Outperforming Bitcoin

Reckoning with the new cost of capital

At Ten31, our central thesis – which we’ve written about extensively elsewhere – is that bitcoin is superior monetary technology, and as understanding of it distributes over time, all self-interested actors across industries will ultimately have to adopt it in some form, driving trillions of dollars of demand for enabling technologies and infrastructure to allow for that adoption. Communicating that thesis to capital allocators has its own hurdles given bitcoin’s relative infancy and volatility, though every year brings this view closer to the mainstream, as most recently evidenced by record-breaking launches for spot bitcoin ETFs and the capitulation of previously ardent critics like BlackRock’s Larry Fink. But once we’re past that discussion, the next question we typically hear from both dedicated bitcoiners and bitcoin-curious allocators is: if our bitcoin thesis is correct, the asset will likely see huge upside over the coming decades, so how can Ten31’s investments possibly outperform that hurdle?

This is an important question and one that is foundational to everything we do at Ten31 – we were the first investment platform to explicitly address this theme nearly three years ago, and it has informed all of our investment decisions since then. If investors agree with our view of bitcoin’s future adoption, they can always simply allocate directly into bitcoin to express that thesis. In the same way, the Ten31 team and all the founders we support could be spending our scarce time at larger companies drawing salaries to stack sats rather than investing in and building innovative bitcoin infrastructure, likely foregoing some near-term bitcoin accumulation in the process. As a result, we evaluate every investment we make relative to its potential to outperform bitcoin over relevant time horizons, and we seek to build a portfolio that can collectively do the same. At the end of the day, bitcoin’s performance is our cost of capital.

This is undoubtedly a high bar to clear, and many investors attempting to hurdle it will fall short. However, for a platform like Ten31 with differentiated deal flow and superior investment selection, the case for this outperformance is much stronger than might be immediately obvious when first considering bitcoin’s expected price trajectory over the coming decades. As the largest investor focused exclusively on the bitcoin ecosystem, Ten31 has deployed over $130 million into 36 of the best companies – including both blue chip “picks and shovels” providers and forward-thinking incumbents who were not originally “bitcoin companies” – that will directly enable and benefit from bitcoin’s adoption growth, and we have high conviction that this portfolio and our future investments will deliver levered returns on bitcoin.

The 21,000 Foot View

To build the high level intuition underpinning this thesis, we’ll start with a caveat: if you’re reading this, you should own bitcoin. Allocations to bitcoin itself and bitcoin-linked equities are not mutually exclusive, just as ownership of an internet-connected smartphone is not mutually exclusive with owning shares of Apple or Google – the potential cash flows and expected returns of the latter are a direct function of the utility and adoption of the former.

Owning bitcoin very likely offers more economic upside to a user than owning the latest iPhone, but that expected price upside forms the foundation of the bullish case for bitcoin infrastructure: ongoing and sustained growth in bitcoin’s price necessarily implies ongoing growth of bitcoin adoption (more users, businesses, and governments coming into the market to utilize bitcoin in a myriad of ways), which in turn implies growing demand for the technologies enabling and adding value to that same adoption. If you’re bullish on bitcoin, the only coherent position is to also be bullish on the infrastructure that will enable and propel its growth.

Many investors inadvertently take an internally inconsistent stance on bitcoin technology investments, arguing that since bitcoin’s expected price performance is so strong, it won’t be possible to outperform bitcoin with technology investments in the space. The key disconnect in this logic is that these technology providers are directly enabling and benefiting from the underlying dynamics driving that price growth. It’s certainly reasonable to take the view that the vast majority of alternative strategies (e.g. generalist venture capital and private equity) will not outperform bitcoin, but Ten31’s strategy is not attempting to drive outperformance with investments in some uncorrelated theme; rather, our investments are directly strapped to the rocket of bitcoin’s adoption growth across payments, financial services, energy and power, consumer technologies, and eventually every industry on earth. Bitcoin-levered equity is therefore the only strategy with a durable opportunity to outperform bitcoin in the coming decades.¹

Moreover, there is strong historical precedent for this dynamic playing out in other industries. The best equity investments in the bitcoin ecosystem will be leveraged plays on bitcoin adoption, just as the leading infrastructure and technology providers in oil & gas and pharmaceuticals have historically been leveraged plays on their underlying themes:

Getting More Granular

With that broad framework in mind, we can delve deeper to illustrate how this outperformance might play out in practice for Ten31, starting with the hypothetical case of an individual investment in our portfolio. A critical precept as we make this evaluation is that Ten31’s funds operate with a standard 10-year life, which means – contrary to a misconception that often plagues investors thinking through these dynamics – that we are not trying to outperform bitcoin over an indefinite, open-ended future, but rather over a defined 10-year window. Bitcoin may well go up forever in purchasing power, but our task as fund managers is to deliver superior risk-adjusted returns levered to bitcoin’s performance over the span of a given 10-year fund.

The most straightforward and obvious way to do this would be to provide investors with expedited dollar-denominated returns – said another way, our best investments should be able to drive 10-100x dollar returns over a shorter period than bitcoin itself and thus higher IRRs than bitcoin. For example, an emerging leader in bitcoin technology (or a forward-thinking player from a traditional vertical leveraging bitcoin in creative ways) might return 50x over a 5-year investment window while bitcoin appreciates “only” 10x over the same time frame. In practice, these expedited returns will be driven primarily by traditional exit events like acquisitions and initial public offerings (IPOs), though we expect acquisitions will be the more common path near-term.

If bitcoin’s ongoing adoption trajectory continues to look much like that of the internet several decades ago, incumbent players will experience progressively more disruption to legacy business models and see growing strategic value in many of the companies in the Ten31 portfolio. This increasing strategic awareness of and interest in bitcoin-linked technology will likely start in the verticals most clearly affected by bitcoin’s properties – financial services and fintech, payments, credit & lending, oil & gas, power & utilities – but will ultimately expand outward to touch virtually every industry on earth, as we’ve detailed in prior writing. As this incumbent interest spreads, the most expeditious and capital-efficient path to integrate innovative bitcoin technologies will in many cases be acquisitions of the leading bitcoin companies that have already developed differentiated technology stacks, expertise, network effects, customer relationships, and brand equity (i.e. strategic acquirers will often choose to buy vs. build).

When acquirers (or public markets investors evaluating new IPOs) take action, they will underwrite their valuations of the leading bitcoin companies by projecting the expected future cash flows of their targets, which will be at least partially a derivative of expected future bitcoin adoption. These acquirers and investors will be willing to pay the discounted present value of a bitcoin company’s future cash flows, in effect pulling forward bitcoin’s expected future performance and allowing early investors in acquired or newly-public companies to capture bitcoin’s price appreciation faster than they would have by holding the asset itself.

To really dig into how this might work and the drivers that could flex outcomes higher or lower, we can posit both an illustrative outlook for bitcoin’s price over the coming decades, as well as an operating profile of a hypothetical early-stage bitcoin company with the kind of growth trajectory and margin expansion typical of a top-quartile software or technology business:²

Given the hypothetical projections above, how might a strategic acquirer or IPO investor evaluate this target? While the answer can vary substantially based on the acquirer’s discount rate, the company’s maturity when the acquisition is made, and many more factors, we can establish some basic error bars. For instance, assuming an initial investment by Ten31 in 2024 and an acquisition of this hypothetical target nine years thereafter (in this case, 2033), an acquirer’s valuation might look something like this:³

For investors who deployed capital into this hypothetical company at the Seed or Series A Stage, exit valuations in the range above would drive highly attractive returns that would outperform bitcoin in virtually every scenario, even ignoring any potential synergies (e.g. cross-selling or back office rationalization) an acquirer might be able to achieve, which would serve to push exit valuations even higher:

For those most concerned with bitcoin-denominated returns – which doesn’t yet describe many institutional investors but certainly applies to the Ten31 team – it’s important to highlight that the above return profiles equate to earning more bitcoin than was foregone in the initial investment. If Ten31 made a $1 million Seed stage investment in this company at a $15 million valuation in Year 0 (2024) with bitcoin’s price at ~$65,000 and achieved a ~86x dilution-adjusted exit in Year 9 (2033) with bitcoin’s price at ~$1.2 million, we would have effectively invested 15.4 bitcoin and returned the equivalent of 72.9 bitcoin, a 4.7x multiple on foregone sats. Note also that in most cases in the above scenario analysis, an acquisition of this nature even in later years would yield an IRR superior to bitcoin liquidated much earlier on, meaning an early-stage equity investor would be more than fairly “paid to wait” for an exit, even in bitcoin terms.

The more bullish an acquirer or public markets investor is on bitcoin’s long-term adoption growth, the more they should be willing to pay for the company’s equity all else equal. Even more importantly, as bitcoin adoption grows and its market cap rises to levels only achieved by the largest, most liquid assets in the world, its staying power will become more obvious and assured, and it will seem progressively more de-risked to both corporate incumbents and large institutional investors (including the world’s largest asset managers). This growing certainty and comfort in bitcoin’s longevity will allow acquirers and investors to a) more confidently and optimistically forecast cash flows for leading bitcoin businesses and b) apply lower discount rates to those cash flows, both of which will tend to drive higher valuations for the best companies with a bitcoin strategy. The Lindy Effect will work just as well for bitcoin-levered companies as it has for bitcoin itself.

Finally, investors in the most successful early-stage bitcoin companies will benefit from a few additional levers that should further amplify returns:

First off, Ten31 estimates roughly a 100:1 mismatch between cumulative funds raised for broader “crypto” funds relative to bitcoin-focused vehicles, meaning that investors deploying into this ecosystem today can often get deals done at valuations 25-75% lower than what might be expected in comparable rounds in broader crypto or tech thanks to the relative dearth of capital currently chasing the bitcoin ecosystem. Ten31 in particular benefits from this dynamic thanks to our deep network, reputation among founders, and our partners’ long track record in the bitcoin space, which have collectively allowed us to lead rounds or serve as exclusive partner for over 80% of the capital we’ve deployed, often at advantaged entry valuations.

Meanwhile, at the end of the investment life cycle, returns to early-stage investors could be compounded by the growing sense of urgency and optimism that typically accompanies the later stages of bitcoin bull cycles, with the resulting spike in corporate and investor appetite likely supporting higher exit multiples for the best bitcoin businesses at local cycle tops (a dynamic that could become particularly common over time after a few early movers have set a precedent for acquisitions).

It’s still early, but Ten31 has already seen evidence of all these dynamics playing out in our portfolio, as several of our larger investments have undergone 20-30x valuation markups since initial deployment a few years ago while bitcoin’s price has increased only 5-6x over the same period. While these markup events still have yet to be monetized, they stand as solid early evidence that the market is validating our thesis that forward-thinking companies building on bitcoin can drive levered returns on bitcoin’s performance.

Downside Mitigation

Another angle on this question that investors should consider is the potential downside volatility mitigation that a portfolio of bitcoin-levered equity positions could provide across bitcoin price cycles. Anyone considering an allocation to bitcoin inevitably notices its price volatility right away, as the asset’s history is littered with examples of 50%+ drawdowns (only for bitcoin to eventually jump back to new all-time highs). However, the same is not true for the overall trajectory of bitcoin’s adoption, which generally seems to move consistently up and to the right over time. The process of a user coming to understand bitcoin is typically a one-way function regardless of near-term price volatility, as evidenced by HODL Waves – which illustrate a consistently growing proportion of bitcoin buyers turning into long-term holders – as well as persistent growth in unique on-chain entities and the number of bitcoin addresses with balances >0.1 bitcoin.

The users that continue to hold and interact with bitcoin across price cycles do so because bitcoin solves some underlying problem for them: a superior long-term store of value, a rail for cheaper remittances, a means of escaping hyperinflation, and many other use cases. Bitcoin’s unique properties can solve a variety of problems at the individual and enterprise levels regardless of the vagaries of short-term price action, and we expect a growing awareness of these properties to drive progressively greater appetite for bitcoin technology acquisitions among a diverse set of strategic players, even during price drawdowns.

For example, oil majors like Exxon and ConocoPhillips are increasingly recognizing bitcoin mining’s potential to monetize otherwise wasted resources like vented or flared gas, and we expect this convergence to accelerate over the coming decade since mining represents a unique and unprecedented source of revenue for the energy industry. Meanwhile, power grids have become progressively more intertwined with bitcoin mining over the past several years, as mining represents a unique flexible power load that – unlike traditional data centers – can be switched off and back on almost instantly to accommodate a grid’s unpredictable needs. While interest in these applications will no doubt be higher during bull markets, neither of these use cases are direct functions of bitcoin price gyrations, as clearly demonstrated by bitcoin network hashrate increasing more than 300% from 2022 to 2024 even as bitcoin’s price ranged anywhere from 30-80% off its prior cycle highs during that same interval – a dynamic that directly benefited several Ten31 portfolio companies during this period.

Various other verticals where founders are building thriving bitcoin businesses not directly tied to bitcoin’s price include payments and remittances, which can drive substantial disruption to legacy infrastructure across market cycles as long as bitcoin remains sufficiently liquid; on / off ramps that see increased trading volume during both upside and downside volatility; and consumer applications that can leverage bitcoin’s unique properties for new use cases regardless of price swings. The Ten31 portfolio has representation from all these sectors, and we believe category leaders in each vertical can drive favorable monetization events for early investors even during bear markets.

To be sure, we certainly expect our portfolio to perform better during periods of more bullish bitcoin price action, but our investments are fundamentally a levered play on bitcoin adoption, not necessarily bitcoin price. Over a longer time frame, those two will largely look the same as price follows adoption, but over shorter intervals they can decouple in either direction: price can outrun underlying adoption growth during periods of leveraged euphoria, and underlying adoption typically continues growing even during drawdowns. Indeed, many of our companies saw exactly that dynamic this past bear market, and we would expect that scenario to become more common as bitcoin technology becomes entrenched into more industries and its perception becomes more de-risked, offering another lever for periodic outperformance of individual investments relative to bitcoin’s price.

Sats Flows

A final and unique driver of potential outperformance for bitcoin companies is their ability to generate positive bitcoin-denominated cash flows, or “sats flows.” As Ten31 first discussed when we coined the term several years ago, companies that understand bitcoin today (whether they’re building enabling technologies for the ecosystem or are simply leveraging bitcoin’s properties to build an unrelated business) are in the uniquely advantaged position of being able to accumulate (or distribute to investors) a greater share of bitcoin’s fixed supply than laggards that only come to understand bitcoin years from now. As we said almost three years ago, those companies that can combine this early understanding of bitcoin with a profitable business model are therefore positioned to effectively become “bitcoin miners” that use their operations to acquire more bitcoin than they could otherwise accumulate by buying spot with the same starting capital. Critically, though, in most cases these businesses will be both far less capital intensive and have far more durable competitive advantages than traditional bitcoin miners.

A major theme of Ten31’s investment process is therefore evaluating how quickly businesses can achieve net positive cash (sats) flows, and bitcoin is a forcing function biasing founders toward this outcome. Just like Ten31, the best founders consider bitcoin their opportunity cost, and they are universally focused on flipping to profitability as quickly as is practical so they can begin accumulating bitcoin. Meanwhile, thanks to the relative scarcity of institutional capital historically focused on bitcoin, these founders have not grown accustomed to coming back to market for another fundraise every ~12 months to sustain unworkable unit economics. As a result of these dynamics, the vast majority of our portfolio companies operate on incredibly lean teams, and several have already paid out bitcoin dividends to investors.

While we expect that the majority of our fund returns in the coming decade will be driven by more traditional monetization events like acquisitions and IPOs, sats flows from efficient, profitable companies can further amplify performance. In some cases these sats flows could return an investment’s foregone bitcoin within a 10-year fund life even before any potential exit event of the underlying equity. For example, in the case of the illustrative company analyzed above, an investment could return 1x its foregone bitcoin solely through bitcoin dividends in as little as 6 years (and in most cases generally in less than 10 years) depending on a handful of variables:

Meanwhile, over the same period, this illustrative investment could drive positive bitcoin-denominated returns (i.e. returns that would more than compensate for foregone bitcoin) even if this company remained a private, independent sats-flow machine indefinitely:

While these returns would spill outside the boundaries of a 10-year fund life construct, investors in such a fund would still benefit from these longer term bitcoin returns either via 1) in-kind distributions of equity positions in this company at the end of the fund life or 2) secondary sales of equity positions to other financial buyers at the close of the fund. In either case, we would expect shares in a bitcoin-producing machine with a dominant market position to be highly attractive as bitcoin’s new supply issuance trends to zero and demand increases exponentially.

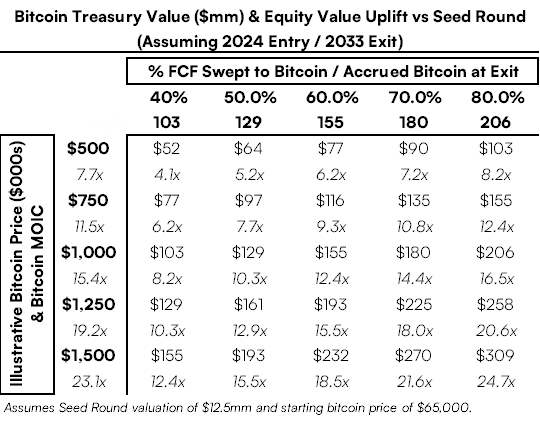

Alternatively, this company could use some of its free cash flow to accumulate bitcoin on its balance sheet – a strategy we’ve discussed at length in prior essays – which could support materially higher ultimate equity value for early investors in the event of a more traditional exit. This accumulated bitcoin treasury would effectively establish a floor value for a liquidity event, and in some cases the uplift in the value of the accrued bitcoin relative to the investment’s entry valuation could by itself drive equity value outperformance vs. bitcoin.

In the case of this hypothetical company, accumulating ~200 or more balance sheet bitcoin would drive equity value uplift (relative to the Seed Round valuation) in excess of bitcoin’s returns even before considering the discounted present value of the operating business.

Once is Happenstance, Twice is Coincidence…

So far, we’ve established that individual investments in the best bitcoin companies have the potential to outperform bitcoin within a typical fund life by pulling forward bitcoin’s future expected performance through traditional exits like acquisitions and IPOs, mitigating near-term price downside through leverage to ongoing adoption trends, and / or sweeping free cash flows to bitcoin. But however we conceptualize a single investment outperforming bitcoin, the ultimate question any individual or institutional allocator will have to ask is whether the same claim can be made at the portfolio level – given the risk and failure rates associated with early-stage companies, what would we have to believe for a fund composed of 20-30 investments to have a chance of outperforming bitcoin?

Assuming a $100 million fund ratably deployed over three years⁶ and a range of monetization outcomes similar to what we illustrated in the hypothetical investment above (and similar to outcomes for the best early-stage venture investments), we can envision a wide variety of scenarios where a fund could outperform even a very bullish price trajectory for bitcoin over the next decade:

As with the individual investment profiles above, this analysis is highly illustrative, but it paints a realistic case that an investor with access to the best deals and strong investment judgment has a path to building a portfolio that can meaningfully outperform bitcoin over a 10-year fund life, often by several multiples. We can make a few additional observations on the above:

In Scenario A, which posits 4 monetization events (a 16% hit rate in a portfolio of 25 companies) evenly spaced across years 3 through 9, this portfolio would return a post-carry IRR substantially above bitcoin’s in virtually every scenario, even relative to the best possible bitcoin IRR in this projection period.

In Scenario B, which assumes a more optimistic 6 monetization events – two in each of years 5 and 7 and one in each of years 3 and 9 for a 24% hit rate – the portfolio would outperform bitcoin’s 10-year IRR and its maximum possible IRR even if the portfolio were underweight its winners and if those winners averaged exit multiples well below 100x.

Even in less favorable outcomes like Scenario C, which assumes only two monetization events in years 5 and 7, the fund IRR would still exceed most achievable bitcoin IRRs.

In any given scenario, returns from an investor’s hit rate could be compounded by skillful sizing. If this fund were to skew more heavily toward investments in the portfolio’s ultimate winners (i.e. with an average pre-dilution investment above the simple average of $4 million for winners), the fund would drive even higher total returns on the same underlying percentage of monetized investments.

All these IRR figures – including bitcoin’s – are highly sensitive to the timing of cash flows. Earlier liquidity events would drive substantially higher IRR figures all else equal, though later exits might be more likely to drive higher MOIC as companies become more mature over the fund life.

While we could construct a very favorable cherry-picked scenario wherein an investor could generate higher bitcoin IRRs by exactly timing cycle bottoms and tops (as indicated by the “Max Possible Bitcoin IRR” scenario in the output above), this is exceedingly difficult to do in practice, as the last few bitcoin cycles have illustrated. Moreover, this type of precisely timed trading strategy doesn’t capture the way the vast majority of capital allocators (from individual bitcoin investors to large institutions) tend to look at bitcoin; instead, most potential investors we interact with have at least a 5-10 year “buy and hold” time horizon for bitcoin, so it’s more instructive to compare a fund strategy to that investment horizon. That said, it’s noteworthy that in many cases the hypothetical fund above would still meaningfully outperform bitcoin’s IRR even relative to that maximally cherry-picked scenario.

We believe the bitcoin price performance outlined throughout this piece is not overly conservative, as there are still few market participants anticipating $1 million+ bitcoin within the next decade. If this bitcoin forecast were to prove too pessimistic – as many of bitcoin’s most outspoken proponents might argue – that would certainly raise the hurdle for fund outperformance. However, that would also necessarily imply an even greater secular tailwind for companies building bitcoin infrastructure and thus likely also higher exit multiples and / or faster monetization events for a fund investing in those companies.

The illustrative fund IRRs reflected in this piece are no doubt ambitious, so it would be reasonable to ask how these returns might compare to some historical benchmarks for early-stage investment funds.

The historical data shown here suggest the range of IRRs targeted by a bitcoin-focused fund should fall well within the established precedent of the best venture funds of the past several decades. This is obviously a bullish target to set, but it’s exactly what we should expect given the backdrop of the strategy. If we’re right about bitcoin’s monetization and its highly disruptive potential, we are sitting at the precipice of a transformative technological wave comparable only to that of the internet in the early 1990s, and the early investors in the blue chips of this wave should be able to achieve returns comparable to the funds that made similar investments during the early adoption phase of the internet.

Conclusion

Ultimately, the relevant question for an investor weighing an allocation to early-stage equity in bitcoin technology companies is not whether the emerging blue chips in the ecosystem can actually outperform bitcoin, or even whether a whole portfolio can outperform. In principle, the case for both of these is very clear, and there’s no fundamental reason either should be inherently unachievable. Instead, the right question is how do you get there? How do you select a fund manager that can provide the best opportunity to achieve positive bitcoin-levered returns?

As discussed, this is by no means a trivial undertaking, and it will require a manager with a combination of differentiated deal flow and superior investment selection. As the largest bitcoin-focused investment platform with over $130 million in cumulative capital deployed, Ten31 provides exactly these capabilities. We have served as lead investor for 90% of the capital we’ve deployed, and over 80% of our capital has been deployed on an exclusive basis. Our funds have sizable, unique allocations to both bitcoin bellwethers at the Series A and B stages and the most promising early-stage innovators at the Pre-Seed and Seed stages. Our team combines deep experience in bitcoin – including several partners with over a decade of focused work in the space – and long tenures at blue chip institutions including CVC Capital Partners, Goldman Sachs, and Citadel, giving us both an unmatched network of founders and the tools to identify and execute on the best deals with institutional sophistication.

Outperforming bitcoin will put the funds that can achieve it among the best-performing vintages of all time, and no investor is better positioned to accomplish that than Ten31.

1 Some observers may contend that non-bitcoin “crypto” strategies have in some cases shown a track record of outperforming bitcoin. While this topic is beyond the scope of this piece, we question the long-term durability and risk-adjusted repeatability of such strategies as long as bitcoin continues to dominate the winner-take-all monetary race, a point addressed at length by Ten31 Advisor Parker Lewis here and here. We also note that a changing regulatory environment may limit some of the strategies that have historically driven outlier returns for some “crypto” funds.

2 Metrics for this hypothetical company are partially informed by comprehensive benchmarking analyses from venture bellwether Bessemer Venture Partners. The operating profile shown here is highly illustrative and only intended to give a sense of a long-term glide path; in practice, most companies will likely show lumpier growth (higher peaks and lower valleys), particularly in their earlier years.

3 Valuation analysis in this section assumes 0 net debt at acquisition and includes no credit for any bitcoin treasury potentially accumulated by the company.

4 Illustrative Seed and Series A valuation ranges are broadly in line with median data from 2020-2023, per data collected by Carta.

5 Expected future dilution assumes this hypothetical company raises a $12 million Series A at a $60 million post-money valuation in Year 2 followed by a $21 million Series B at a $150 million post-money valuation in Year 5. Assumes the investor does not participate in any future funding rounds (e.g. no exercises of pro rata rights).

6 The hypothetical bitcoin deployment schedule shown here is aligned with the typical multi-year deployment of a standard private capital vehicle, which is representative of true opportunity cost given capital is generally called over a number of years rather than all upfront. We note that the illustrative bitcoin IRRs shown here would not materially increase even if all capital were deployed into bitcoin in Year 0.