Ten31 - A Vision for Supporting the Bitcoin Ecosystem

As we reach the end of what was another incredibly notable year in Bitcoin and look forward to what is to come in 2022, I wanted to share my thoughts on our vision for Ten31, investing in Bitcoin infrastructure, and my story as to how I got here. Bitcoin gives the world incredible reason for optimism, and we are excited to continue supporting the ecosystem…

Building a Leading Platform to Invest in Bitcoin Infrastructure

December 27, 2021 ● Grant Gilliam

As we reach the end of what was another incredibly notable year in Bitcoin and look forward to what is to come in 2022, I wanted to share my thoughts on our vision for Ten31, investing in Bitcoin infrastructure, and my story as to how I got here. Bitcoin gives the world incredible reason for optimism, and we are excited to continue supporting the ecosystem.

My Path to Bitcoin

I am from Kentucky, the oldest of 7 children, and an Eagle Scout. I studied electrical engineering and math in college, with coursework in programming and cryptography. That probably doesn’t seem like an obvious path to Wall Street, but that’s where I ended up after graduating. I moved to NYC at a time when bankers were hiring anyone and everyone, regardless of background or degree. You only had to be smart and malleable, and they would teach you the craft. I never considered myself a suit, but up to New York I went, starting in leveraged finance and getting a front row seat to the excesses of the mid 2000s which were a precursor to the Great Financial Crisis. I then saw cascading failures of Bear Stearns and Lehman Brothers, which were pivotal in my young career trying to make sense of the financial system and the factors leading to its systemic collapse. I had a technical background from school, but I was also interested in business and investing, and I soon decided to pursue a career in private equity where I could develop professionally.

Found in the middle school yearbook archives, early inclinations of a low time preference philosophy. It used to be realistic that saving money in a bank could yield real returns…

I was living in downtown Manhattan in 2013 and 2014 and would walk past the New York Stock Exchange every day on my way to the subway while commuting to work. And every day, right next to the NYSE, I would also walk by the Bitcoin Center founded by Nick Spanos. I never went in, initially thinking Bitcoin was a scam, and continued to dismiss it over the next couple years. It wasn’t until 2016 that I decided to look into Bitcoin, as I had enough pattern recognition after reading articles in Wired to finally become curious, and my college coursework gave me the technical interest to dig deeper. I heard Nick Szabo discussing Bitcoin and social scalability on Tim Ferriss’ podcast, and when I started looking more into Nick’s writing, my mind was blown. I became endlessly fascinated by what this new monetary system might bring to benefit humanity.

Bitcoin is complex; practically no one understands it with just a few encounters. It has a multidimensional foundation rooted in cryptography, game theory, and monetary economics, and its impact on the world will be all-encompassing, driving positive economic, societal, cultural and ethical change. Most people feel late to Bitcoin in hindsight, but those initial encounters I dismissed were important and valuable first sparks that eventually led to the burning flame that now feeds my passion to dedicate my time, energy, and career to Bitcoin.

My Proof of Work to Bitcoin

Over the last decade-and-a-half, I worked as a private equity investor, employed at one of the largest firms globally where I was tasked with building relationships with founders, sourcing interesting investment opportunities, and ultimately supporting companies as a value-added partner in their pursuit of growth. I was directly involved with deploying more than $3 billion in equity and served on Boards of multi-billion dollar companies, developing experience at all levels of business (strategy, HR/recruiting, finance, capital markets, governance, legal, IT/infrastructure, Ops, etc.) to understand what it takes to become best-in-class and eventually scale to the billion-dollar+ capitalization level.

Every partnership with a team is different, with unique challenges and opportunities, and therefore you cannot rely on the same playbook for each investment. However, patterns do emerge, and you develop insights from your experiences and learnings that can be helpful to companies as they inevitably encounter bumps on the road. No business plan ever goes exactly as planned. Therefore, as a business partner, being able to offer experiences and relationships to teams that haven't had the same number of repetitions with similar issues is often incredibly valuable.

While continuing to hone my skills as an investor over the last 5 years, I immersed myself more and more into Bitcoin in practically every spare moment of time I could find. As my understanding and conviction deepened, I felt an ever-increasing desire to get more involved. I followed this ambition and passion, and my financial investments evolved from initially holding bitcoin directly to also investing in Bitcoin-related companies. I wanted to support the great Bitcoin companies that I was getting to know, and I wanted to contribute my professional skills as an investor and partner to founders and businesses to help them in any way I could. I knew my professional background was relatively unique to the Bitcoin space, in that I had put in the work at a top-tier investment firm in what is a notoriously challenging and ruthlessly competitive field. I had risen the ranks and proven myself as an astute investor and reputable partner to companies and teams, and I had gained knowledge and experience that could be valuable to early stage companies in the space.

My first investment was in Unchained Capital, and my cousin Jonathan Kirkwood, who was also an avid Bitcoiner with a history of successful investing, invested alongside me. There was much less market enthusiasm for investing capital into Unchained back then (not to mention in companies dedicated to Bitcoin as a whole), but to us it was a no-brainer. While the fiat world didn't understand the Unchained business model, we understood Bitcoiners would hold their own private keys and needed a better form of custody, with access to lending and other future financial services that didn't map to the legacy fiat world. We continued to seek out other compelling Bitcoin companies to support as well, and as Jonathan and I increased our equity investments in the space, we decided we wanted to dedicate ourselves full-time to Bitcoin and this ultimately led us to found Ten31 as a better way to realize our vision.

Ten31 - An Investment Platform for Bitcoin Infrastructure

We are building Ten31 as an investment platform to scale and institutionalize investments in companies building infrastructure dedicated solely to the Bitcoin ecosystem. Ten31 has an investment edge due to:

The asymmetry of bitcoin: bitcoin is the most asymmetric investment the world has ever seen, which first and foremost provides an edge over investors deploying capital in any other ecosystem

Capital misallocation in crypto: capital has disproportionately been dedicated to crypto and underweight in Bitcoin infrastructure, creating an opportunity for Ten31

Ten31’s alignment, experience and value add: we are better partners for Bitcoin companies because our fundamental understanding of bitcoin, combined with our investment and partnership experience, allows us to add value beyond simply as a capital partner

The Asymmetry of Bitcoin

Bitcoin is solving one of the largest and most important issues of our time, creating a sound money that is outside the control or influence of centralized and trusted third parties. Without sound money at the base layer, we face negative externalities downstream in all aspects of our lives, most of which do not seem obviously related to a broken monetary system (except to Bitcoiners).

Bitcoin now provides a system where value can be protected from inflation, confiscation, or deauthorization, and proof of work is at the center of this innovation. Bitcoin is the best technology for storing and transmitting value over space and time. It represents a paradigm shift that will impact everyone; it is a tool to support individual freedom and allow for unprecedented human coordination and flourishing. Bitcoin will also unlock an energy revolution which is unfathomable to most at present—not just from a natural resources and energy production perspective, but also from the perspective of humanity’s collective allocation of financial capital, productive assets and human energy output. It is the most beautiful game theoretic system ever developed, and it will save us from the worst of human tendencies and the worst of technology while unlocking the best of our human potential and the best of technology. In short, it is the soundest and hardest form of money that has ever existed, offering the potential for a new monetary and economic system free from the pitfalls and broken incentives created by the current fiat-based command and control systems of today.

In our view, the world will converge on one form of money, and that will be bitcoin. The monetization of bitcoin over time will continue to offer asymmetry unlike any other asset previously; not only will holders of the currency continue to benefit from outsized increases in purchasing power, but investors in Bitcoin infrastructure will also inherently benefit from this asymmetry relative to investors deploying capital elsewhere.

Capital Misallocation in Crypto

Despite the incredible potential of Bitcoin, less than $100 million has been raised in Bitcoin-focused VC strategies, whereas we estimate more than $25 billion has been raised for crypto/blockchain strategies (a large portion of which are dedicated to trading, which artificially prop up the value of crypto ecosystems more than they are actually building real infrastructure). This imbalance ultimately will prove to be a massive misallocation of capital, which creates an opportunity for Ten31.

The exuberance we see today in crypto platforms, NFT exchanges, DEX speculation platforms, and promises of the potential for web3 remind me a lot of what I saw in the mid 2000s before the GFC. It is a symptom of money printing, excess liquidity driving speculation, and ultimately a broken base layer of money. It leads to crypto companies with unsupportable valuations and unsustainable/broken business models, whereas Bitcoin companies building real businesses are underappreciated by the market and deeply discounted because of the market’s flawed consensus view of bitcoin vs. crypto.

Bitcoin is the revolutionary advancement; crypto is the noise. The continued monetization of bitcoin will necessitate the further development of infrastructure built around the ecosystem, offering tremendous economic upside to those who invest in, build, and deliver that future. At Ten31, we understand not just bitcoin, but also the need for continued investment in real infrastructure around it and the importance of attracting additional financial and human capital into the space (including recruiting technologists from outside the industry).

Ten31’s Alignment, Experience and Value Add

The name “Ten31” comes from the day Satoshi released the whitepaper, October 31, 2008. We have named our series of funds the Low Time Preference Funds, in reference to the concept of time preference discussed in The Bitcoin Standard, which highlights (i) time preference is the extent to which individuals value the present over the future; (ii) sound money preserves its value across time, allowing humans to lower their time preference and plan for the future; and (iii) a low time preference underlies long term investment, which is the bedrock for driving productivity for society and improved civilization for future generations. In addition, we commit a portion of our management fees to developer grants on a recurring basis, the next round of which we will be announcing soon.

Because of our fundamental alignment with Bitcoin companies, we are more desirable partners than the traditional VCs or crypto funds. We understand bitcoin, we won’t be pressuring companies to support other assets, and we won’t be looking for companies to launch their own token so that we can obtain a pre-mined allocation. Instead, we will take a long term approach to supporting companies to build the Bitcoin future we want to see, which will provide asymmetric opportunities to generate value, discussed below. We aim to be a value-added partner to all the Bitcoin companies in which we invest – more than just a capital partner – and to do so in a way that aligns with the ethos of Bitcoin. Due to (i) our institutional background and blue-chip investing pedigree; (ii) the breadth of our portfolio and network in the space; and (iii) the depth and complementary skill sets of our team; we can offer unique insights and support to companies operating in Bitcoin, differentiating Ten31 in the ecosystem, especially relative to VCs without a laser-eyed Bitcoin focus. As a result, we are better partners and provide more aligned capital to Bitcoin companies, bringing to bear a Bitcoin mindset with broad reach and first class investing and partnership experience, all of which founders value.

Looking Forward - Bitcoin Infrastructure is Inherently Asymmetric

As we move towards a Bitcoin standard, Bitcoin will reset the way everyone thinks about opportunity costs. Every potential investment will be considered on a risk/return basis relative to the alternative of holding bitcoin. We are bitcoiners and of course believe holding bitcoin directly still has tremendous upside as an investment, but the only way it can truly reach its maximum potential is if infrastructure continues to be built around it . That seems intuitive, but investing in Bitcoin infrastructure remains a contrarian strategy. Bitcoin companies have been de-risked and are rapidly scaling. Many exciting technology developments are taking hold which we expect will unlock additional opportunities for entrepreneurs and new businesses as the next phase of adoption is underway globally.

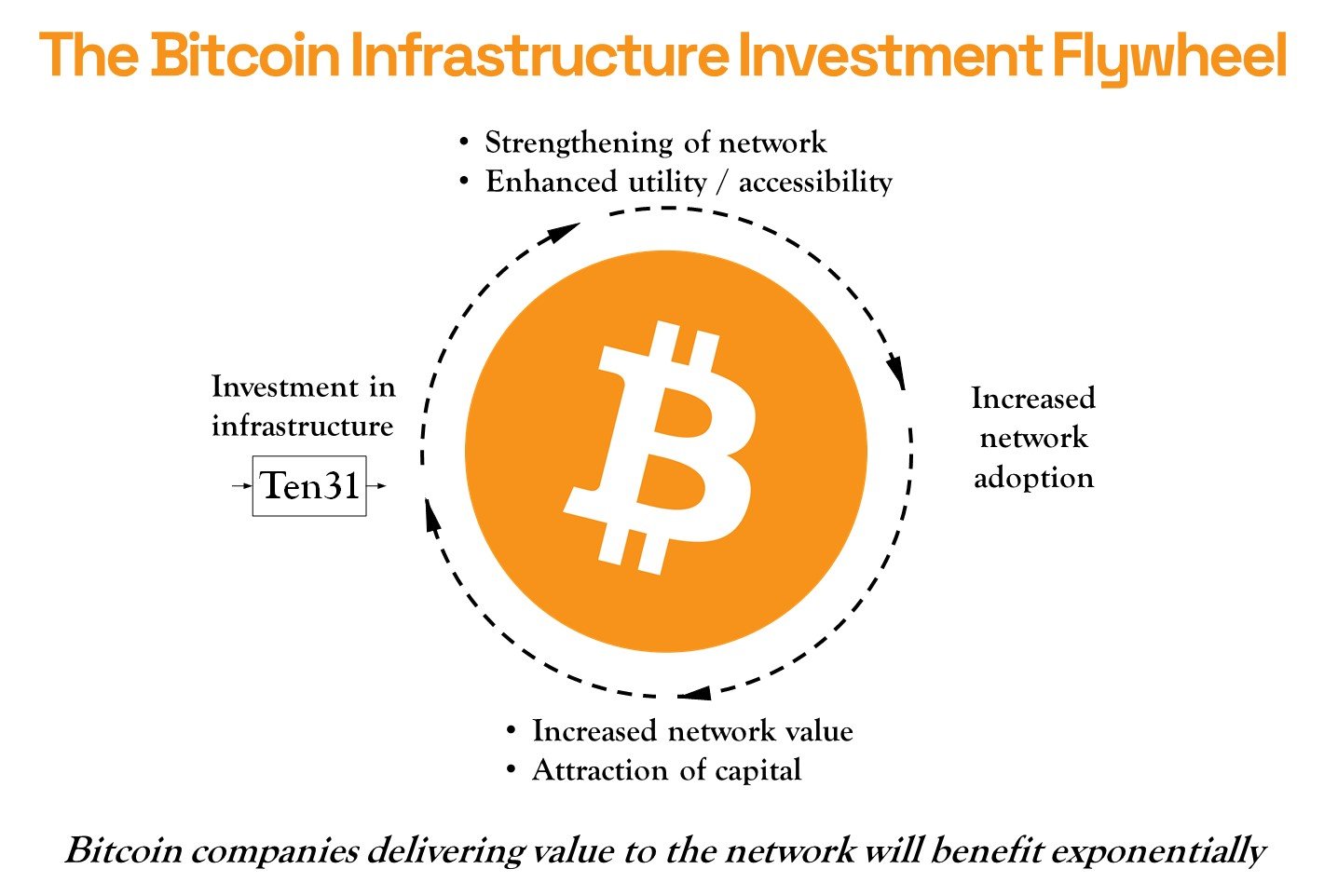

Just as bitcoin as a direct investment offers asymmetric upside, equity investments in Bitcoin companies are inherently asymmetric, with a potential leveraged return to investing in bitcoin directly. There is a virtuous circle from investing in this space: investing in Bitcoin infrastructure causes the network to become more valuable, and as the network and supporting infrastructure strengthens, more capital is contributed to supporting and building out new infrastructure.

Our focus is on directing capital to the most promising founders and companies, and the successful execution of this strategy will allow our investors and the founders and companies we back to benefit disproportionately over time as these companies establish early leadership in the growth of the open monetary network. We are focused on supporting companies building infrastructure that holders of bitcoin will value over time, which is critical to building profitable Bitcoin businesses. If Bitcoin companies can consistently deliver services and infrastructure bitcoin holders value, then in a Bitcoin economy it follows that these companies will be accumulating the most bitcoin over time and becoming a larger part of the Bitcoin economy as a result (a larger portion of a fixed 21 million bitcoin supply).

We are moving towards a future where bitcoin will play an increasingly important role and will eventually serve as the world reserve asset and standard for economic and monetary activity. By consequence, eventually every person, every business, and every industry will need bitcoin and infrastructure that supports it. Building infrastructure that every other segment of the economy will need in order to access the Bitcoin network – whether it’s payment rails, custody/security solutions, financial services, consumer facing applications, mining/energy services, etc. – will offer exceptional asymmetry. We believe owning equity in the critical infrastructure built around the Bitcoin network will lead to immense equity appreciation and potential for long term bitcoin dividends from profits, which will be one of the most effective ways to earn bitcoin in the future, and we want to help the companies in which we invest capture a greater share of that value.

We have great conviction that we are right about bitcoin. Bitcoin accrued tremendous value over the last decade and will continue to in this next decade, and the value opportunity presented by investing in the infrastructure built around the network will become self-evident. The time is now for a platform like Ten31, and our ability to create value will be differentiated by our deep understanding of bitcoin and our execution capability in partnership with the founders and companies we back. We have a strong team, with Matt Odell, Marty Bent, and Michael Tanguma as partners and Parker Lewis as an advisor, bringing deep and complementary skill sets to support founders and companies in all aspects of their business (finance, technical, go to market, reach, etc.), but always with a Bitcoin-first mindset. We will be the anti-fiat VC, aligned with Bitcoin.

As a result, we will not just be better partners for Bitcoin companies than the likes of a Silicon Valley VC, but we will also be able to create more value investing $50 million in Bitcoin infrastructure than traditional VCs investing billions across crypto more broadly. By aligning with Bitcoin as our North Star, we can help make the world a better place, and ultimately long term value accrual will follow.

We will be sharing more thoughts on these topics in the coming weeks. Stay tuned for a dedicated series of writing with our views on venture investing under a Bitcoin Standard, as well as our views of the investment landscape.

Accelerating the Flywheel

This is how I believe we bring the world a sufficiently distributed and robust open monetary system that cannot be controlled or co-opted by any centralized entity…

Help Build the Future We Want For Our Children

As a bitcoiner, I have always looked on venture capital with disappointment, anger, and frustration. I have watched passionate bitcoin teams struggle to find their footing as massive funds deploy into shitcoin projects and private token allocations. It is time we flip the script…

As a bitcoiner, I have always looked on venture capital with disappointment, anger, and frustration. I have watched passionate bitcoin teams struggle to find their footing as massive funds deploy into shitcoin projects and private token allocations.

It is time we flip the script.

Ten31 is a proper bitcoin fund; run by bitcoiners, for bitcoiners. We support teams from around the world who dedicate their time and energy to build on bitcoin.

No shitcoins, no tokens, no orb scanning retinas; only bitcoin, forever.

Ten31 will reframe how venture capital is done.

Our objective is clear: help build the future we want for our children and their children. We need a model properly suited for a post-bitcoin world. This means not only funding bitcoin businesses, but also free and open source projects. FOSS is absolutely crucial to our goals which is why we will be directing a portion of management fees with no strings attached to fund open source contributors and projects.

I love bitcoin. Bitcoiners are family. No matter how much time I give to bitcoin, I remain struck with the feeling I should be doing more. Ten31 is just one piece of this puzzle. My hope is that we will become a substantial force for good as we move to a bitcoin standard.

To all reading this, I expect you to keep us honest and to provide feedback. Your insights are always appreciated and together we cannot be stopped.

We must win. There is no other option.

stay humble and stack,

ODELL

Bitcoin White Paper Day and Ten31

October 31 marks the day Satoshi Nakamoto posted the Bitcoin White Paper on the cypherpunks mailing list, a day that forever reshaped the direction of humanity. Ten31 was named after October 31--not only as a hat tip to that historic day, but also as a declaration of a venture fund threaded with the ethos of Bitcoin…

October 31 marks the day Satoshi Nakamoto posted the Bitcoin White Paper on the cypherpunks mailing list, a day that forever reshaped the direction of humanity. Ten31 was named after October 31--not only as a hat tip to that historic day, but also as a declaration of a venture fund threaded with the ethos of Bitcoin. Our mission is to partner with, invest in, and support great Bitcoin companies creating infrastructure for a Bitcoin monetary system. We believe bitcoin is the tool that will facilitate freedom of mankind and unlock individual sovereignty and human flourishing.

Ten31 acts on an urge to help push Bitcoin forward. We know not everyone can be shadowy super coders, but there are skills others have at their disposal to contribute to the ecosystem. We believe the traditional venture capital model falls short in its potential impact on the space, and thus we have purposely designed Ten31 to be different from traditional VC.

Our series of funds are called the Low Time Preference Funds, and we direct a portion of our management fees to open source development and grants to contributors in the space. Rather than passive relationships with our LPs, we are building an active community of supporters who have seen the orange light of bitcoin and want to contribute. We are calling this the Ten31 Tribe. The Ten31 Tribe comes from all walks of life and brings to bear a wealth of experience, relationships and expertise across diverse fields and subject matter. LPs are largely an untapped resource for traditional VC, but we believe with the Ten31 Tribe we can be more impactful as a group and leverage the burning desire of those who have understood bitcoin and feel compelled to offer themselves to the Bitcoin mission. In a sense, we are the anti-fiat VC, with a singular focus: Bitcoin.

Finally, we are also excited to announce the addition of new members to our team. Parker Lewis, Head of Business Development at Unchained Capital, has joined as an advisor. Parker’s Gradually, then Suddenly series has been a source of in-depth evaluation on ‘why Bitcoin’ and has helped orange pill countless people. We have also added Michael Tanguma, Matt Odell, and Marty Bent as Venture Partners. Michael is currently Managing Director of Client Solutions at Unchained Capital. Matt Odell is a Bitcoin and privacy advocate, host of Citadel Dispatch and TFTC, co-Founder of several Bitcoin projects (Open Sats, BitcoinTV, Bitcoin Dev List, Final Message) and advisor to several Bitcoin companies (BottlePay, Hexa Wallet, Bitcoin Magazine, Swan Bitcoin). Marty Bent is the founder of TFTC.io, a Board member of Fortress Technologies (TSX-V:FORT), and previously Director of Business Development at Great American Mining.

Introducing Ten31

Investing in Bitcoin-native companies. Founded and backed by Bitcoiners.

Investing in Bitcoin-native companies. Founded and backed by Bitcoiners.

Our Mission: To facilitate the freedom of mankind through individual sovereignty.

Investing in Bitcoin-native companies.

Focused on advancing individual sovereignty.

Low time preference philosophy.

Management fees directed toward Bitcoin core and Lightning developers.

Ten31 was formed by Bitcoiners looking to support the Bitcoin ecosystem by investing in Bitcoin-native companies building the world’s future infrastructure.

There are plenty of VC funds and ‘crypto funds’. Ten31 is neither. We are Bitcoiners supporting Bitcoiners. We believe there is an imbalance in the market of equity capital directed to support Bitcoin-only companies relative to the significant attention and amount of capital being deployed in ‘crypto’ and ‘DeFi.’ Bitcoin-only still remains somewhat of a contrarian view. In addition, among Bitcoin maximalists it is common to argue BTC will outperform all other investments (including equity investments in Bitcoin companies) and thus the argument you are better off to HODL.

We do not necessarily disagree — we are long term HODLers and will remain so — but as the monetization of Bitcoin as a world reserve asset continues, the relative balance between the asymmetric upside currently offered by holding Bitcoin vs. the return potential offered by supporting the companies which will ultimately form the foundation of the new economic and monetary system will (over time) begin to offer favorable risk/return tradeoffs. We admire what Fulgur Ventures, Trammell Venture Partners, and Bitcoiner Ventures are doing in the space, and we hope to emulate the success they have had so far.

With Ten31 we have formed our first fund, Low Time Preference Fund I, to actively support and invest in exciting Bitcoin companies. Ten31 will invest in the equity of Bitcoin-native companies and will also hold BTC directly.

Our Thesis:

Bitcoin is the most important technology development in a generation (or more): an open source protocol for transmitting value over space and time; the first ever non-state monetary asset with provable and perfect digital scarcity where the supply is entirely unaffected by demand.

Bitcoin will become the next World Reserve Asset.

It is still early: Bitcoin is still misunderstood by most, and its upside is underestimated.

The sheer potential of the Bitcoin ecosystem makes it risky NOT to have exposure.

An entirely new decentralized economic and monetary system will be based on Bitcoin, where the monetary policy is governed by rules, and not rulers

Bitcoin is a force for good that will reshape humanity, help alleviate inequality and allow humans to flourish.

Ten31 is investing in companies forming the foundation of this new world through technological innovation.

Our Vision:

We believe founders and companies will welcome the involvement and support from like-minded investors like Ten31. We are not an incumbent VC and will not be taking an institutional approach to participating across other technology sectors. We are singularly focused on Bitcoin and have named our platform Ten31 after the date of Satoshi’s whitepaper. The Ten31 logo is a hat tip to the proof of work diagram within it. The fund name, Low Time Preference Fund I, embodies a long term philosophy and investment for the future, all of which is more natural with a sound money like Bitcoin.

Bitcoin is one of the most important things to ever happen to us personally. We have been passionate Bitcoiners for quite some time, have been feeling the gravitational pull of Bitcoin, and now feel compelled to dedicate ourselves to supporting the ecosystem given its importance to future generations.

We share the same philosophy and worldview about Bitcoin as many who are dedicating their lives to building companies in the space. Bitcoin has the potential to reshape the world and humanity for the better. This singular focus has already resonated with founders, and we are excited to continue backing interesting and exciting companies and their founders, employees and ideas.

However, we want to do more. One of the ideas we are most excited about is supporting Bitcoin and Lightning developers with the management fees generated by our fund. We have admired the efforts to support open source developers by the likes of Square and the Human Rights Foundation (among others), and we would like to follow their lead and do our part. We are not paying ourselves salaries and will be going out of pocket to cover fund expenses. We believe this will be the first time a fund has directed its management fees to developers and believe this signals strong alignment with and support for the ecosystem. We are hopeful others will consider similar actions.

Initial Portfolio

We are excited to already back a number of very promising companies in the space. To date, our portfolio includes Swan Bitcoin, Unchained Capital, Satoshi Energy and Start9 Labs. Going forward, we expect to focus on a number of areas within the Bitcoin ecosystem, including:

Financial services (consumer / institutional)

Bitcoin mining / energy services

Personal sovereignty (hardware / software)

Layer 2 / Lightning network (e.g. new payments infrastructure; applications for earning sats; gaming)

Privacy

We look forward to providing further updates.