various open source tools on MIT licenses

Nodl: fully open source with a MIT license; supporter of OpenSats

River: supporter of Brink

Samourai Wallet: fully open source operating on a GPL license

Sphinx Chat: fully open source operating on a MIT licence

Start9: platform for hosting a broad suite of FOSS, operating with a custom non-commercial open source license

Strike: supporting open source development through the Bitcoin Indy car and recent Lightning bounties with HRF

Swan: supporter of OpenSats, released an xpub tool with a MIT license

Unchained Capital: its Caravan multisig tool is fully open source on a MIT license

Final thoughts

Development of free and open source software is an imperative for human freedom.

Open source development in the bitcoin ecosystem creates a powerful vortex that benefits contributors, companies and the network.

Open source development can coexist alongside for profit business models and can be enhanced with external investment capital.

There are many open source business models that can produce sats flows and bitcoin dividends, particularly when harnessing the power of bitcoin network effects and differentiating on services, brand, community, experience and time to market.

Every participant in the ecosystem should be considering how it can support open source development. We will continue to contribute in a meaningful way from Ten31 and will actively encourage every company we invest in to consider the same.

For companies building open source tools and considering taking on investors, it is critical to find a partner aligned with those objectives; the best way to judge that is by historical contributions (similar to reviewing a developer’s commits on github). The actions supporting open source development should speak for themselves (“proof of work”).

Those that provide value and contribute back to the network will ultimately accrue value in their business, brand, customer base, and relationships. Open source development is good for bitcoin, and what is good for bitcoin will be good for humanity and will ultimately be good for those enabling it, whether developers, founders, companies or investors.