Announcement of Strategic Partnership Between Seetee and Ten31

Seetee and Ten31 have agreed to a strategic partnership to help accelerate the development of bitcoin infrastructure through increased investment in projects, companies, and founders building exclusively in the bitcoin ecosystem. As part of the partnership, Seetee has directly invested in Ten31's most recent fund, Low Time Preference Fund II, becoming a leading investor with Ten31…

Seetee and Ten31 have agreed to a strategic partnership to help accelerate the development of bitcoin infrastructure through increased investment in projects, companies, and founders building exclusively in the bitcoin ecosystem. As part of the partnership, Seetee has directly invested in Ten31's most recent fund, Low Time Preference Fund II, becoming a leading investor with Ten31. The fund's existing portfolio includes multiple industry leaders such as Unchained Capital and Strike and emerging players like Stakwork and Sphinx Chat, which are building innovative solutions in developing countries and pioneering new business models like value-for-value, respectively.

Ola Snøve, co-founder and Chair of Seetee, said, "Bitcoin is a protocol. As the internet has shown, resilient protocols are transformative and form the basis of entirely new industries. We believe that Bitcoin’s relevance will increase over the next decade, which is why we are especially excited about this partnership with Ten31. Grant, Jonathan, and their team have a deep understanding of Bitcoin and the long-term vision required to invest in companies and build structures that can last for generations."

Grant Gilliam, co-founder and managing partner of Ten31, said, "We are delighted to establish this partnership with Seetee, which is based on shared values and vision for the space, and an ultimate trust in working with high quality people of the highest integrity." Jonathan Kirkwood, also co-founder and managing partner of Ten31, added, "There is strong long-term alignment between the two organizations, and we couldn't ask for a better strategic partner than Seetee."

Seetee and Ten31 will each continue to independently invest directly in Bitcoin companies, with Ten31 serving as Seetee's preferred lead partner for investments pursued together or alongside one another. The alliance between Seetee and Ten31 aims to further the efforts each organization has made to support ecosystem development to date. Seetee and Ten31 have collectively already invested in more than 20 bitcoin companies, supported open source development through direct contributions and grants, and each brings to bear a diverse range of complementary experience and resources as value-added partners and contributors to the space.

Seetee became well known after its formation just over one year ago following the letter by Aker’s Chair Kjell Inge Røkke to the shareholders of the 180-year-old industrial group. In its announcement, Seetee highlighted its intention to actively participate in the Bitcoin community, contribute to free open source software, invest in and support projects and companies throughout the Bitcoin ecosystem, and establish bitcoin mining operations. Since then, Aker has executed exactly on that plan, building an in-house development team contributing to the space, investing directly as a partner to several Bitcoin companies, working towards mining operations that accelerate the energy transition, as well as keeping bitcoin on its balance sheet.

Ten31 has become a leading equity partner and supporter of bitcoin companies since ramping up its efforts over the last couple of years. In addition to Gilliam and Kirkwood, the Ten31 team includes notable venture partners Matt Odell and Marty Bent, each of whom are actively involved in numerous projects in the bitcoin space and have platforms for producing general industry and technical content, venture partner Michael Tanguma who is also an advisor to Unchained Capital, and Parker Lewis as an advisor to Ten31, who is head of Business Development at Unchained Capital and the author of the Gradually, then Suddenly series.

Through the partnership with Ten31, Seetee is significantly scaling its investment ambitions to support great companies in the space. Seetee and Ten31 believe their partnership will allow for a more positive overall impact on the ecosystem, with the overarching goals of facilitating further bitcoin adoption, advancing individual freedoms, and enabling human flourishing.

Both Seetee and Ten31 are supporters of the Human Rights Foundation, with Seetee sponsoring the Financial Freedom track as well as the Bitcoin Academy at the upcoming Oslo Freedom Forum, and Ten31 sponsoring the travel and accommodation of several developers to attend the Forum. Seetee and Ten31 view the further development of the bitcoin ecosystem as paramount to the advancement of human rights, and this is central to their motivations to be actively involved in the space.

About Aker and Seetee:

Aker is an industrial investment company with ownership interests concentrated in oil and gas, renewable energy and green technologies, maritime assets, marine biotechnology, and industrial software. Aker is listed on the Oslo Stock Exchange.

Seetee sees Bitcoin as a protocol for transfer of value much like https is a protocol for transfer of information. Seetee contributes to the development of free open source software, invests in seed and venture capital, encourages mining projects that accelerate the energy transition, and owns and accumulates bitcoin.

About Ten31:

Ten31 is a leading investment platform focused on backing bitcoin companies building the world's future infrastructure. Ten31 also supports development through grants to open source contributors using a recurring, management fee-driven contribution model, and also sponsors a developer seat at the Bitcoin Commons in Austin, TX.

The Case for Building, Supporting and Investing in Open Source Businesses

It may seem obvious to those who most believe in bitcoin, but the importance of the open source nature of bitcoin cannot be overstated. The continued development of open source software and business applications remains paramount to counteract the centralizing forces of institutions, technology, and the associated encroachment on human freedoms that come as a result…

It may seem obvious to those who most believe in bitcoin, but the importance of the open source nature of bitcoin cannot be overstated. Bitcoin is a natively-digital, bearer asset independent of governments and corporations and resistant to debasement, confiscation and deauthorization. Bitcoin operates on a singular, global, open network that anyone can use to store or transmit value across space and time without permission.

While proof-of-work mining clearly plays a central role in bitcoin’s censorship-resistant and seigniorage-resistant properties, the open source nature of bitcoin is also a critical component enabling its decentralization and censorship resistance. In a world that is becoming increasingly gated, controlled, censored, and manipulated, it is more important than ever to offer an alternative which is open, permissionless, transparent, trust-minimized and egalitarian. Bitcoin offers a new financial system which provides financial freedom and financial inclusion to all. The open source principles from which it is based represent a key building block for protecting human rights and freedom over the long term.

It is also critically important to apply open source principles to software and business applications plugging into the bitcoin network or built on top of bitcoin. The continued development of open source software and business applications remains paramount to counteract the centralizing forces of institutions, technology, and the associated encroachment on human freedoms that come as a result.

Most people might instinctively think the pursuit or support of open source development is some combination of (i) a philanthropic endeavor, (ii) a lopsided David vs. Goliath battle with entrenched, better funded incumbents, or (iii) an effort destined to burn cash even if an open source project becomes successful. However, the development of open source software and business applications in the open bitcoin monetary network can not only coexist alongside commercial motivations, but open source development and commercial aspirations can in fact be additive to one another resulting in a better end result than would have been achieved by either strategy on a standalone basis. The value proposition from an open source strategy will be far more meaningful than we’ve seen prior to bitcoin, and the open nature of its network will be the key value unlock for enabling this.

While it is traditionally tough to derive the community benefits at the early stages of an open source project, the value proposition of open source within bitcoin will be accelerated dramatically as the network effect of bitcoin grows stronger block by block. Rather than starting from scratch, open source applications can plug into the growing open source network we already have with bitcoin and get a head start. Suddenly it’s not just David vs Goliath, but an army of David’s that can quickly displace incumbents with open source innovation and scale benefits from the growing bitcoin network. That paves the way for participants across the ecosystem to pursue open source endeavors in a more meaningful way than they might have considered previously, including individual contributors, companies, investors and other capital providers. Some already understand this (e.g. @jack), but most do not. The attractiveness of building, supporting, and investing in open source businesses specifically within the bitcoin ecosystem will become more obvious over time, especially as early winners emerge.

The importance of free and open source software

It is helpful to look back at the origins of the cypherpunk movement to understand the importance of open source principles. I will not give a full history lesson here—you will get a better overview from Alex Gladstein in The Quest for Digital Cash—but the cypherpunk movement is rooted in an open source ethos. To counteract growing concerns about technological power centralizing to institutions and governments (and the coercive tendencies as that power grows), the cypherpunks took an offensive approach to invent and use technology that these groups could not stop. Core to that effort was not just cryptography, but also open source principles.

Authorities classified cryptography as munitions and tried to ban the export of encryption software. The cypherpunks understood the importance of maintaining individual privacy through encryption, and Paul Zimmerman released PGP in 1991 under a core cypherpunk belief that code is free speech and should be protected by first amendment rights. There were significant efforts to share that open source code widely, and as a result the knowledge base decentralized and the code became censorship resistant. We may not have PGP today if it wasn’t for those open source principles.

Cryptography has done wonders to tip the scale in favor of individuals with respect to communication, information, privacy, and now money; open source values are a critical complement, democratizing and decentralizing access to information, tools and applications, thereby supporting censorship resistance. Cryptography and open source principles together serve as critical tools for protecting freedom. Just as encryption is a human rights imperative, so too are other open source tools and systems.

What is open source software?

Free and open source software (FOSS) is by definition software that is free for anyone to use, modify, and distribute. Free does not just mean free of cost, but also means freedom (the four essential freedoms as defined by Stallman):

The source code is available and open for anyone to see, verify, access and use

Anyone has the freedom to modify the code in any way they choose

Anyone has the freedom to redistribute and/or commercialize the code

Anyone has the freedom to distribute copies of the modified code, which gives the community the opportunity to benefit from any such changes

There are many benefits of free and open source software, including accessibility and censorship resistance. FOSS can create a viral community that strengthens the software and can protect users from coercive actions of an antagonistic third party, whether a centralized authority or even the upstream team. In addition, open source software gives users the power to verify the code that is running (it is otherwise impossible to interact with software in a trust-minimized way if the source code is not viewable). In effect, open source software dramatically tilts the power balance away from those who might want to exploit their position to control users, allowing the code to outlive the team and project.

There are dozens of common open source licensing strategies, the most common of which are GPL, MIT and Apache, estimated to represent roughly 85% of open source licenses:

GNU General Public License (GPL) - referred to as a “copyleft” license, GPL protects the open source code such that anyone can fork the code, modify and sell it, but the code (and any modifications/contributions) must remain open under the same GPL licensing framework (i.e. any derived code inherits its license terms). This license would, for example, provide protection that a corporate giant doesn’t steal the original work, make modifications to it and then switch the greater work to closed source.

MIT - this license (used in bitcoin core) is generally most permissive in that it allows anyone to do whatever they wish with the original code without copyleft restrictions, meaning anyone has the freedom to fork the code and switch to another licensing model or even switch to closed source. The essence is that the community owns the code; no single entity owns more rights to it (important for self sovereignty). As well, there is no warranty behind it, removing any liability from the authors.

Apache 2.0 - a permissive license similar to MIT, with the primary differences being that any major modifications to the original source code must be disclosed (unlike MIT) and the explicit grant of patent rights to users (somewhat ambiguous in MIT)

In practice, some companies opt for licensing strategies which are not by definition free and open source but do offer users benefits versus proprietary software. For example, two common approaches are:

Business Source License (BSL) - the source code can be modified and compiled, non-production use of the code is free, and the code is available to become open source under a GPL or compatible license at a certain point in time. This license provides a model for a company to protect commercial interests, while allowing for open code which protects users from vendor lock-in.

Open core - typically involves offering a core or limited feature version of open source software, while offering enhanced features in a commercial version. In this case some code is open source, but non-core code is not available in source form, cannot be modified and compiled, cannot be contributed to and will remain closed source (does not protect users from vendor lock-in for those features).

Under these approaches, users have the power of source-viewable code, but the companies utilizing these types of licenses do not fully unleash the viral nature of FOSS development.

For companies, the open license utilized has often been a triggering topic within the bitcoin community, resulting in feuds among different teams (usually based on the “openness” of a company’s license, how it is marketed to the broader ecosystem/user base, and the commercial implications of the license). I will not get into specific past debates here but will note there are tradeoffs that need to be considered in a company’s licensing strategy, including potential impacts on scaling, development, community building, competition, and funding/monetization, among other factors. Depending on the existing license (and subject to existing code remaining protected under that license), a company may consider pivoting to a different licensing strategy as its business objectives and the merits of its open source strategy evolve.

There are obvious benefits that can come to a company from building an open source business/application and allowing for community contributions, including accelerating product feedback and innovation, improving software reliability, scaling support, driving adoption, and increasing the pool of technical talent contributing to the business. On the flip side, some perceived challenges of open source are that a company opens itself up to more competition and restricts its ability to monetize its efforts. Common concerns are the possibilities of (i) a VC firm funding a fork of the project, allocating a significant marketing budget to prop up the new business, and none of the financial benefits accruing to the original creators, or (ii) a large corporation leveraging its more extensive resources or existing customer base to exploit the open source code for its benefit and at the expense of the original creators.

Notwithstanding these potential concerns, the real power of open source is the ability to take the code, remix it, provide it to the market and let the market decide. Competition drives progress. As we move towards a more bitcoin-oriented world, having an open approach will build trust with the community (anti-rent seeking behavior; win based on the merits, rather than exploiting a current position of power i.e. “proof-of-stake” approach). Within the bitcoin ecosystem, there are also tangible and reinforcing benefits for both the company and the network when building open source applications, which I’ll discuss in more detail further below.

Not every business will make sense for an open source model, and not every team or company will want to pursue an open source strategy, but every company should think about how it can support the open source mission in some way (for example, making a portion of its business open source or making contributions to open source development in the ecosystem). Some level of support for open source development is better than none, and we generally feel the more, the better, but that is up to each team to decide and strike a balance they feel is appropriate. From a company perspective, honesty is critical so as not to misrepresent the nature of the license used, the motivations around the selection of that license, and the considerations applicable to the use of its software.

Open source licensing is a tool to help deliver a better, more open and free world. Open networks are superior to closed networks, open software is superior to closed software, and everyone will win as these ways of business proliferate.

Open source business models

The full potential of open source can be achieved when technological development is paired with a sound commercial and funding model. Developing a viable economic model that pays for itself not only creates sustainability in a project, but can also accelerate the open source movement. A sustainable economic model can support a growing developer community, spurring further technological development, which in turn increases the economic incentives for open source.

There are many business models that can work, but they all typically revolve around selling services on top of open source software:

Support services: maintenance, installation, support

SaaS / managed services: backup, hosting, security, etc.

Tooling / enhanced functionality: paid features / performance on top of base software

Other services: diverse range depending on nature of the software functionality, and could even include hardware manufacturing / distribution bundled with FOSS

Red Hat is one of the more well-known companies to have successfully commercialized open source software by offering software for free and charging a support fee to customers for maintenance, support, and installation. Red Hat was founded in 1993, went public in 1999, was later acquired by IBM in 2018 for $34 billion, and today boasts more than $3 billion in revenue. Other businesses with open source models have proven successful, including MySQL (purchased by Sun Microsystems for $1 billion), XenSource (acquired by Citrix), Revolution Analytics (acquired by Microsoft), MongoDB (IPO), Mulesoft (acquired by Salesforce for $6.5 billion), Elastic (IPO), and Gitlab (IPO), among many others.

While it is not trivial to successfully commercialize an open source business, it is clear from past examples that companies can achieve tremendous success while incorporating an open source model. Companies must deliver a product or service which customers are willing to pay for on top of free software. The nuance is that it becomes less about monetizing the past (rent seeking), and more about getting paid for delivering value in the present. Companies that open source their business can win competitively by providing better service, community, expertise (knowing the code better than competitors), and customer experience.

There is a misconception that investors would not want to invest in something that isn’t proprietary, and that likely is true for a large chunk of traditional VC investors. But just like bitcoin requires an adjustment of mental frameworks and an openness to understand its potential, the same is true for conceptualizing investments in open source businesses. Investor participation in an open source business can also enhance development, growth and value creation.

Open source businesses in bitcoin

Building open source technology businesses has proven it can be an attractive strategy, but nowhere will this prove to be more true than in the bitcoin ecosystem, where the open monetary network will provide a stronger feedback loop to benefit both the network and those developing open source applications on top of it.

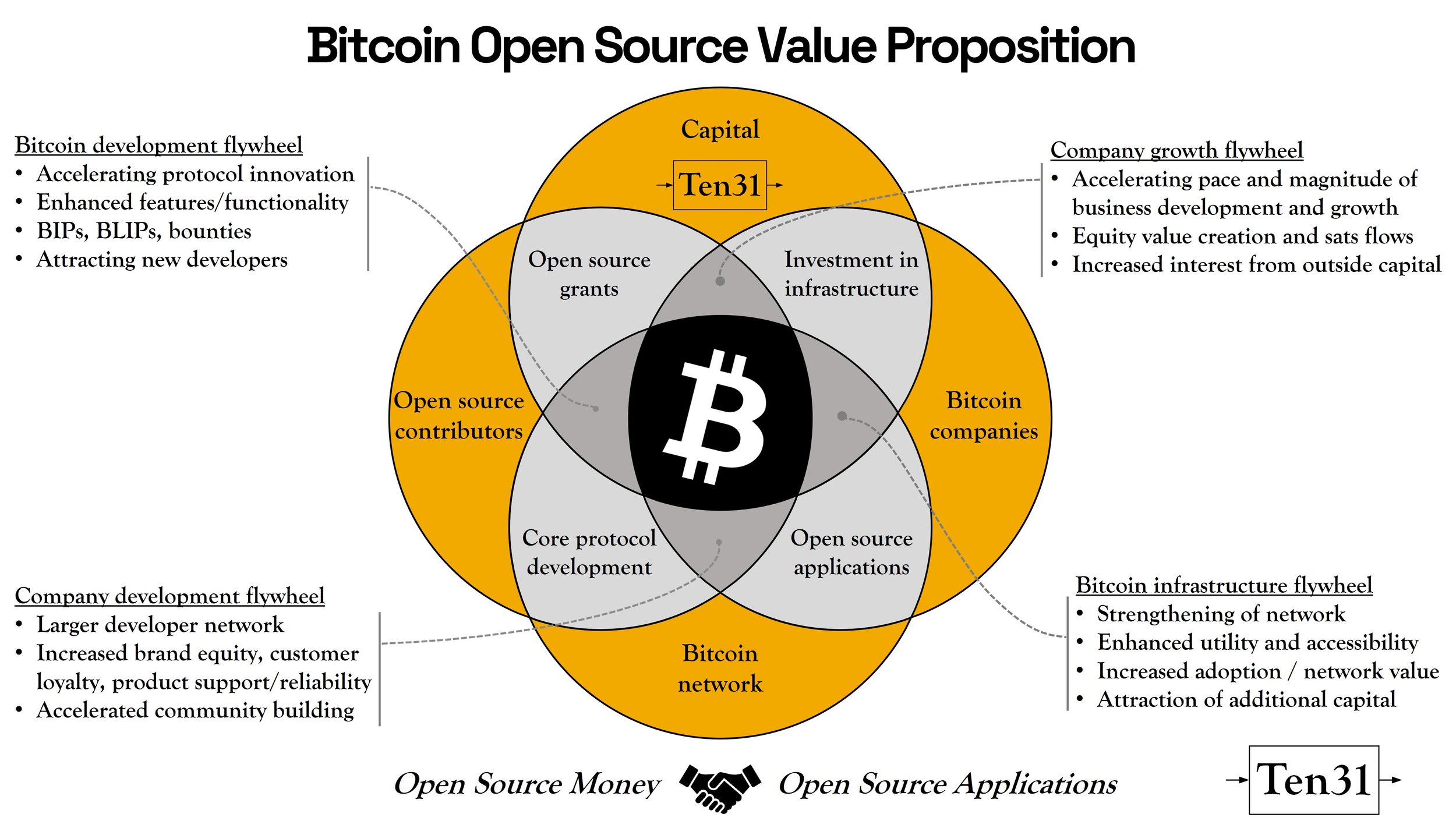

As above, an open source business model can provide a company with a larger developer network to support technological innovation, enhancing product support / reliability, building customer loyalty and brand equity and ultimately accelerating community building, which drives further interest from open source developers (the “company development flywheel”). In addition, within the bitcoin ecosystem, the value proposition to open source development extends beyond the company to also strengthen the network as a whole, driving enhanced utility for all participants, increasing adoption, and creating a flywheel that attracts additional capital into the ecosystem to support infrastructure development (the “bitcoin infrastructure flywheel”, which I outlined in my prior piece).

Furthermore, as capital is deployed within the ecosystem, both in the form of investments in companies building open source applications as well as grants to open source contributors, (i) further company resources are available for technological development, driving accelerated company growth and attracting additional capital investment (the “company growth flywheel”), and (ii) further resources are allocated to protocol innovation, opening up the possibilities of enhanced features and functionality, further attracting new developers and altogether strengthening the network (the “bitcoin development flywheel”).

These forces together form a very powerful vortex through which the entire ecosystem is pushed forward, reinforcing its strength and benefiting all participants in the network.

It should sound intuitive that open source applications should go hand in hand with open source money, but I think it is difficult for most to comprehend just how dramatic the impact of this will be. It will not only be a game changer for individual participants, but there is also a significant opportunity for early movers in the bitcoin ecosystem to unleash the power of open source to drive growth for their business and create projects of unprecedented scale by leveraging the network effects of bitcoin. In addition, one of the pain points for open source tools in the past was receiving money directly from users without a trusted third party; bitcoin enables new models as a result.

While it might be instinctive to think offering open source products could be cannabalistic to one’s own business, in the future we will find these efforts to have been a significant net add, strengthening not only the network but also the business and any others who contributed to those efforts (individual contributors or capital providers). It should be noted that not every open source project needs to have a profit motive to drive value, but it is also not the case that contributing to open source vs. pursuing commercial endeavors is an “either/or”: open source projects can drive significant profits, and in the bitcoin ecosystem this will result in sats flows and bitcoin dividends.

Just as I’ve said investing in bitcoin infrastructure provides great asymmetry, contributing to open source development will similarly provide great asymmetry to all those who do it, while benefiting all other participants at the same time. Bitcoin is uniquely designed to provide an incentive structure where the devotion of resources can be good for business, good for the industry, and good for humanity.

Ten31’s contribution to open source

When we formed Ten31 we thought it was important at the outset to give back to the ecosystem and to those contributing to its development. We were inspired early on by the efforts of Square and HRF, as well as Brink and OpenSats. We created a recurring management fee-based donation model, earmarking capital that could create a consistent source of funds to support the ecosystem. In doing this, we also hoped it might inspire other funds to think similarly and consider giving back on a recurring basis.

We continue to be impressed by the magnitude of contributions and open source development happening in the ecosystem today, and are grateful for all those committing time and resources to that effort, especially the developers and companies.

At Ten31 we are supporting the open source ecosystem in a variety of ways:

Grants to open source contributors: Initial grant in 2021 to Bitcoin QnA for his work in bitcoin education and informational content. 2022 grants will be announced soon

Founding contributor to OpenSats

HRF: sponsoring 4 developers to attend 2022 Oslo Freedom Forum

Bitcoin Commons: sponsoring a permanent seat for a developer to work in the new Bitcoin Commons in Austin, Texas

Investing in open source businesses: we are proud to be one of the most active investors supporting bitcoin businesses who contribute to open source development, including:

Hodl Hodl: built various open source tools on MIT licenses

Nodl: fully open source with a MIT license; supporter of OpenSats

River: supporter of Brink

Samourai Wallet: fully open source operating on a GPL license

Sphinx Chat: fully open source operating on a MIT licence

Start9: platform for hosting a broad suite of FOSS, operating with a custom non-commercial open source license

Strike: supporting open source development through the Bitcoin Indy car and recent Lightning bounties with HRF

Swan: supporter of OpenSats, released an xpub tool with a MIT license

Unchained Capital: its Caravan multisig tool is fully open source on a MIT license

Final thoughts

Development of free and open source software is an imperative for human freedom.

Open source development in the bitcoin ecosystem creates a powerful vortex that benefits contributors, companies and the network.

Open source development can coexist alongside for profit business models and can be enhanced with external investment capital.

There are many open source business models that can produce sats flows and bitcoin dividends, particularly when harnessing the power of bitcoin network effects and differentiating on services, brand, community, experience and time to market.

Every participant in the ecosystem should be considering how it can support open source development. We will continue to contribute in a meaningful way from Ten31 and will actively encourage every company we invest in to consider the same.

For companies building open source tools and considering taking on investors, it is critical to find a partner aligned with those objectives; the best way to judge that is by historical contributions (similar to reviewing a developer’s commits on github). The actions supporting open source development should speak for themselves (“proof of work”).

Those that provide value and contribute back to the network will ultimately accrue value in their business, brand, customer base, and relationships. Open source development is good for bitcoin, and what is good for bitcoin will be good for humanity and will ultimately be good for those enabling it, whether developers, founders, companies or investors.

Investing in Bitcoin Infrastructure

There is very clearly an imbalance in capital disproportionately allocated to “crypto” and underweight the Bitcoin ecosystem. This creates tremendous asymmetry for investing in Bitcoin companies, which has not yet been appreciated by most and remains one of the most overlooked and best kept secrets in the industry at present…

In my 2021 end of year essay, I shared my path to Bitcoin, the vision for Ten31, and my views about investing in Bitcoin infrastructure. Despite Bitcoin irrefutably being the most secure network with the longest history, most decentralization, largest ‘market cap’, and best brand, among other factors, there is very clearly an imbalance in capital disproportionately allocated to “crypto” and underweight the Bitcoin ecosystem. This creates tremendous asymmetry for investing in Bitcoin companies, which has not yet been appreciated by most and remains one of the most overlooked and best kept secrets in the industry at present. Following my previous essay, I wanted to share further thoughts on the opportunity I see in investing in Bitcoin infrastructure and how a Bitcoin-oriented world will impact investing going forward.

The economic case for investing in Bitcoin infrastructure

To see value, you need to think differently…

What is the key to being a great investor? Is sound investment judgement an innate capability, or can you learn it? In my 15 years as an investor professionally, I’ve found that investment judgement develops over time. You must have personal honesty and discipline. You must know when you should say “no” and be willing to do it. You should learn not just from the deals you do but also from those you don’t. But above all else, what I have found key to investing well is independent thought. That is, being yourself and challenging the norm, and seeing value where others do not. In my experience this usually comes from one of three sources:

Getting there first / being early (“unearthing value others have not”)

Having proprietary information / insights: not just unique information but also unique capabilities to capitalize on the information and insights you have (“the ability to crystallize value others cannot”)

Thinking differently: having the same data but a different view, or a greater understanding of that information, or seeing value (or risk) in it where others do not (“recognizing value where others do not”)

Ten31’s strategy is to invest in and support great Bitcoin companies, and we have the benefit of all three sources of alpha above. As it stands, most professional investors aren’t yet thinking about investing in Bitcoin companies because the broader market (even those interested in “crypto” or “blockchain”) generally still does not understand bitcoin. That’s what creates the huge upside in the BTC/USD price (which will ultimately be captured as information and general understanding of bitcoin becomes more distributed), but this pricing upside also often underlies the impulse to only hold the asset and not consider investing in the “picks and shovels” around it. I’ve found the hesitation among bitcoin believers to invest in Bitcoin equities most often stems from (i) a desire to wait until future price gains on bitcoin are realized (in a sense, a future FOMO), (ii) a disbelief that investing in Bitcoin equities can outperform bitcoin, or (iii) risk aversion.

Bitcoin is the safest asset and most pristine collateral on the planet (1 BTC = 1 BTC), so I understand the third group above who may prefer to only hold bitcoin out of risk aversion (every individual should decide their risk tolerance and orient their asset portfolio accordingly). I have less sympathy for the first two perspectives, (i) those waiting for a higher bitcoin price (i.e. future FOMO) and (ii) those who don’t think investing in Bitcoin companies can outperform bitcoin (i.e. Bitcoin equity skeptics), for several reasons.

First, both of these points of view implicitly suggest that an allocation to Bitcoin infrastructure is an “either/or” relative to holding bitcoin. Unless you have 100% exposure to bitcoin and hold no other assets or investments (in which case, well done), those arguments are misplaced, as an investment in Bitcoin infrastructure should be evaluated in context to all other allocations within a portfolio, including traditional markets (public markets, real estate, PE/VC, etc.). The measuring stick shouldn’t strictly be against bitcoin.

My second argument is that investments in Bitcoin companies can in fact outperform bitcoin. If deployed carefully and selectively, successful investments in early stage Bitcoin companies have 100x+ return potential over a shorter time frame, unlikely to be matched by bitcoin over the same horizon (even if we all believe the appreciation potential for holding bitcoin remains hugely significant over the longer term). Investments in Bitcoin companies that earn and build bitcoin on their balance sheet (at effectively below market prices) also offer the opportunity to outperform bitcoin (for example, think of a bitcoin miner). As more companies successfully offer products and services desired by holders of bitcoin, these companies will eventually be paid in bitcoin, and bitcoin will accrue to their bottom line and strengthen their balance sheet (indirectly becoming ‘bitcoin miners’...more on this below). In this way Bitcoin companies can in effect become leveraged plays on bitcoin.

Thirdly, and perhaps just as powerful and very much overlooked, investing in Bitcoin companies can enhance your bitcoin portfolio by offering returns which are disentangled from near term price swings of bitcoin, balancing out the underlying volatility of the asset. An early stage Bitcoin company with product market fit and/or customer traction might be achieving significant equity growth over a period when the bitcoin price temporarily stagnates or even declines due to broader market factors. Given the significant secular tailwinds expected over the coming decade as adoption continues, investing in early stage Bitcoin companies can capture these benefits, regardless of shorter term bitcoin price volatility. For example, BTC/USD is up roughly 35% over the last 6 months, 15% over the last 12 months, 350% over the last 18 months, and 400% over the last 24 months. In Ten31’s Low Time Preference Funds, we have investments in Bitcoin companies that have outperformed each of these metrics over the same shorter-term time frames. While in many cases the value of private, illiquid company stock doesn’t move over these shorter periods (updated mark-to-markets are typically done in conjunction with subsequent fundraising activity), the point is that once valuations are updated upon such an event, it can crystallize returns in excess of bitcoin over the same period.

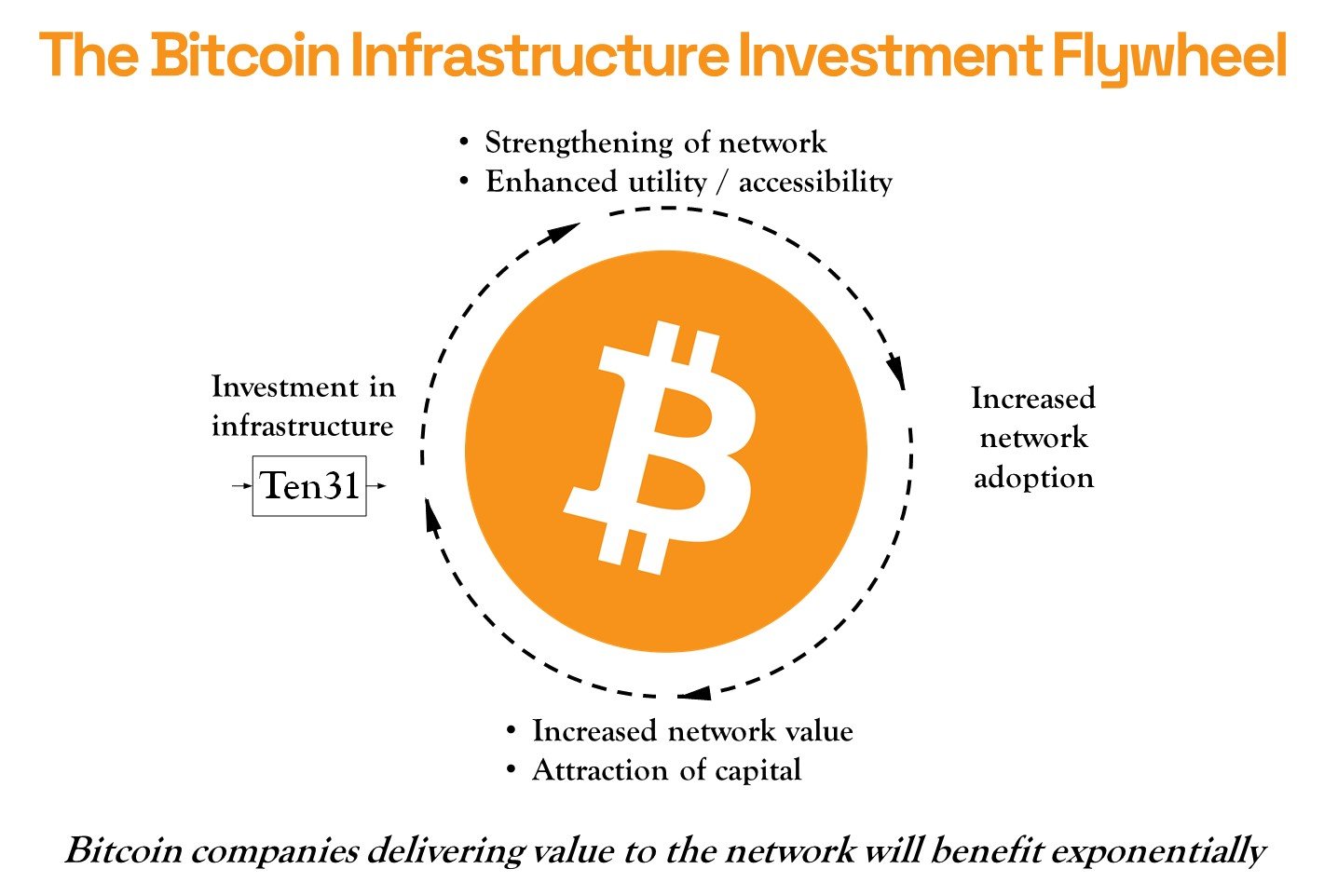

And finally, as I described in my last essay, there is also a flywheel from investing in Bitcoin infrastructure. Investments in the Bitcoin ecosystem strengthen the network, driving increased adoption and value of the asset, which in turn attracts additional capital and supports further investment in infrastructure in a virtuous circle. There are natural synergies from holding bitcoin and investing in the network, and the result is an overall improved risk/return profile versus holding bitcoin on a standalone basis. Therefore, rather than an “either/or” with holding bitcoin and investing in Bitcoin infrastructure, the conclusion is that one should both hold bitcoin AND invest in Bitcoin companies. We were all convinced at one point to own bitcoin, and the next logical step should be to “get off zero” in terms of allocating capital to Bitcoin equities.

Tying back my concepts of independent thought to investing in the Bitcoin ecosystem, Ten31 captures all three sources of alpha previously mentioned:

- We are early: the capital misallocation is significant - most still are not allocating capital to Bitcoin infrastructure

- We have unique insights and capabilities: Ten31’s network and execution capabilities allow us to access investment opportunities other funds cannot (including top tier VCs and crypto funds), as well as offer unmatched value to the Bitcoin companies to support their growth and long term value creation. We bring an institutional background and blue-chip investing pedigree, combined with a deep understanding of bitcoin and a strong team with broad reach, to align ourselves with Bitcoin companies and support the ecosystem over the long term

- We see value where others in the space do not: as above, the rationale for investing in the ecosystem is clear, but not yet appreciated by most

Investing Under a Bitcoin Standard - A Shift to Sats Flow Investing

As we’ve seen over the last couple decades under a fiat standard, very often the profile for a venture investment has been to burn cash and pursue growth at all costs, with no need or ambition to consider profitability or cash flow (the profitability dial can theoretically be turned later, or perhaps an exit can be realized before ever reaching profitability). A world of infinite liquidity can prime the pump with fresh capital to rinse and repeat this process over and over again.

As we transition to a more Bitcoin-oriented world, the importance of profitability and sound business models will increase, and there will be a greater emphasis on returns on invested capital (measured in bitcoin terms). That is not to say that venture backed Bitcoin companies won’t also burn cash initially while experiencing hyper growth–likely most will initially, but the drive to achieve profitability more quickly will be greater, and the allocation of scarce capital resources based on those ambitions will be more disciplined than before. That’s because Bitcoin companies are backed by bitcoiners, and the common goal among every bitcoiner is to obtain more bitcoin. Under a Bitcoin standard, earning bitcoin today will generally require less work than earning the equivalent amount of bitcoin in the future. Said another way, for the same amount of work you will earn less bitcoin in the future. This will emphasize the opportunity cost of foregoing bitcoin today for the prospect of bitcoin tomorrow (which will be harder to earn). When the objective is to accumulate as much of the 21 million fixed supply as possible, this will become a forcing function on a company's mindset for evaluating investments in growth. Return on investment ("ROI")-based analyses will become more common, even in the earlier stage venture world (e.g. "what is the expected bitcoin yield we could expect in profits from this investment?").

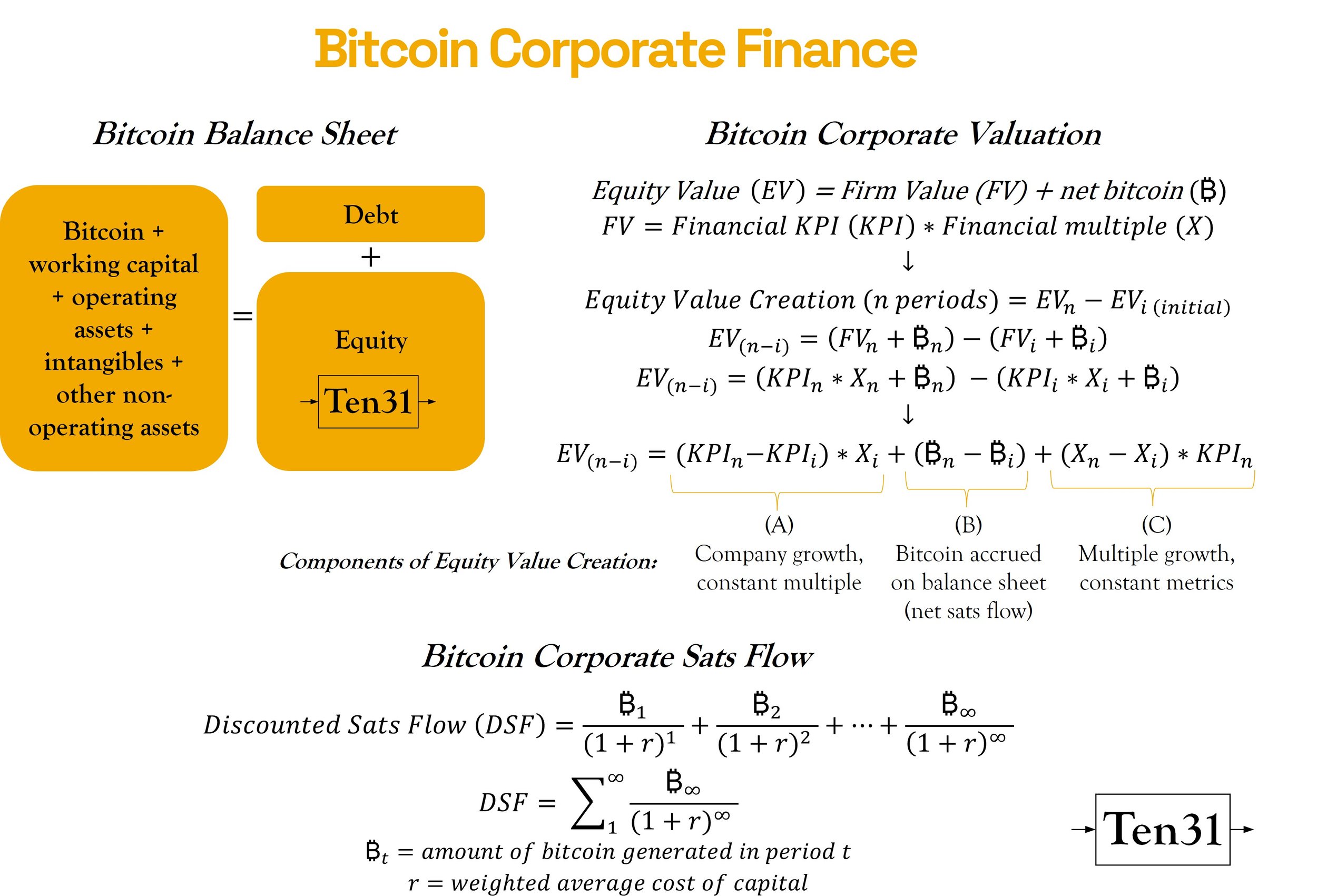

Not only will entrepreneurs start to think in terms of how much bitcoin can be generated from allocation of its resources, but investors will also begin to think more in bitcoin terms when evaluating the risk/return of investment opportunities. Let’s take a look at some simple corporate finance and valuation concepts, applied to bitcoin.

If an investor is making the economic decision of holding bitcoin today vs. investing in the equity of a Bitcoin company, the investor should only do this if he/she has conviction the investment will yield more bitcoin, with some premium required based on the risk being taken and the cost of capital (i.e. the investment generates excess returns). Simplistically, an investor could value a business using a multiple-based approach (e.g. revenue- or earnings-based valuation) as a proxy for the bitcoin it can ultimately deliver to shareholders over the longer term. Alternatively, a business could be valued directly based on how much bitcoin it is estimated to produce in the future, discounted by its cost of capital in bitcoin (“discounted sats flow”).

These are familiar concepts to anyone who has taken corporate finance, but under a Bitcoin standard the relative level of importance of the different value drivers may shift. In an inflationary system, holders of assets win. With deflation, holders of money win. Under the simplistic multiple-based valuation approach above, equity value creation is driven by:

- Growth in the company (revenue or earnings, measured in sats) relative to its valuation multiple; plus

- The net additional bitcoin accrued on a company's balance sheet (net sats flow); plus

- Any change in the valuation multiple of the business relative to its financial performance.

If future financial performance measured in sats (in the diagram above, KPIn) is harder to achieve in bitcoin terms in an absolute sense due to its deflationary nature (i.e. KPIn may grow less, if at all), it follows that the components (A) and (C) of equity value creation will also become more challenging in an absolute sense, and therefore component (B), the ability to generate sats flow, will become more important. Equity value creation, and by consequence investment success, will be more rooted in profitably generating sats.

In turn, this may lead to an increased emphasis on Discounted Sats Flow analysis. Following the same logic as above, if the amount of Bitcoin earned in the future (₿t) is harder to achieve (and possibly declining over time), then the value of a company’s Discounted Sats Flow will be more heavily weighted towards the present than in the previous paradigm, incentivizing the pursuit of a sound, sustainable and profitable business model more quickly, as compared to the growth-at-all-costs model incentivized by the fiat standard. Another likelihood under this line of thinking is that profitable Bitcoin companies which accrue bitcoin on its balance sheets will benefit from a lower cost of capital than those who don’t, further incentivizing sound business behavior. In calculating a company’s cost of capital, investors using DSF models will likely estimate a risk free rate in bitcoin using an emerging bitcoin yield curve (see Nik Bhatia’s writing).

Qualitatively, it should seem obvious that Bitcoin will usher in a shift towards sats flow investing. In a fiat world of money printing, cash is not valued; artificially reduced interest rates mathematically favor growth investing, and cash flow investing has taken a back seat as a result. In a bitcoin world, if people start to value the monetary base unit more (sats), people will start to increasingly value the businesses that produce it. Ownership of sound money leads to ownership of sound equities and creation of sound business models.

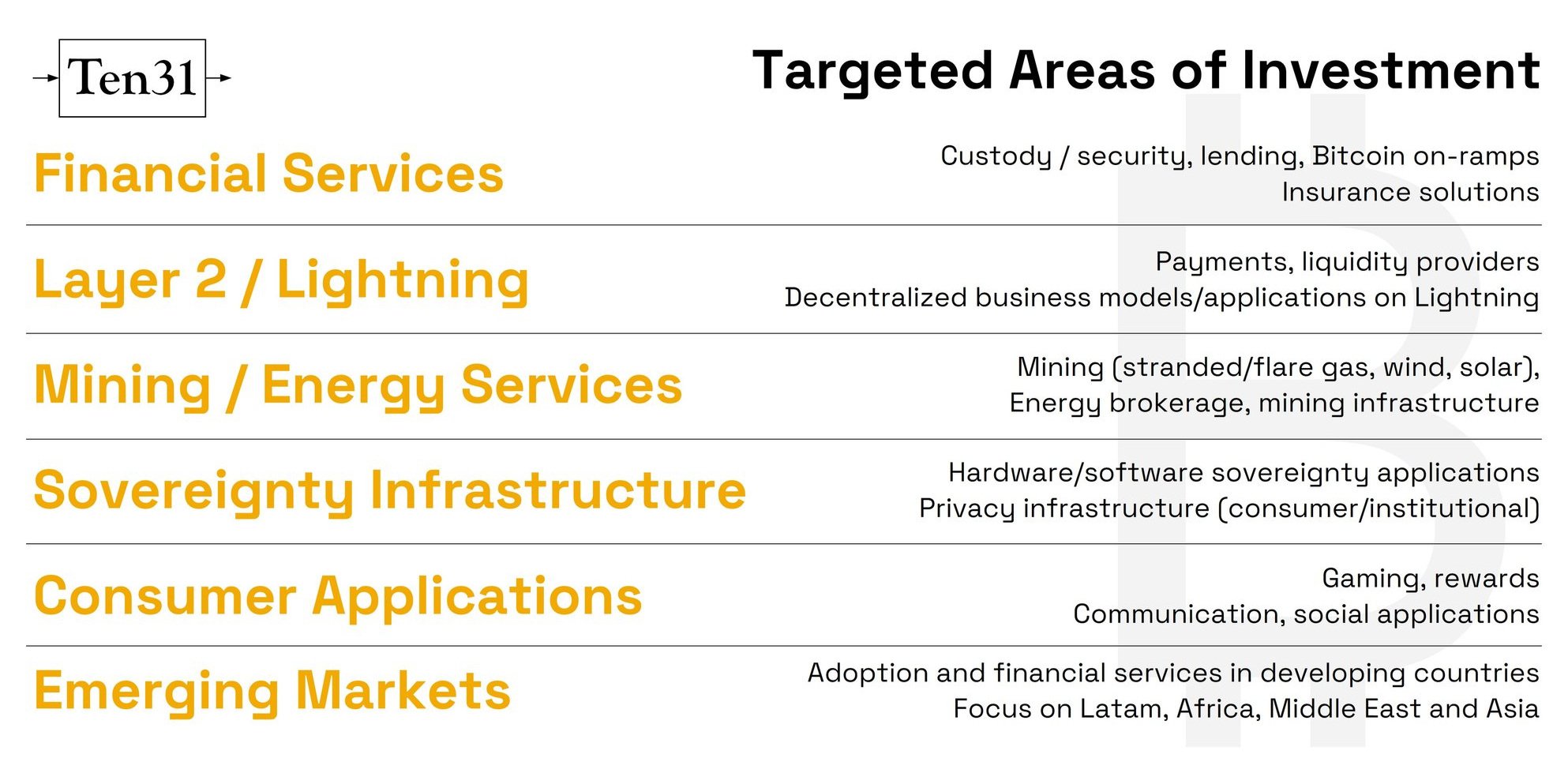

As one last thought experiment, imagine a company that denominates its income statement in bitcoin, is profitable, and accrues bitcoin on its balance sheet. That sounds a lot like a bitcoin mining company. However, bitcoin mining companies are extremely capital intensive and fiercely competitive (anyone can plug in a miner and compete). In an open monetary network like Bitcoin, it is plausible that certain Bitcoin technology companies could establish early leadership positions in their respective fields with sustainable competitive advantages (sticky business models, technology infrastructure, network effect businesses, brand loyalty, etc.). Those companies would implicitly look a lot like bitcoin miners (generating a consistent stream of sats flows), except with a less capital intensive business model (no constant replenishment of equipment) and with less competition than bitcoin miners. This is a very compelling financial profile and an underappreciated aspect of investing in the future leaders of the Bitcoin ecosystem, and we are pursuing these types of investments at Ten31. I have provided below a snapshot of the investment areas we are targeting, and we’ll provide more detail about how we view the investable landscape in a future piece.

Conclusions

Investing in Bitcoin infrastructure is one of the most overlooked and best kept secrets in the industry today, offering tremendous asymmetry

An investment in Bitcoin infrastructure should be considered in conjunction with holding bitcoin (an “AND”, not an “either/or”)

As we move closer to a Bitcoin standard, we expect a gravitation towards more sound business models and a re-focus by companies and investors on sats flows

As the Bitcoin distribution schedule continues to reduce the new supply of bitcoin available to the market over time, one of the most effective ways to earn bitcoin will be to have equity stakes in Bitcoin companies

Companies with the talent to build bitcoin infrastructure and profitably produce bitcoin will be significantly more valued, and this will be appreciated more by investors over time

There is going to be a longer term increase in capital attracted to Bitcoin equities. Owning equity in the leading Bitcoin companies will become the future "scarce real estate." It might make sense just to get some in case it catches on…

Joining Ten31 as an Advisor

There are two rules in bitcoin that never seem to fail. Everyone always feels late and everyone always wishes they had bought more. Without fail, it is true of just about everyone and it is certainly true of me…

There are two rules in bitcoin that never seem to fail. Everyone always feels late and everyone always wishes they had bought more. Without fail, it is true of just about everyone and it is certainly true of me. When I became interested in bitcoin in 2016, I felt very late. Now, over five years later and with the benefit of perspective and having been building infrastructure for bitcoin over the past three years at Unchained Capital, I have a great appreciation for just how early we are and how great the magnitude of the sea change we are witnessing really is.

In my view, bitcoin represents the greatest asymmetry that has ever existed. We are not just witnessing the monetization of a monetary good on the free market for the first time in any and all of our lifetimes but many of us are lucky enough to be building the monetary system itself, each in our own small way. Driven by the strength and credibility of its monetary properties, bitcoin is emerging as the global standard of value. I personally expect bitcoin to be adopted by billions of people and to mature into a day-to-day transactional currency that facilitates the vast majority of all the world’s commerce over the course of the next decade (maybe two).

When I say that bitcoin is the greatest asymmetry that has ever existed it is because there can be no greater asymmetry than that inherent in a monetization event (when one money emerges and displaces another). Money is the foundation of the entire economic structure and practically all economic activity is coordinated by the function of money. Despite the surrounding noise, what is actually happening at a fundamental level is the very early stages of the world adopting a superior form of money and shifting away from broken alternatives.

Everything hinges on the credible enforcement of a fixed supply of 21 million on a decentralized basis. That is the foundation of bitcoin’s value proposition and bitcoin’s monetary policy becomes stronger as the network grows. While most asymmetric events are low probability, bitcoin combines positive asymmetry with a high probability event. The global shift to bitcoin becomes more and more probable as a function of time, scale and further decentralization because it translates to an increasingly, and ever more, secure system. However, it does not end there. There is also great negative symmetry to holding money that is actively being displaced - a consequence of governments printing trillions of dollars combined with bitcoin emerging as a perfected alternative in parallel. That in aggregate is what makes bitcoin the greatest asymmetry that has ever existed; positive asymmetry of global monetary adoption + high probability + the negative asymmetry of a legacy currency being demonetized. Ultimately, the only winning move is to play and doing nothing has consequences.

Bitcoin is a strange game where the only winning move is to play. pic.twitter.com/dKpVK4R1G4

— Bitstein (@bitstein) January 14, 2019

When this reality came into focus for me over the course of 2016 and 2017, I also arrived at the conclusion that my time would best be spent building infrastructure for bitcoin. If there is asymmetry inherent in bitcoin, infrastructure critical to the bitcoin monetary system is similarly asymmetric. However, my decision to work on bitcoin wasn’t just about financial gains. At the risk of sounding hyperbolic, I also consider bitcoin critical to preserving our freedoms and the American way of life. To me, working on bitcoin is an imperative. When currency fails, Venezuela happens and anyone who believes it could not happen here is not applying logic to the inevitable end game of governments all over the world printing the equivalent of trillions of dollars in perpetuity.

While most people are resigned to sit back and accept the tenuous fate of financial instability, bitcoiners are chopping wood every day to build a more resilient monetary system. Failure is not an option because the stakes could not be higher. When I moved back to Austin, Texas in 2017 to work on bitcoin, I considered long-term custody as the most important problem to solve. I ended up joining co-founders Joe Kelly and Dhruv Bansal to help build out a vision of Unchained Capital centered on a foundation of custody where clients hold bitcoin keys alongside a financial institution as a partner. Rather than entrusting a financial institution with full control and custody of bitcoin, we had a vision that individuals and businesses would demand private key ownership. But beyond that, we believed that collaborative custody was the most secure and sustainable long-term approach to custody.

Despite a very clear vision and great conviction, building infrastructure dedicated to bitcoin was not popular in 2018 and 2019. There is a reality that the traditional world of San Francisco and New York venture capital is very much a monoculture. Most see crypto as a technology play. It’s the next tech wave! A world of 1,000s of cryptocurrencies, blockchain tech, ICOs and NFTs. That is the world most coastal tech investors see (and maybe want). The problem is bitcoin is moreso a monetary revolution than it is a technological revolution. It does not pattern match well and while VCs know easy money and asset-light, app-heavy business models, most of them do not understand money at a first principles level (or bitcoin as a consequence).

In my view, there may be a thousand cryptocurrencies, but there is only one that is relevant to the world in the end. And that is bitcoin. However, when you’re building infrastructure exclusively focused on bitcoin and have a vision of people holding their own bitcoin keys, well, that idea could not be further from the Silicon Valley world view and that largely closes it off as a source of capital to build bitcoin infrastructure. Ultimately, it takes bitcoin-minded entrepreneurs and bitcoin-minded investors to create long-term value in bitcoin. And I mean infrastructure that is actually of value to the bitcoin network and bitcoin holders.

I can speak from experience that entrepreneurs building on bitcoin value investors that have their own vision and understanding of bitcoin at a monetary first principle level. Coinbase may be Myspace, but bitcoin is not and Silicon Valley can’t see it. But that does not change the fact that the pools of capital willing to allocate to bitcoin-dedicated infrastructure were scarce at the time and remain scarce to this day. It is a contrarian view but having vision is about seeing things that are difficult to see. When we needed it and before it was popular to invest in Unchained, the two managing partners at Ten31, Grant Gilliam and Jonathan Kirkwood, both individually and as a fund understood and aligned behind our vision.

Grant and Jonathan understand bitcoin at an intuitive level and that matters materially for entrepreneurs in bitcoin. It meant the world to me personally and it helped afford Unchained Capital the ability to continue to work toward realizing our vision and mission. We subsequently gained sufficient traction to attract strategic partners in Stone Ridge Asset Holdings and its subsidiary NYDIG, which led both our seed extension and our Series A of $30 million in June 2021. But similarly, that only happened because the founders at Stone Ridge and NYDIG shared a North Star in bitcoin and valued the infrastructure we were building more than a traditional VC could.

When Grant and Jonathan approached me about their plans to expand Ten31 to a $50 million fund dedicated exclusively to bitcoin infrastructure, I actively encouraged them to execute on that path. That target figure has further expanded to $100 million based on the market opportunity. There is a significant gap between the founders in bitcoin with long-term vision working to build critical rails and the capital necessary to do so. That gap creates opportunity for Ten31. Risk and value are mispriced, and investors with a clear vision of bitcoin have a major role to play in bridging the gap. Bitcoin entrepreneurs with vision and defensible models want those investors on their boards and cap tables, and Ten31 will expand the pools of capital accessible to those founders by combining their institutional pedigree with the ability to effectively communicate a long-term vision of their own to investors.

After recruiting close friends of mine, Michael Tanguma, Matt Odell and Marty Bent, to be venture partners, the Ten31 founders asked me to come on board as an advisor. While my first, second and third priorities will continue to be building out Unchained Capital, I could not be more excited to have joined the Ten31 team in an advisory capacity. I align completely behind the vision and values of Grant and Jonathan as managing partners while Michael, Matt, and Marty individually and collectively have a strong pulse on valuable infrastructure and have deep relationships throughout the bitcoin community, especially among founders. The portfolio that Ten31 has already put together speaks volumes, and I look forward to serving as an advisor as the team expands the fund’s capital raising and evaluates future investments.

Building bitcoin infrastructure is critically important and in my opinion, there will be no greater opportunity to create wealth over the next few decades than through the rails that fuel bitcoin’s monetary revolution. The meek shall inherit the earth but not its bitcoin.

Best, Parker

Ten31 - A Vision for Supporting the Bitcoin Ecosystem

As we reach the end of what was another incredibly notable year in Bitcoin and look forward to what is to come in 2022, I wanted to share my thoughts on our vision for Ten31, investing in Bitcoin infrastructure, and my story as to how I got here. Bitcoin gives the world incredible reason for optimism, and we are excited to continue supporting the ecosystem…

Building a Leading Platform to Invest in Bitcoin Infrastructure

December 27, 2021 ● Grant Gilliam

As we reach the end of what was another incredibly notable year in Bitcoin and look forward to what is to come in 2022, I wanted to share my thoughts on our vision for Ten31, investing in Bitcoin infrastructure, and my story as to how I got here. Bitcoin gives the world incredible reason for optimism, and we are excited to continue supporting the ecosystem.

My Path to Bitcoin

I am from Kentucky, the oldest of 7 children, and an Eagle Scout. I studied electrical engineering and math in college, with coursework in programming and cryptography. That probably doesn’t seem like an obvious path to Wall Street, but that’s where I ended up after graduating. I moved to NYC at a time when bankers were hiring anyone and everyone, regardless of background or degree. You only had to be smart and malleable, and they would teach you the craft. I never considered myself a suit, but up to New York I went, starting in leveraged finance and getting a front row seat to the excesses of the mid 2000s which were a precursor to the Great Financial Crisis. I then saw cascading failures of Bear Stearns and Lehman Brothers, which were pivotal in my young career trying to make sense of the financial system and the factors leading to its systemic collapse. I had a technical background from school, but I was also interested in business and investing, and I soon decided to pursue a career in private equity where I could develop professionally.

Found in the middle school yearbook archives, early inclinations of a low time preference philosophy. It used to be realistic that saving money in a bank could yield real returns…

I was living in downtown Manhattan in 2013 and 2014 and would walk past the New York Stock Exchange every day on my way to the subway while commuting to work. And every day, right next to the NYSE, I would also walk by the Bitcoin Center founded by Nick Spanos. I never went in, initially thinking Bitcoin was a scam, and continued to dismiss it over the next couple years. It wasn’t until 2016 that I decided to look into Bitcoin, as I had enough pattern recognition after reading articles in Wired to finally become curious, and my college coursework gave me the technical interest to dig deeper. I heard Nick Szabo discussing Bitcoin and social scalability on Tim Ferriss’ podcast, and when I started looking more into Nick’s writing, my mind was blown. I became endlessly fascinated by what this new monetary system might bring to benefit humanity.

Bitcoin is complex; practically no one understands it with just a few encounters. It has a multidimensional foundation rooted in cryptography, game theory, and monetary economics, and its impact on the world will be all-encompassing, driving positive economic, societal, cultural and ethical change. Most people feel late to Bitcoin in hindsight, but those initial encounters I dismissed were important and valuable first sparks that eventually led to the burning flame that now feeds my passion to dedicate my time, energy, and career to Bitcoin.

My Proof of Work to Bitcoin

Over the last decade-and-a-half, I worked as a private equity investor, employed at one of the largest firms globally where I was tasked with building relationships with founders, sourcing interesting investment opportunities, and ultimately supporting companies as a value-added partner in their pursuit of growth. I was directly involved with deploying more than $3 billion in equity and served on Boards of multi-billion dollar companies, developing experience at all levels of business (strategy, HR/recruiting, finance, capital markets, governance, legal, IT/infrastructure, Ops, etc.) to understand what it takes to become best-in-class and eventually scale to the billion-dollar+ capitalization level.

Every partnership with a team is different, with unique challenges and opportunities, and therefore you cannot rely on the same playbook for each investment. However, patterns do emerge, and you develop insights from your experiences and learnings that can be helpful to companies as they inevitably encounter bumps on the road. No business plan ever goes exactly as planned. Therefore, as a business partner, being able to offer experiences and relationships to teams that haven't had the same number of repetitions with similar issues is often incredibly valuable.

While continuing to hone my skills as an investor over the last 5 years, I immersed myself more and more into Bitcoin in practically every spare moment of time I could find. As my understanding and conviction deepened, I felt an ever-increasing desire to get more involved. I followed this ambition and passion, and my financial investments evolved from initially holding bitcoin directly to also investing in Bitcoin-related companies. I wanted to support the great Bitcoin companies that I was getting to know, and I wanted to contribute my professional skills as an investor and partner to founders and businesses to help them in any way I could. I knew my professional background was relatively unique to the Bitcoin space, in that I had put in the work at a top-tier investment firm in what is a notoriously challenging and ruthlessly competitive field. I had risen the ranks and proven myself as an astute investor and reputable partner to companies and teams, and I had gained knowledge and experience that could be valuable to early stage companies in the space.

My first investment was in Unchained Capital, and my cousin Jonathan Kirkwood, who was also an avid Bitcoiner with a history of successful investing, invested alongside me. There was much less market enthusiasm for investing capital into Unchained back then (not to mention in companies dedicated to Bitcoin as a whole), but to us it was a no-brainer. While the fiat world didn't understand the Unchained business model, we understood Bitcoiners would hold their own private keys and needed a better form of custody, with access to lending and other future financial services that didn't map to the legacy fiat world. We continued to seek out other compelling Bitcoin companies to support as well, and as Jonathan and I increased our equity investments in the space, we decided we wanted to dedicate ourselves full-time to Bitcoin and this ultimately led us to found Ten31 as a better way to realize our vision.

Ten31 - An Investment Platform for Bitcoin Infrastructure

We are building Ten31 as an investment platform to scale and institutionalize investments in companies building infrastructure dedicated solely to the Bitcoin ecosystem. Ten31 has an investment edge due to:

The asymmetry of bitcoin: bitcoin is the most asymmetric investment the world has ever seen, which first and foremost provides an edge over investors deploying capital in any other ecosystem

Capital misallocation in crypto: capital has disproportionately been dedicated to crypto and underweight in Bitcoin infrastructure, creating an opportunity for Ten31

Ten31’s alignment, experience and value add: we are better partners for Bitcoin companies because our fundamental understanding of bitcoin, combined with our investment and partnership experience, allows us to add value beyond simply as a capital partner

The Asymmetry of Bitcoin

Bitcoin is solving one of the largest and most important issues of our time, creating a sound money that is outside the control or influence of centralized and trusted third parties. Without sound money at the base layer, we face negative externalities downstream in all aspects of our lives, most of which do not seem obviously related to a broken monetary system (except to Bitcoiners).

Bitcoin now provides a system where value can be protected from inflation, confiscation, or deauthorization, and proof of work is at the center of this innovation. Bitcoin is the best technology for storing and transmitting value over space and time. It represents a paradigm shift that will impact everyone; it is a tool to support individual freedom and allow for unprecedented human coordination and flourishing. Bitcoin will also unlock an energy revolution which is unfathomable to most at present—not just from a natural resources and energy production perspective, but also from the perspective of humanity’s collective allocation of financial capital, productive assets and human energy output. It is the most beautiful game theoretic system ever developed, and it will save us from the worst of human tendencies and the worst of technology while unlocking the best of our human potential and the best of technology. In short, it is the soundest and hardest form of money that has ever existed, offering the potential for a new monetary and economic system free from the pitfalls and broken incentives created by the current fiat-based command and control systems of today.

In our view, the world will converge on one form of money, and that will be bitcoin. The monetization of bitcoin over time will continue to offer asymmetry unlike any other asset previously; not only will holders of the currency continue to benefit from outsized increases in purchasing power, but investors in Bitcoin infrastructure will also inherently benefit from this asymmetry relative to investors deploying capital elsewhere.

Capital Misallocation in Crypto

Despite the incredible potential of Bitcoin, less than $100 million has been raised in Bitcoin-focused VC strategies, whereas we estimate more than $25 billion has been raised for crypto/blockchain strategies (a large portion of which are dedicated to trading, which artificially prop up the value of crypto ecosystems more than they are actually building real infrastructure). This imbalance ultimately will prove to be a massive misallocation of capital, which creates an opportunity for Ten31.

The exuberance we see today in crypto platforms, NFT exchanges, DEX speculation platforms, and promises of the potential for web3 remind me a lot of what I saw in the mid 2000s before the GFC. It is a symptom of money printing, excess liquidity driving speculation, and ultimately a broken base layer of money. It leads to crypto companies with unsupportable valuations and unsustainable/broken business models, whereas Bitcoin companies building real businesses are underappreciated by the market and deeply discounted because of the market’s flawed consensus view of bitcoin vs. crypto.

Bitcoin is the revolutionary advancement; crypto is the noise. The continued monetization of bitcoin will necessitate the further development of infrastructure built around the ecosystem, offering tremendous economic upside to those who invest in, build, and deliver that future. At Ten31, we understand not just bitcoin, but also the need for continued investment in real infrastructure around it and the importance of attracting additional financial and human capital into the space (including recruiting technologists from outside the industry).

Ten31’s Alignment, Experience and Value Add

The name “Ten31” comes from the day Satoshi released the whitepaper, October 31, 2008. We have named our series of funds the Low Time Preference Funds, in reference to the concept of time preference discussed in The Bitcoin Standard, which highlights (i) time preference is the extent to which individuals value the present over the future; (ii) sound money preserves its value across time, allowing humans to lower their time preference and plan for the future; and (iii) a low time preference underlies long term investment, which is the bedrock for driving productivity for society and improved civilization for future generations. In addition, we commit a portion of our management fees to developer grants on a recurring basis, the next round of which we will be announcing soon.

Because of our fundamental alignment with Bitcoin companies, we are more desirable partners than the traditional VCs or crypto funds. We understand bitcoin, we won’t be pressuring companies to support other assets, and we won’t be looking for companies to launch their own token so that we can obtain a pre-mined allocation. Instead, we will take a long term approach to supporting companies to build the Bitcoin future we want to see, which will provide asymmetric opportunities to generate value, discussed below. We aim to be a value-added partner to all the Bitcoin companies in which we invest – more than just a capital partner – and to do so in a way that aligns with the ethos of Bitcoin. Due to (i) our institutional background and blue-chip investing pedigree; (ii) the breadth of our portfolio and network in the space; and (iii) the depth and complementary skill sets of our team; we can offer unique insights and support to companies operating in Bitcoin, differentiating Ten31 in the ecosystem, especially relative to VCs without a laser-eyed Bitcoin focus. As a result, we are better partners and provide more aligned capital to Bitcoin companies, bringing to bear a Bitcoin mindset with broad reach and first class investing and partnership experience, all of which founders value.

Looking Forward - Bitcoin Infrastructure is Inherently Asymmetric

As we move towards a Bitcoin standard, Bitcoin will reset the way everyone thinks about opportunity costs. Every potential investment will be considered on a risk/return basis relative to the alternative of holding bitcoin. We are bitcoiners and of course believe holding bitcoin directly still has tremendous upside as an investment, but the only way it can truly reach its maximum potential is if infrastructure continues to be built around it . That seems intuitive, but investing in Bitcoin infrastructure remains a contrarian strategy. Bitcoin companies have been de-risked and are rapidly scaling. Many exciting technology developments are taking hold which we expect will unlock additional opportunities for entrepreneurs and new businesses as the next phase of adoption is underway globally.

Just as bitcoin as a direct investment offers asymmetric upside, equity investments in Bitcoin companies are inherently asymmetric, with a potential leveraged return to investing in bitcoin directly. There is a virtuous circle from investing in this space: investing in Bitcoin infrastructure causes the network to become more valuable, and as the network and supporting infrastructure strengthens, more capital is contributed to supporting and building out new infrastructure.

Our focus is on directing capital to the most promising founders and companies, and the successful execution of this strategy will allow our investors and the founders and companies we back to benefit disproportionately over time as these companies establish early leadership in the growth of the open monetary network. We are focused on supporting companies building infrastructure that holders of bitcoin will value over time, which is critical to building profitable Bitcoin businesses. If Bitcoin companies can consistently deliver services and infrastructure bitcoin holders value, then in a Bitcoin economy it follows that these companies will be accumulating the most bitcoin over time and becoming a larger part of the Bitcoin economy as a result (a larger portion of a fixed 21 million bitcoin supply).

We are moving towards a future where bitcoin will play an increasingly important role and will eventually serve as the world reserve asset and standard for economic and monetary activity. By consequence, eventually every person, every business, and every industry will need bitcoin and infrastructure that supports it. Building infrastructure that every other segment of the economy will need in order to access the Bitcoin network – whether it’s payment rails, custody/security solutions, financial services, consumer facing applications, mining/energy services, etc. – will offer exceptional asymmetry. We believe owning equity in the critical infrastructure built around the Bitcoin network will lead to immense equity appreciation and potential for long term bitcoin dividends from profits, which will be one of the most effective ways to earn bitcoin in the future, and we want to help the companies in which we invest capture a greater share of that value.

We have great conviction that we are right about bitcoin. Bitcoin accrued tremendous value over the last decade and will continue to in this next decade, and the value opportunity presented by investing in the infrastructure built around the network will become self-evident. The time is now for a platform like Ten31, and our ability to create value will be differentiated by our deep understanding of bitcoin and our execution capability in partnership with the founders and companies we back. We have a strong team, with Matt Odell, Marty Bent, and Michael Tanguma as partners and Parker Lewis as an advisor, bringing deep and complementary skill sets to support founders and companies in all aspects of their business (finance, technical, go to market, reach, etc.), but always with a Bitcoin-first mindset. We will be the anti-fiat VC, aligned with Bitcoin.

As a result, we will not just be better partners for Bitcoin companies than the likes of a Silicon Valley VC, but we will also be able to create more value investing $50 million in Bitcoin infrastructure than traditional VCs investing billions across crypto more broadly. By aligning with Bitcoin as our North Star, we can help make the world a better place, and ultimately long term value accrual will follow.

We will be sharing more thoughts on these topics in the coming weeks. Stay tuned for a dedicated series of writing with our views on venture investing under a Bitcoin Standard, as well as our views of the investment landscape.

Accelerating the Flywheel

This is how I believe we bring the world a sufficiently distributed and robust open monetary system that cannot be controlled or co-opted by any centralized entity…

Help Build the Future We Want For Our Children

As a bitcoiner, I have always looked on venture capital with disappointment, anger, and frustration. I have watched passionate bitcoin teams struggle to find their footing as massive funds deploy into shitcoin projects and private token allocations. It is time we flip the script…

As a bitcoiner, I have always looked on venture capital with disappointment, anger, and frustration. I have watched passionate bitcoin teams struggle to find their footing as massive funds deploy into shitcoin projects and private token allocations.

It is time we flip the script.

Ten31 is a proper bitcoin fund; run by bitcoiners, for bitcoiners. We support teams from around the world who dedicate their time and energy to build on bitcoin.

No shitcoins, no tokens, no orb scanning retinas; only bitcoin, forever.

Ten31 will reframe how venture capital is done.

Our objective is clear: help build the future we want for our children and their children. We need a model properly suited for a post-bitcoin world. This means not only funding bitcoin businesses, but also free and open source projects. FOSS is absolutely crucial to our goals which is why we will be directing a portion of management fees with no strings attached to fund open source contributors and projects.

I love bitcoin. Bitcoiners are family. No matter how much time I give to bitcoin, I remain struck with the feeling I should be doing more. Ten31 is just one piece of this puzzle. My hope is that we will become a substantial force for good as we move to a bitcoin standard.

To all reading this, I expect you to keep us honest and to provide feedback. Your insights are always appreciated and together we cannot be stopped.

We must win. There is no other option.

stay humble and stack,

ODELL

Bitcoin White Paper Day and Ten31

October 31 marks the day Satoshi Nakamoto posted the Bitcoin White Paper on the cypherpunks mailing list, a day that forever reshaped the direction of humanity. Ten31 was named after October 31--not only as a hat tip to that historic day, but also as a declaration of a venture fund threaded with the ethos of Bitcoin…

October 31 marks the day Satoshi Nakamoto posted the Bitcoin White Paper on the cypherpunks mailing list, a day that forever reshaped the direction of humanity. Ten31 was named after October 31--not only as a hat tip to that historic day, but also as a declaration of a venture fund threaded with the ethos of Bitcoin. Our mission is to partner with, invest in, and support great Bitcoin companies creating infrastructure for a Bitcoin monetary system. We believe bitcoin is the tool that will facilitate freedom of mankind and unlock individual sovereignty and human flourishing.

Ten31 acts on an urge to help push Bitcoin forward. We know not everyone can be shadowy super coders, but there are skills others have at their disposal to contribute to the ecosystem. We believe the traditional venture capital model falls short in its potential impact on the space, and thus we have purposely designed Ten31 to be different from traditional VC.

Our series of funds are called the Low Time Preference Funds, and we direct a portion of our management fees to open source development and grants to contributors in the space. Rather than passive relationships with our LPs, we are building an active community of supporters who have seen the orange light of bitcoin and want to contribute. We are calling this the Ten31 Tribe. The Ten31 Tribe comes from all walks of life and brings to bear a wealth of experience, relationships and expertise across diverse fields and subject matter. LPs are largely an untapped resource for traditional VC, but we believe with the Ten31 Tribe we can be more impactful as a group and leverage the burning desire of those who have understood bitcoin and feel compelled to offer themselves to the Bitcoin mission. In a sense, we are the anti-fiat VC, with a singular focus: Bitcoin.

Finally, we are also excited to announce the addition of new members to our team. Parker Lewis, Head of Business Development at Unchained Capital, has joined as an advisor. Parker’s Gradually, then Suddenly series has been a source of in-depth evaluation on ‘why Bitcoin’ and has helped orange pill countless people. We have also added Michael Tanguma, Matt Odell, and Marty Bent as Venture Partners. Michael is currently Managing Director of Client Solutions at Unchained Capital. Matt Odell is a Bitcoin and privacy advocate, host of Citadel Dispatch and TFTC, co-Founder of several Bitcoin projects (Open Sats, BitcoinTV, Bitcoin Dev List, Final Message) and advisor to several Bitcoin companies (BottlePay, Hexa Wallet, Bitcoin Magazine, Swan Bitcoin). Marty Bent is the founder of TFTC.io, a Board member of Fortress Technologies (TSX-V:FORT), and previously Director of Business Development at Great American Mining.

Introducing Ten31

Investing in Bitcoin-native companies. Founded and backed by Bitcoiners.